May 7 (Reuters) – Chicago Mercantile Exchange live cattle futures moved upward on Wednesday, with support from their discounts to prices for market-ready, or cash, cattle last week, traders said.

* Wednesday is the first of five days in which funds that follow the Standard & Poor’s Goldman Sachs Commodity Index will sell, or “roll,” their June long CME live cattle and hog, positions into deferred months.

* At 8:38 a.m. CDT (1338 GMT), June was up 0.675 cent per lb to 138.975 cents, and August rose 0.800 cent to 138.725 cents.

* Another choppy trading day may be in store for CME live cattle as investors await reports regarding this week’s cash sales, an analyst said.

Read Also

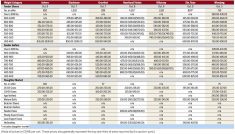

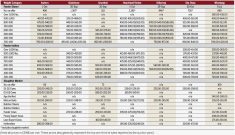

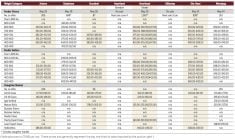

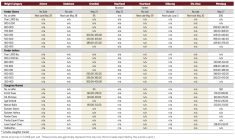

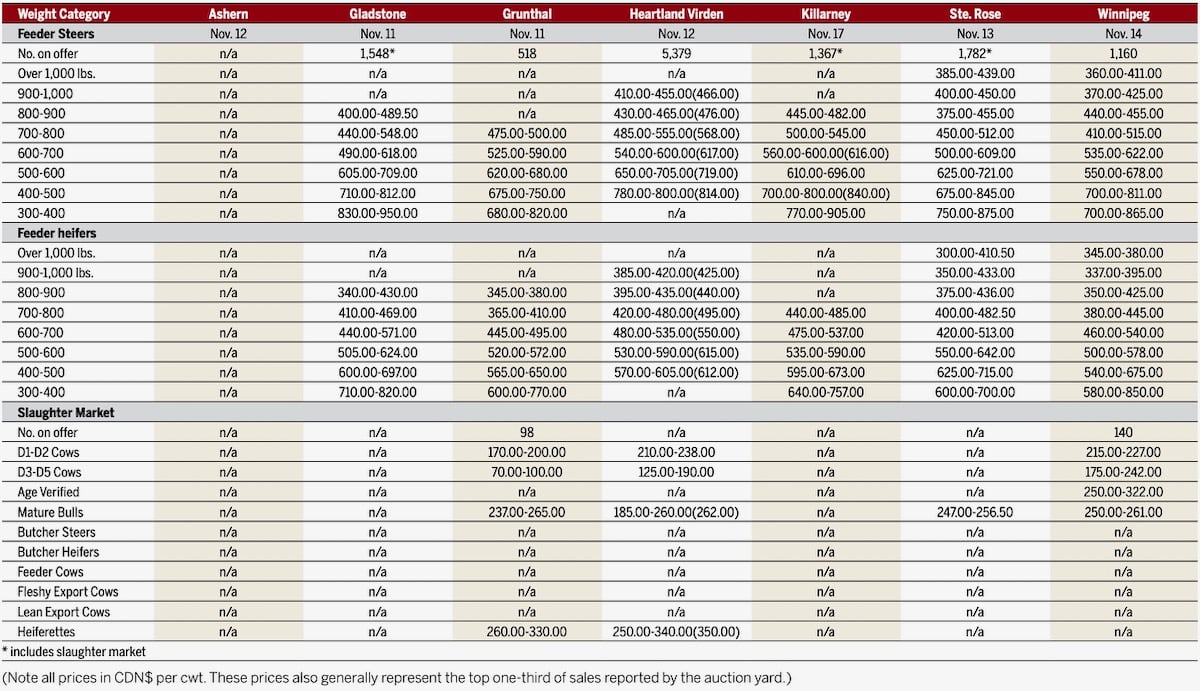

Manitoba cattle prices, Nov. 17

* A seasonal rise in cattle numbers and Tuesday’s lower wholesale beef price are bearish factors for cash prices, traders said.

* They said futures’ recent upswing and improved packer margins might underpin cash returns.

* Cash cattle bids in Texas and Kansas developed at $144 per hundredweight (cwt), feedlot sources said.

* Last week, cash cattle in Texas and Kansas sold at $146 per cwt, with sales of $147 to $150 in Nebraska.

* FEEDER CATTLE – May was at 184.375 cents, up 0.900 cent per lb, and August was 1.650 cents higher at 192.900.

* CME live cattle futures’ buying and weak corn prices lifted feeder cattle contracts.

* LEAN HOGS – May lean hogs were at 115.400 cents per lb, down 0.650 cent. Most actively traded June was 0.550 cent lower at 122.675 cents.

* CME hogs slid on profit-taking following Tuesday’s sizable wholesale pork price setback, traders said.

* The delayed start of spring grilling slowed retail demand for pork, a trader said.

* Futures’ premium to CME’s hog index, at 114.21 cents, discouraged buyers.

* Investors are eyeing news that workers at the JBS Worthington, Minnesota hog plant voted to authorize a strike over wages and health benefits, according to statement late on Tuesday from a union representing the employees. (Reporting by Theopolis Waters in Chicago Editing by W Simon)