* Feeder futures follow live cattle higher

* CME hogs climb on futures' discount to cash

By Theopolis Waters

CHICAGO, Oct 22 (Reuters) - Chicago Mercantile Exchange live

cattle on Tuesday gained for a third straight session, helped by

recent wholesale beef price advances that may contribute to

record-high cash prices this week, traders said.

Consumer demand for select beef cuts, which includes roasts,

tends to improve during the fall as interest in outdoor grilling

wanes.

And wholesalers actively compete for less available fresh

beef that coincides with fewer cattle than last year.

Read Also

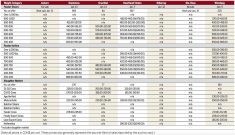

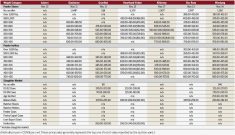

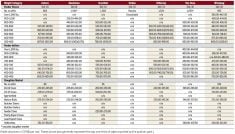

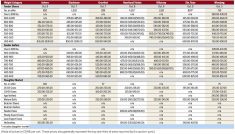

Manitoba cattle prices, Feb. 11

Your overview of cattle prices from Manitoba's livestock auction markets for the period of Feb. 2-10, 2026.

Cattle are scarce now after multi-year droughts in the

United States hurt crops. That drove feed costs to all-time

highs last summer, which at that time forced ranchers to

downsize their herds.

Tuesday morning's average wholesale choice beef price, or

cutout, was at $199.79 per hundredweight (cwt), up $1.50 from

Monday, according to U.S. Department of Agriculture data.

Retailers tend to resist booking large orders of beef around

the $200 price level, which has not been seen since June 18 at

$200.24.

"I think the market has woken up to the idea that our

supplies are really tightening," said Mike Zuzolo, president of

Global Commodity Analytics.

Some feedyards in the U.S. Plains are asking $131 per cwt

for cattle with no response from buyers, feedlot sources said.

Potential $131 sales this week would eclipse the previous record

of $130 for the week ended March 2, 2012.

Last week, cash-basis cattle in the central Midwest fetched

mostly $129 to $130.

Fund buying surfaced after the December contract broke

through its 20-day and 10-day moving averages of 132.20 and

132.45 cents.

Live cattle October closed up 0.975 cent per lb at

131.100 cents. December finished at 132.975 cents,

1.075 cents higher.

CME feeder cattle finished higher with support from live

cattle futures' gains and weaker corn prices. Cheaper corn may

encourage feedlots to buy young cattle.

October closed at 166.050 cents per lb, up 0.225

cent, while November gained 1.450 cents to 167.850

cents.

HOGS JUMP ON DISCOUNT TO CASH

CME hogs halted a three-day losing skid, finishing higher as

December futures' discount to the exchange's hog index, which

was at 90.43 cents, motivated buyers.

The CME on Tuesday morning issued its first lean hog

index since the exchange suspended the data due to the partial

U.S. government shutdown.

December hogs closed 1.100 cents per lb higher at

88.575 cents and February finished at 90.525 cents, up

0.875 cent.

Speculative traders bought hog futures in the belief that

high-priced beef could prompt consumers to switch to less-costly

pork or chicken, traders and analysts said.

Upward market momentum, fueled in part by short-covering,

generated fund buying.

Futures gained upward traction despite the slump in

wholesale pork and cash hog prices amid plentiful supplies.

Tuesday morning's average price of hogs in the western

Midwest market were at $85.90 per cwt, $1.88 lower than on

Monday, based on USDA data. Hog prices in the eastern Midwest

slipped 46 cents to $87.01.

USDA's data showed the wholesale pork price, or cutout, was

at $94.27 per cwt on Tuesday morning, down $1.38 from Monday.

That price decline was mostly due to the $13.54 tumble in the

price of pork bellies, which are made into bacon.

LIVESTOCK-Strong beef prices lift U.S. live cattle futures

By