* CME feeder cattle end firm

By Meredith Davis

CHICAGO, Dec 10 (Reuters) - Chicago Mercantile Exchange live

cattle futures closed mixed on Tuesday, with the December

contract supported by steady cash expectations for this week

while bearish spreads pressured the February contract, traders

said.

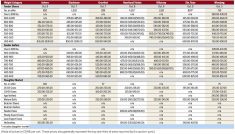

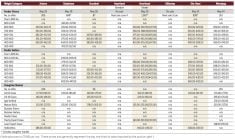

Cash cattle asking prices in Texas and Kansas surfaced at

$134 per cwt with no bids from packers, feedlot sources said.

Last week, cattle in both states sold at $132, while $131 to

$132 traded in Nebraska.

"The (cash) market has been unable to get much above a $132

to $133 trade and it looks like that is going to be the case

Read Also

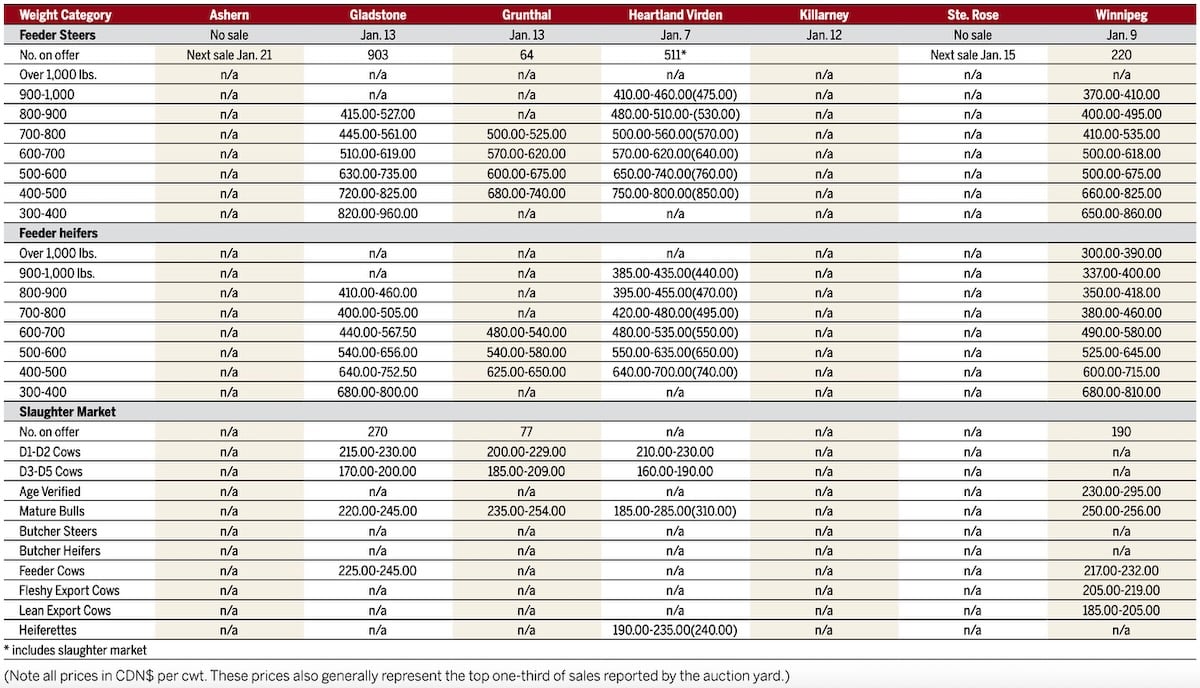

Manitoba cattle prices, Jan. 15

this week," KIS Futures analyst Lane Broadbent said.

Although overall cattle numbers remain tight, packers may be

selective this week due to more animals available for sale.

Unprofitable margins and tepid wholesale beef demand may

restrict how much processors will spend for supplies.

Tuesday afternoon's wholesale choice beef price fell 40

cents from Monday to $202.12 per cwt, and select cuts slipped 11

cents to $188.01, based on U.S. Department of Agriculture data.

According to HedgersEdge.com, beef packer margins for

Tuesday were at a negative $41.50 per head, compared with a

negative $54.05 on Monday and negative $14.85 a week ago.

Spot December live cattle closed up 0.075 cent per

lb at 131.675 cents. February ended down 0.400 cent at

132.650 cents.

CME feeder cattle ended higher, with support from weaker

Chicago Board of Trade corn prices. Cheaper corn may encourage

feedlots to buy young cattle.

CBOT corn sagged on profit taking and technical selling

after the March contract neared a one-month high, traders said.

The closely-followed Oklahoma City feeder cattle market was

closed on Monday due to inclement weather, but light sales were

reported on Tuesday at steady prices, a stockyard source said.

January feeder cattle ended 0.400 cent per lb higher

at 165.550 cents, and March closed at 165.475 cents, up

0.075 cent.

FUND SELLING PRESSURE HOGS

Fund liquidation and profit-taking pushed CME hogs lower on

Tuesday, traders and analysts said.

February futures triggered sell stops after dropping below

the 10-day moving average of 89.610 cents.

Funds also sold the February contract and bought April and

May ahead of December future's expiration on Dec. 17.

February, which will assume lead-month duties after the

December contract expires, is at a sizable premium to CME's hog

index of 81.98 cents.

Lower cash hog prices further weakened nearby hog futures.

Most packers have this week's needs met despite the onset of

wintry weather in the Midwest.

USDA data on Tuesday afternoon quoted the closely-watched

Iowa/Minnesota hog market at $77.56 per cwt, $1.86 lower than on

Monday.

Bitterly cold temperatures across portions of the U.S.

Plains slowed hog movement and will likely slow animal weight

gains, a trader said.

Spot December ended 0.550 cent per lb lower at

80.825 cents. February hogs closed 1.125 cents lower at

88.725 cents.

(Additional reporting by Theopolis Waters; Editing by Diane

Craft)

LIVESTOCK-U.S. live cattle futures settle mixed, hogs lower

By