* CME feeder cattle track weak live cattle

* Hog futures mixed on holiday positioning

By Theopolis Waters

CHICAGO, Dec 24 (Reuters) - Chicago Mercantile Exchange live

cattle futures posted modest losses on Tuesday as investors

pocketed profits before the Christmas holiday, traders said.

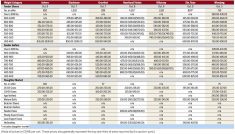

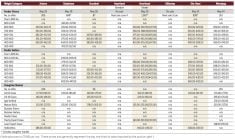

December live cattle futures finished 0.350 cent per

lb lower at 132.350 cents, and February ended down 0.225

cent at 133.725 cents.

December felt added pressure this week from market anxiety

about cash cattle prices.

Last week, cash cattle in the U.S. Plains moved at mostly

$130 per cwt, feedlot sources said.

Meatpacking plants will be dark during two holiday-shortened

Read Also

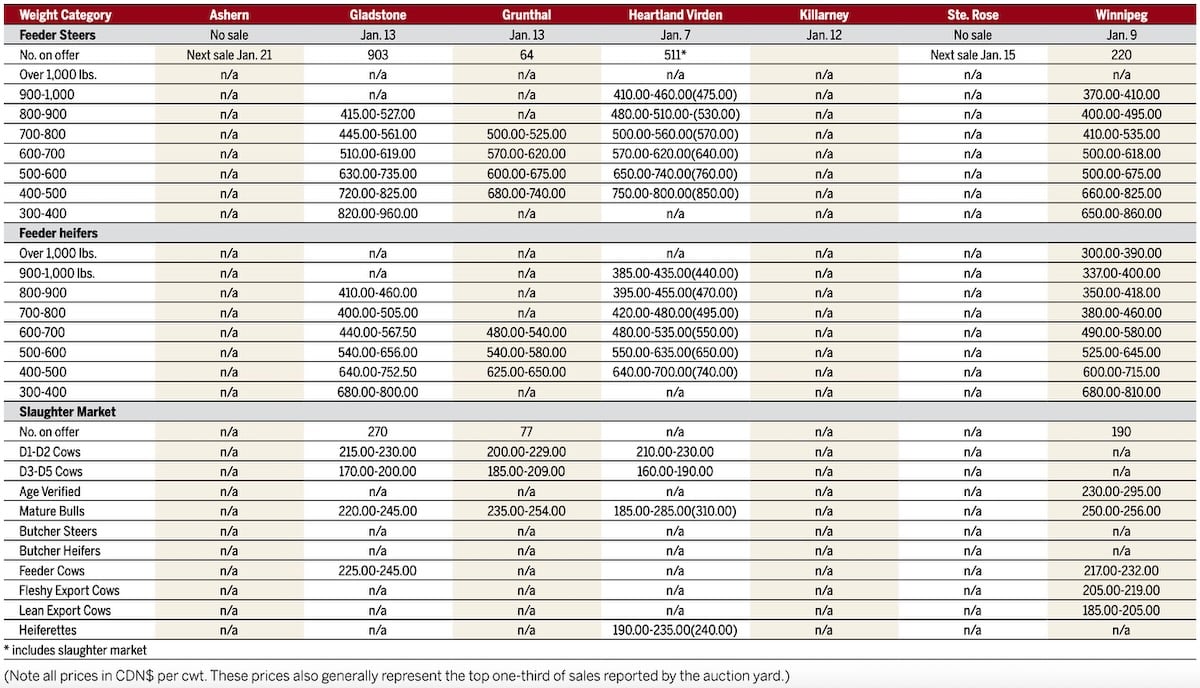

Manitoba cattle prices, Jan. 15

workweeks, making processors reluctant to spend more for

supplies.

Deteriorating packer margins and lukewarm wholesale beef

demand, prior to Tuesday's cutout upturn, could lean on cash

cattle values.

"They (packers) can't move this product. We're continuing to

struggle and packer margins are just one reflection of that,"

CHS Hedging analyst Steve Wagner said.

Tuesday morning's wholesale choice beef price, or cutout,

gained 34 cents per cwt to $197.03, and select climbed $1.90 to

$192.42, based on U.S. Department of Agriculture data.

Beef packer margins for Tuesday were at a negative $77.25

per head, compared with a negative $55.15 per head on Monday and

a negative $41.00 per head a week ago.

Investors planning extended year-end holiday vacations sold

December futures and bought deferred contracts in advance of the

last trading day of the quarter next week.

The Cargill Inc beef packing plant near Dodge

City, Kansas, is expected to be closed until next week as damage

is assessed from a minor fire that broke out Monday evening, a

company official told Reuters.

Live cattle market weakness and profit-taking after recent

gains pulled down CME feeder cattle.

Feeder cattle for January closed at 166.250 cents,

0.425 cent lower, and March finished down 0.450 cent at

166.650 cents.

MIXED HOG FUTURES BEFORE HOLIDAY

CME hogs closed mixed on position-evening before Wednesday's

holiday, traders and analysts said.

Investors await the government's quarterly hog and pig

report on Friday.

February hogs closed down 0.325 cent per lb at

85.875 cents, and April ended at 91.050 cents, up 0.100

cent.

The lack of USDA cash hog prices on Tuesday morning put

February futures buyers on the defensive, triggering sell stops.

"With cash as low as it is, there is no incentive to buy the

February contract," said Wagner.

Traders continued to monitor wholesale pork demand with end

users possibly gearing up to feature product after the New

Year's holiday.

The government's morning wholesale pork price rose 66 cents

per cwt to $85.86, helped by higher loin and rib costs.

(Editing by G Crosse)

LIVESTOCK-Profit-taking weakens CME live cattle futures

By