* Profit taking drags down CME live cattle

* Feeder futures fall as corn prices climb

By Theopolis Waters

CHICAGO, Oct 15 (Reuters) - Chicago Mercantile Exchange hog

futures prices finished more than 1 percent higher on Tuesday as

fund buying rallied the market from early-session lows, traders

and analysts said.

They said nearby hog contracts punched through resistance

levels at key moving averages, drawing the attention of fund

buyers and triggering buy stops.

December hogs closed 1.450 cents per lb higher, up

1.68 percent, at 87.800 cents. It settled above the 20-day and

10-day moving averages of 87.15 cents and 87.03 cents,

Read Also

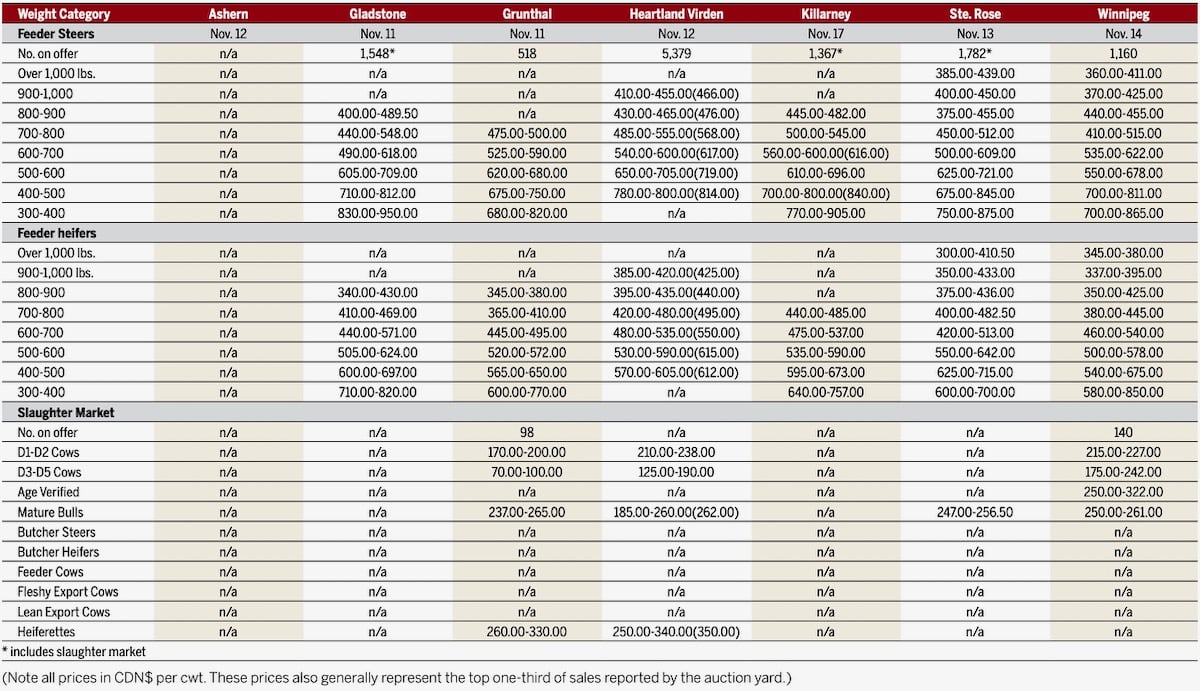

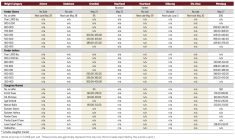

Manitoba cattle prices, Nov. 17

respectively.

February finished 1.150 cents, or 1.3 percent,

higher at 89.800 cents. It ended above the 10-day and 20-day

moving averages of 89.39 cents and 89.17 cents.

Higher-than-expected prices for hogs in local markets

motivated futures buyers and prompted short-covering. Futures'

discount to those cash returns provided more market support.

"From a fundamental standpoint, the cash market sounds like

it's in good shape," R.J. O'Brien hog futures trader Tom

Cawthorne said.

CATTLE SAG ON PROFIT TAKING

CME live cattle futures suffered their biggest

one-day decline, 0.65 percent, in 1-1/2 months on profit taking

led by sentiment that futures are overpriced based on last

week's cash cattle prices.

Last week, cash cattle in Texas and Kansas moved at mostly

$128 per hundredweight (cwt), up $2 from the week before.

Live-basis cattle in Nebraska a week ago traded at $127.50 to

$129, $1.50 to $3 higher than the previous week.

"The $2 push in cattle prices last week was probably a

little surprising. Maybe we did two weeks worth of prices in

one," U.S. Commodities analyst Don Roose said.

October futures are factoring in the possibility of a steady

cash cattle trade this week, and December is at a premium to

cash, he said.

Live cattle October closed 0.950 cent per lb lower

at 128.500 cents while December finished down 0.400 cent

to 132.750 cents.

Improved wholesale beef prices and tight supplies may

underpin cash prices, with packers mindful of their poor

margins.

Estimated margins for U.S. beef packers on Tuesday were a

negative $42.75 per head, compared with a negative $37.40 on

Monday and negative $41.95 last week, according to

HedgersEdge.com.

Data supplied by analytical market-research firm Urner Barry

showed the Tuesday morning wholesale choice beef price, or

cutout, at $193.95 per cwt, up 67 cents from Monday. Select cuts

rose 54 cents to $180.27.

Packers on Tuesday processed an estimated 122,000 head of

cattle, 6,200 fewer than last year, according to Urner Barry.

CME feeder cattle fell about 1 percent on lower live cattle

futures and profit taking after futures' recent spike to new

highs.

October feeder cattle ended 1.675 cents per lb

lower, or 1.0 percent, at 165.700 cents. November

settled at 167.500 cents, down 1.900 cents, or 1.12 percent.

Feeder cattle futures also felt pressure from higher corn

prices. Feedlots will be reluctant to buy young cattle if corn

prices trend higher.

Chicago Board of Trade Corn for December delivery

ended up 6-1/2 cents to $4.43-1/2 per bushel on short-covering.

"Cheap corn and the market got overextended," said Linn

Group analyst John Ginzel regarding Tuesday's CME feeder cattle

losses.

(editing by Jim Marshall)

LIVESTOCK-Fund buying lifts US hog futures from morning lows

By