ICE Futures Canada canola futures continued to lose ground on the charts with the front-month May contract dropping from $503.70 per tonne on March 17 to $482.50 by the close on March 24.

Funds were liquidating long positions and moving to the short side while others bailed as the dominant contract sunk below the psychologically important $500 mark.

There seems to have been some thought that canola could hold up against the massive stream of soybeans coming onto the market from South America; however, as one analyst pointed out, unlike last year, soybean acreage in the U.S. is expected to increase this spring.

Read Also

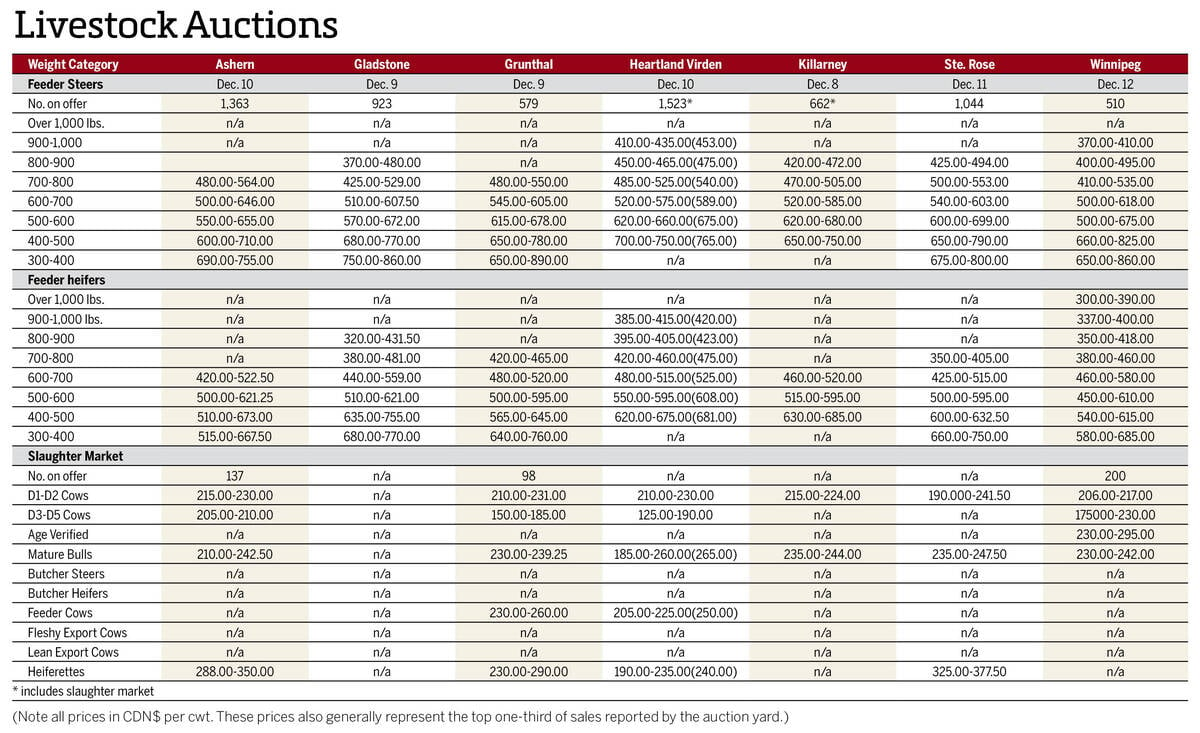

Manitoba cattle prices Dec. 16

Here’s what local farmers were getting paid last week for their cattle at Manitoba livestock auction marts; prices covering the week Dec. 8-12, 2025.

Technical selling was a main feature of the week as traders unwound the July/November spread and took positions ahead of the release of the U.S. Department of Agriculture’s prospective plantings report on March 31. Others also took large positions on canola/soybeans spreads.

Rumours that canola orders had been cancelled also made the rounds in the market, adding to the downturn, even while bearish chart signals were present.

The Canadian dollar was a relative non-factor during the period, dropping just a quarter of a cent.

The damage could have been worse, except for the fact Canada’s canola stocks appear to be dwindling. Some participants say we could run out before the start of the fall harvest.

However, the one factor that could change this is the unknown amount of unharvested canola still lying in Prairie fields. Some market watchers say some of it could still be usable, while others doubt the quality is any good at all. Whatever the case, the uncertainty is creating some trepidation in the market.

Soybean potential

Rising estimates for crops in Brazil and Argentina continues to weigh on the soybean market. The crop was already expected to be massive long ago, but good weather has increased that potential even more.

Corn was consolidating over the week as traders began to position themselves in advance of USDA’s prospective plantings report. Large world supplies and reports of reduced fertilizer usage dragged on corn prices.

Chicago wheat was lower during the period as rain fell on parts of the U.S. Plains, alleviating concerns over excess dryness. On the other side, U.S. acreage was expected to be lower, which limited the losses.