* Live cattle futures lift CME feeder cattle

* Cash jitters pare hog futures' advances

By Theopolis Waters

CHICAGO, Dec 30 (Reuters) - Chicago Mercantile Exchange live

cattle futures on Monday landed in positive territory for a

third straight session, fueled by sharply higher wholesale beef

prices, traders said.

Monday morning's wholesale price for choice beef rose $2.33

per cwt from Friday to $199.32, and select surged $3.30 to

$194.60, according to the U.S. Department of Agriculture.

Plant closures during the Thanksgiving, Christmas and New

Year's holidays reduced the amount of beef available to end

users, thereby driving up wholesale prices, analysts and traders

Read Also

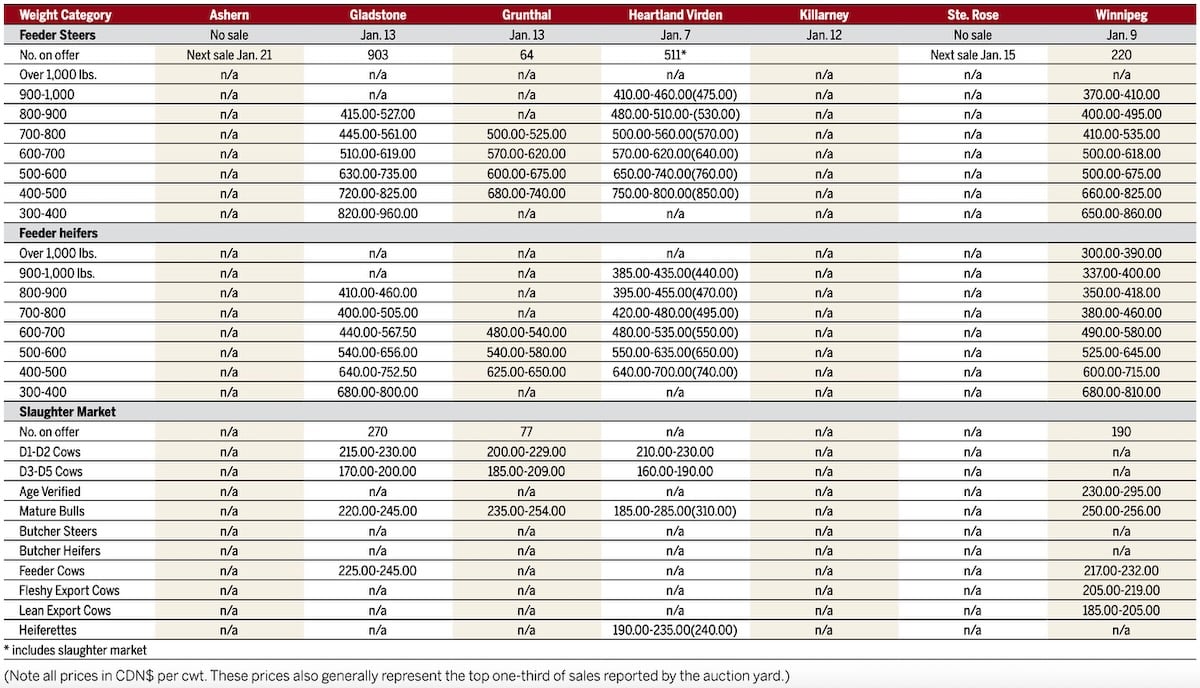

Manitoba cattle prices, Jan. 15

said.

And, they said, some supermarkets are stocking up on beef to

feature it soon after Jan. 1.

Monday's beef price upswing followed Friday's record high

cash cattle returns in the midst of tight supplies.

Last week, cash cattle in Texas moved at mostly $133.50 per

hundredweight (cwt), feedlots sources said. They reported sales

of mainly $133 in Kansas and $135 in Nebraska.

Typically, beef prices may have to move sharply higher for

packers to rationalize paying record prices for cattle,

EBOTTrading.com senior analyst John Kleist said.

Despite poor margins, processors paid more for cattle,

knowing they will need them for the first full week of

production after the holiday-shortened workweeks.

Packers are expected to cut operating hours to offset scarce

supplies and cushion margins.

Beef packer margins for Monday were estimated at a negative

$88.25 per head, compared with a negative $73.50 per head on

Friday and negative $55.15, a week ago, as calculated by

HedgersEdge.com.

USDA estimated Monday's cattle slaughter at 130,000 head,

including 10,000 head that were processed on Sunday.

Cargill Inc. likely harvested cattle on Sunday to

make up for one of its plants that was temporarily sidelined by

fire last week, traders and analysts said.

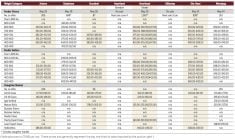

December live cattle, which will expire on Tuesday,

finished 0.550 cent per lb higher at 134.400 cents. February

settled up 0.150 cent at 135.100 cents.

CME feeder cattle drew support from live cattle futures

advances and weaker corn prices.

Feeder cattle for January closed at 167.275 cents

per lb, 0.275 cent higher, and March finished at 167.950

cents, up 0.150 cent.

HOG FUTURES FALL FROM HIGHS

CME hogs turned lower on profit taking and cash price

worries that erased initial futures gains sparked by Friday's

bullish USDA hog report, traders said.

That data showed the U.S. hog herd fell by 1 percent in the

latest quarter, slightly more than forecast as a deadly swine

virus thwarted pork producers' efforts to rebuild herds.

Premiums in the April and June contracts imply that traders

had already anticipated a big impact from the virus, independent

livestock futures trader Dan Norcini said.

USDA showed the morning's average cash hog price in the

eastern Midwest at $76.13 per cwt, down 27 cents from Friday.

Overall cash hogs in the Midwest sold steady to $1.00 lower,

according to hog dealers.

Some packers are reluctant to raise cash hog bids given

ample supplies and plants closed on New Year's. Others will soon

need hogs for Saturday to make up for Wednesday's holiday

downtime.

February hogs closed 0.675 cent per lb lower at

84.975 cents, and April ended down 0.525 cent at 90.450

cents.

(Editing by Steve Orlofsky)

LIVESTOCK-Beef price hike extends CME live cattle futures gains

By