Manitoba farmers mostly have their 2025 crop in the bin, but with dried-up markets, low grain prices, high input costs and large harvests glutting supply, they may face some hard choices selling it.

The province’s grain farmers have been warned to expect a cash crunch, both this year and into 2026. Fertilizer prices are up, Manitoba Agriculture has noted, and, although not quite at the astronomical levels farmers faced going into 2023, the cost of production jump seen since 2022 hasn’t entirely deflated. Meanwhile, grain prices haven’t been anything to write home about, and agricultural commodities — on the grain side, largely reliant on export markets — remain braced for swings as trade policy between Canada and some of its largest trading partners remains uncertain.

WHY IT MATTERS: Manitoba farmers are grappling with tough marketing decisions and a shift toward managing cash flow and gross revenue, despite bringing in a strong harvest.

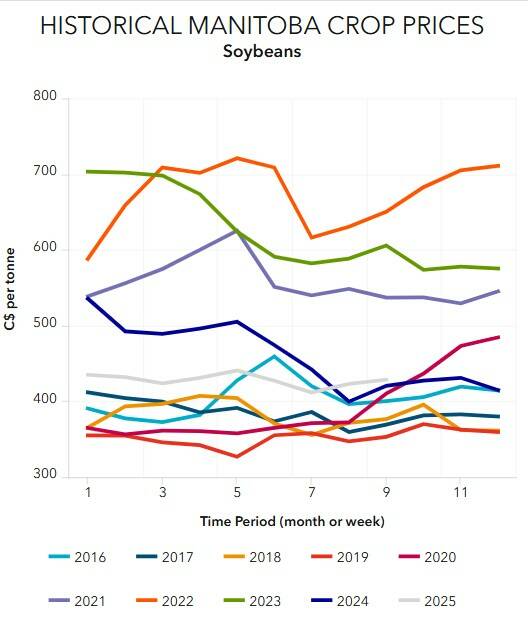

Strong 2025 yields that would normally have farmers smiling are also adding downward pressure on prices, analysts have said. Statistics Canada expected 36.624 million tonnes of wheat and 20.03 million tonnes of canola as of its September 2025 crop projections, although anecdotal reports suggest that latter number may come in even higher than expected. Soybeans were one of the few major crops expecting a hit, projected at 7.13 million tonnes, down from 7.57 million in 2024.

Normally an income driver for Manitoba farmers, canola price news has been less than rosy this year. As of mid-October, canola prices had avoided a dip below $600 a tonne, although some analysts expect that might still happen, based on headwinds facing the oilseed, not least of which being the general tariff-driven loss of the Chinese market for seed, oil and meal.

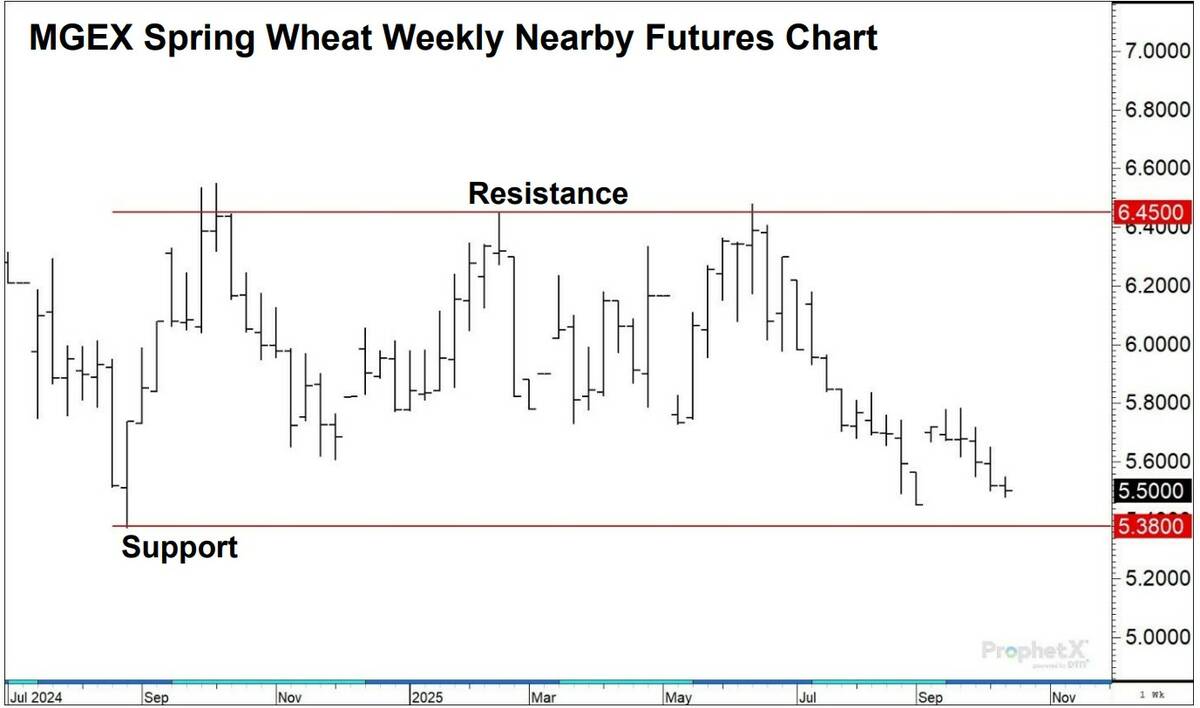

Wheat futures on the Chicago Board of Trade, meanwhile, hit a five-year low in mid-October.

For producers, the timing creates a cash flow challenge.

“I think we all go through our processes before we plan our crop, our acre allocations. And, we go through and have our break even price and what we essentially think we need to sell for in order to at least keep farming,” said Kevin Peters, vice-president of Keystone Agricultural Producers and a farmer near Steinbach.

Deciding what to haul first

With multiple crops needing to move and prices disappointing across the board, farmers are struggling to parse what they should sell first. For Peters, local markets provide some direction.

“For us in our location, we’ve got a lot of livestock and hogs in our area, so feed grains continually move for us. So, it’s a very competitive market … often it’s a similar price to the elevator, or at least comparable,” he said.

But not every farmer has nearby livestock operations or enough on-farm storage to wait for better prices. Peters, for example, said his operation doesn’t have enough storage to hold an entire harvest. To manage that limitation, the farm forward-prices ahead of time. That forward contracting helps offset early costs of fertilizer and seed, a strategy for managing competing cash flow pressures.

Read Also

MANITOBA AG DAYS: Wild oat resistance tightens its grip in Manitoba

Herbicides are increasingly failing to control wild oats as the weed pops up across Manitoba farm fields.

China absence affects markets

China hasn’t purchased any Canadian canola this crop year, creating uncertainty for farmers deciding whether to sell now or wait.

“Year-to-date, we’re shy a million tonnes already on exports relative to last year,” said David Drozd, co-founder and senior marketing analyst with AgChieve Grain Marketing Experts. “That bill is starting to back up in the country. You’re already seeing it moving to the crushers.”

The situation has created cash flow challenges for producers across the province. Crushers, aware of the building supply, have widened basis levels and filled nearby delivery slots, leaving farmers with limited options to move grain before year-end, Drozd said during an Oct. 8 Manitoba Agriculture Crop Talk webinar. Some crops are showing no bids until January in certain areas as elevators and processors manage their own inventory challenges.

Weakness across grain markets

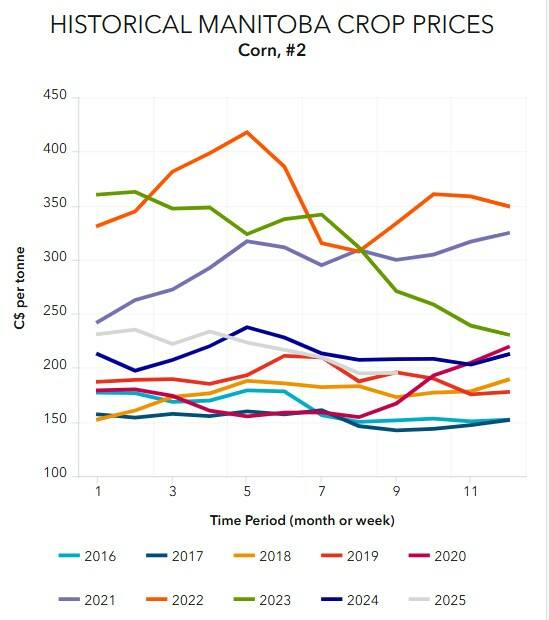

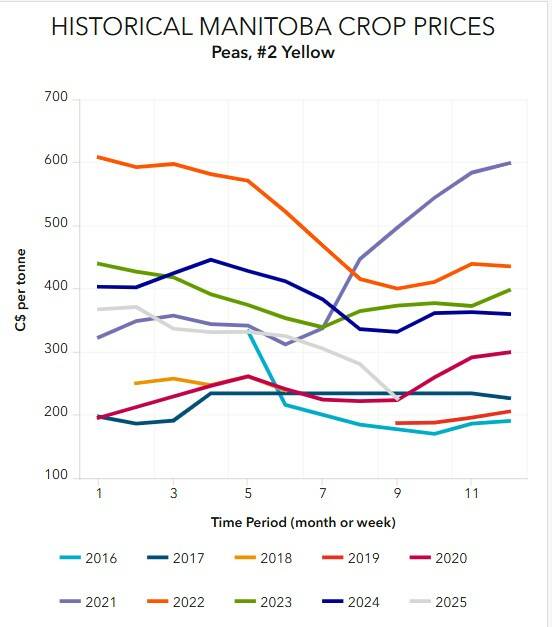

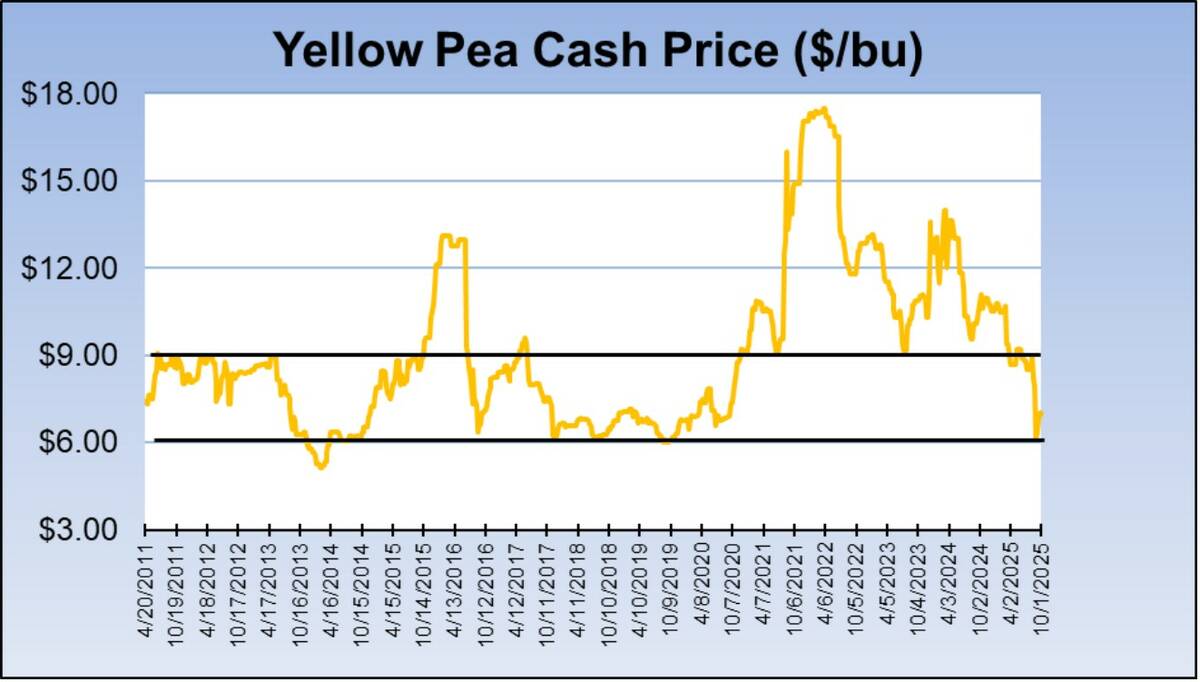

As of the time of writing, spring wheat was trading near $5.50 per bushel. Yellow peas have dropped to $6 per bushel from highs of $9 to $10 earlier in the year. Soybeans continue trading in a sideways pattern between $10 and $12 per bushel. Corn prices in Manitoba have seen the $6 per bushel level disappear.

Drozd projects November canola futures could drop to $550 per tonne, with cash prices bottoming around $11 to $12 per bushel, based on chart patterns showing the market breaking below key support levels and forming a measuring gap that typically predicts further declines.

He recommends farmers target $13 to $14 per bushel on any market bounces for canola, particularly in deferred months with crushers, though those opportunities are becoming harder to find for grain needed before December.

“On minor bounces, you’re seeing limited upside because there’s more willing farmers to sell that bounce before it goes lower,” Drozd said. “The farmers that had started selling earlier, of course, they’re pleased with what they did. They all wish they did more.”

The pattern mirrors challenges from the previous Trump administration, Drozd said. During the 2017-2020 term, grain markets largely traded sideways in relatively narrow ranges, with significant rallies only materializing after the administration ended. He said farmers should prepare for similar range-bound trading over the next several years.

That scenario changes the marketing approach but also simplifies some decisions, Peters said.

“If you’re only trading within a certain price range, then you know sort of what that upper limit is probably going to look like,” he said. “So, you can hit that upper limit more easily when you get a little bounce, because you know that trading range is more horizontal.”

Staying profitable

For Peters, staying profitable comes down to the fundamentals of number crunching and shaving expenses.

“Those are direct-to-bottom-line type solutions,” he said.

Grain markets typically remain under pressure through the U.S. harvest period, often not finding seasonal lows until November or even December, Drozd said. Any significant rally may not materialize until January, when stored grain becomes more expensive to move and farmer selling naturally slows.

Dealing with inputs

While some 46-0-0 urea can be found below $800 per tonne, Drozd cautioned against paying more than that level. He suggested waiting for potential further softening into late fall. Last year, farmers who waited until July secured prices around $660 per tonne, though Drozd doesn’t expect prices to fall that low again.

“Fertilizer prices generally follow the price of corn. It’s a big user,” he said. “We’re not seeing higher prices. With grain markets coming down, farmers are going to be a little bit reluctant to want to pay the higher prices, reluctant to pour on as much nitrogen.”

Fertilizer-to-crop price ratios are showing declining affordability, a Farm Credit Canada analysis noted in September, putting additional pressure on farm margins for the upcoming crop year.

Gross revenue instead of price

Drozd further encouraged producers to focus on gross revenue instead of just price. Farmers with strong yields might be achieving near-record gross revenue even at disappointing prices. Furthermore, he said, the better market conditions producers may be waiting for might not materialize.

“The price isn’t coming … but if the gross revenue is there, don’t let it slip away. You will farm another day.”

He also suggested farmers should develop marketing plans now rather than waiting for prices to improve, particularly for grain needed to cover cash flow before December.

“We make our best decisions on what to look for to the upside when we’re actually down at the lows, and then we have the discipline not to raise the bar when we get up to that price,” Drozd said.

Peters said his operation hasn’t changed its fundamental approach as the markets sour.

“Overall, I don’t know that we’ve really shifted how we look at selling grain,” he said. “I think for us, it’s important to sort of continually do what we’ve done in the past in order to average our sale price out.”

Seeding decisions for 2026

Peters has also already plans to adjust his next seeding plans.

“We did cut a little bit already for 25-26 (marketing year),” he said. “And we may shave a little bit more off.”

But there are limits to how much a farmer can deviate from plans already in motion when rotation and fertility come into play, he believes. That makes Drozd’s advice to grow the crop “that your neighbours are not going to grow” harder, Peters said.

“You don’t necessarily have that luxury,” the farmer said.