* CME live cattle gain on cash expectations

* Feeders climb as corn prices drift lower

By Theopolis Waters

CHICAGO, Aug 28 (Reuters) - Chicago Mercantile Exchange hog

futures turned lower on Wednesday as packers slashed cash bids

ahead of the Sept. 2 U.S. Labor Day holiday, traders and

analysts said.

The U.S. Department of Agriculture on Wednesday morning

quoted the average hog price in the most-watched Iowa/Minnesota

market $3.10 cents per hundredweight (cwt) lower from Tuesday at

$85.13.

Cash hog prices fell for a third straight day pressured by

the seasonal increase in supplies.

Read Also

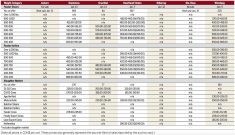

Manitoba cattle prices, Feb. 25

Your weekly table of price ranges for beef cattle from seven Manitoba auction markets during the week ending Feb. 24, 2026.

Hog farmers are sending their animals to market to avoid

lower cash prices as the Labor Day holiday approaches. And,

packing plants will be closed for Monday's holiday, limiting

their need for hogs.

Grocers cutback pork purchases for a third day in row after

covering needs for holiday grilling demand.

Wednesday morning's government data showed the wholesale

pork price, or cutout, at $96.20 per cwt. The cutout tumbled

$5.60 from Tuesday led by the $15.81 drop in prices for pork

bellies, which are made into bacon.

Pork belly values were hit hard as the summer

bacon-lettuce-tomato season winds down, said traders.

They said speculative investors sold deferred CME hog

contracts in the belief that cheaper corn will increase hog

production.

October hogs finished 0.525 cent lower at 86.050

cents per lb while December ended down 0.400 cent to

83.150 cents.

CASH IDEAS LIFT LIVE CATTLE

CME live cattle settled moderately higher on short-covering

in anticipation of at least steady cash prices this week,

traders and analysts said.

Cash cattle bids in Texas and Kansas stood at $121 per cwt

against $125 and higher asking prices, feedlot sources said.

Last week, cash cattle traded at mostly $123 per cwt in

Texas and Kansas, and $125 in Nebraska.

Mixed to higher wholesale beef prices the past five days is

supportive for cash prices. Consistent beef demand suggests

packers are buying product beyond the Labor Day holiday.

USDA Wednesday morning reported the wholesale choice beef

price, or cutout, at $196.74 per cwt, up 65 cents from Tuesday.

Select cuts slipped 47 cents to $185.17.

Investors may buy futures if the cutout moves higher, which

increases the chances of packers paying more for cattle, Doane

Advisory Services economist Dan Vaught said.

Deferred live cattle contracts rose slightly on the prospect

that tighter cattle numbers would support cash cattle values at

that time.

Spot August live cattle ended 0.350 cent higher at

123.300 cents per lb. Most-actively traded October

closed up 0.200 cent to 126.925 cents.

Feeder cattle futures at the CME finished steady to higher.

Spot-August feeder cattle was led by the exchange's feeder

cattle index which was at 155.00 cents. That contract will

expire on Aug. 29.

Spot August feeder closed unchanged at 154.725

cents.

Firm deferred-month live cattle and weaker corn prices

boosted remaining CME feeder cattle futures.

Most-actively traded September finished 0.650 cent

higher at 155.925 cents and October at 157.625 cents,

0.675 cent higher.

(editing by Gunna Dickson)

LIVESTOCK-Lower cash prices pull down U.S. hog futures

By