May 20 (Reuters) – Chicago Mercantile Exchange live cattle turned moderately weaker on Tuesday, pressured by profit-taking after Monday’s rally, traders said.

* Futures’ discount to last week’s cash cattle prices, along with Monday’s wholesale beef price gains, limited losses, they said.

* At 8:19 a.m. CDT (1319 GMT), June was down 0.325 cent per lb at 139.075 cents, and August dropped 0.350 cent to 140.200 cents.

* Investors await this week’s cash cattle prices that may feel pressure as packers buy animals for the Memorial Day holiday week.

* Packers are trying to avoid spending for supplies that are poised to increase seasonally.

Read Also

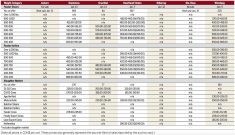

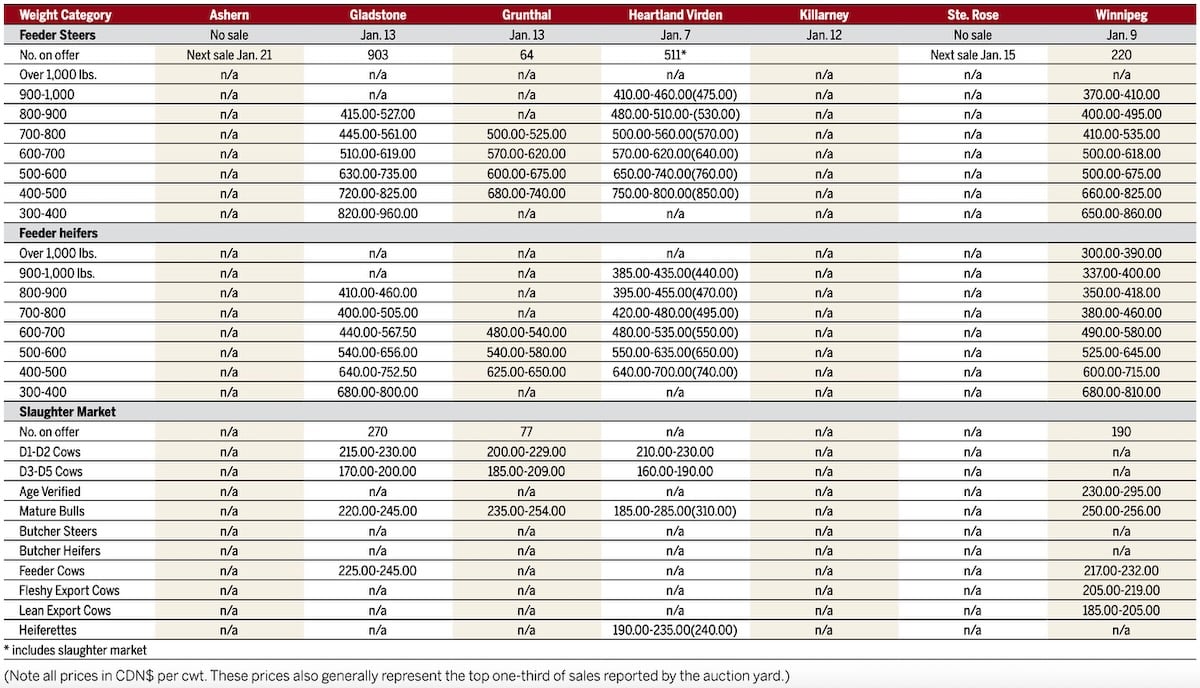

Manitoba cattle prices, Jan. 20

* Traders are encouraged by the recent upturn in wholesale beef prices, suggesting grocers are buying product to accommodate post-Memorial Day holiday grilling demand.

* FEEDER CATTLE – May traded at 188.625 cents, up 0.150 cent per lb. August was at 196.450 cents, 0.250 cent higher.

* CME feeder cattle drew support from tight feeder cattle supply expectations and buying leftover from Monday’s futures spike to an all-time high.

* LEAN HOGS – June was 0.225 cent weaker at 119.150 cents, and July slipped 0.375 cent at 125.300 cents.

* Profit-taking and CME hogs’ premium to the exchange’s hog index at 112.30 cents pressured futures, traders said.

* Uneasiness about cash hog prices as packers pull back operations before the 3-day holiday weekend discouraged futures buyers.

* Speculators look to buy dips in the market with the view the deadly Porcine Epidemic Diarrhea virus will hurt supplies beginning this summer. (Reporting by Theopolis Waters in Chicago)