* CME live cattle slide amid cash caution

* Live cattle losses weigh on feeder futures

* USDA cold storage report Thursday at 2 p.m.

* USDA monthly cattle-on-feed report due Friday

By Theopolis Waters

CHICAGO, Aug 22 (Reuters) - Chicago Mercantile Exchange hog

futures fell on Thursday in reaction to lower cash hog and pork

prices and a seasonal increase in hog supplies, traders and

analysts said.

The U.S. Department of Agriculture on Thursday morning

reported the average hog price in the closely watched

Iowa/Minnesota market fell $1.92 per hundredweight (cwt) from

Wednesday to $90.29.

Read Also

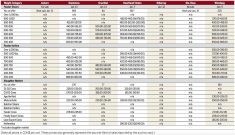

Manitoba cattle prices, Feb. 25

Your weekly table of price ranges for beef cattle from seven Manitoba auction markets during the week ending Feb. 24, 2026.

Another USDA report on Thursday reported the wholesale pork

price, or cutout, at $99.95 per cwt, down $1.80 from Wednesday.

In that report the price of frozen pork bellies, which are made

into bacon, dropped $24.83.

Pork belly prices often drop in late summer as the

bacon-lettuce-tomato season winds down.

Heavier hog weights and higher slaughter numbers have

increased pork production at a time when the peak demand season

is drawing to a close, said independent livestock futures trader

Dan Norcini.

From Monday to Thursday, packers processed 1.714 million

hogs, up 26,000 from last week and 12,000 more than a year

earlier, according to USDA.

Traders sold deferred hog contracts with the view that

lower-priced corn will increase hog production.

Fund liquidation developed when CME October and December

hogs fell below key moving averages. October hogs closed

down 1.425 cents at 84.400 cents per lb. That was below the

40-day moving average of 85.47 cents.

December hogs settled down 1.025 cents at 81.600

cents and under the 20- and 40-day moving averages, which

converged at 82.29 cents.

After the close USDA released its monthly cold storage

report. As of July 31, it showed 463.92 million lbs of beef in

storage, up slightly from 461.1 million a year ago; 545.26

million lbs of pork, down from 549.62 million a year ago; and

685.1 million lbs of chicken, versus 650.44 million a year ago.

CASH CAUTION WEAKENS LIVE CATTLE

CME live cattle futures settled lower as the lack of cash

cattle sales so far this week discouraged buyers, traders and

analysts said.

The recent pattern of packers purchasing cattle late on

Friday coupled with lower cash hog prices have weighed on both

markets in the second half of the week, Global Commodity

Analytics & Consulting president Mike Zuzolo said.

Cash cattle bids in the southern U.S. Plains stood at $121

per cwt versus $125 and higher asking prices from sellers,

feedlot sources said.

Last week, cash cattle in Texas and Kansas moved at $123 per

cwt, and in Nebraska at $125.

Bullish traders believe tight supplies and firm wholesale

beef prices will force packers to raise bids for cattle. Market

bears contend futures' recent pullback might keep a lid on cash

values.

Thursday morning, the government quoted the wholesale choice

beef price at $195.92 per cwt, up 46 cents from Wednesday.

Select cuts jumped 87 cents to $185.31.

Investors adjusted positions before USDA's monthly

cattle-on-feed report on Friday.

Analysts polled by Reuters believe fewer feeder cattle and

expensive corn resulted in less U.S. cattle available for

feeding.

Spot August live cattle closed 0.800 cent lower at

123.350 cents per lb. Most-actively traded October

closed down 0.775 cent to 127.200 cents.

CME feeder cattle closed flat to week pressured by live

cattle futures' losses.

Spot August feeder cattle closed at 155.450 cents,

down 0.125 cent per lb. Most-actively traded September

ended unchanged at 157.700 cents and October settled

down 0.075 cent to 160.000 cents.

(Editing by Bob Burgdorfer)

LIVESTOCK-Lower cash prices drag down US hog futures

By