We’re halfway through the year and a lot has happened already. From a major invasion in Europe to rising interest rates and one of the worst starts for stocks ever, this year has not been without volatility.

We’ll take this mid-summer opportunity to do a 2022 halftime financial review of where we’ve been, what it means and where we might be going.

After the first six months of the year, the main European and U.S. stock market indices are down about 20 per cent, while the technology-heavy NASDAQ Index is down 30 per cent. With a group of commodities indices having been up by as much as 50 per cent at one point and still up around 20 per cent, the commodity-resource-intensive Toronto Stock Exchange Index is off only about 14 per cent.

Read Also

Wheat prices likely headed for sideways trade

U.S. brush with a severe winter storm put only brief upward pressure on wheat futures markets into last week of January.

At the time of writing in mid-July, the Canadian dollar is down almost three cents versus the U.S., continuing its downward trend of the past 12 months. Meanwhile, a measure of the U.S. dollar against a broad basket of global currencies, including the euro, Japanese yen and British pound, is up 13 per cent.

Inflation and interest rates have been grabbing a lot of attention. Consumer prices are up almost eight per cent across Canada, nine per cent in the U.S. and nearly nine per cent throughout Europe. This has forced the Bank of Canada to raise central bank rates from 0.25 per cent to 2.5 per cent. The U.S. expects to see similar increases.

Let’s focus on interest rates for a moment. They are important because they price time, money and therefore almost everything else, from mortgages and consumer purchases to business loans and government debt. This is, in turn, the case for stocks, commodities and real estate.

Likewise, relative interest rate differentials between countries will affect the value of one currency against another. Rates can also help forecast economic activity.

The Federal Reserve of San Francisco notes that the difference between long-term and short-term interest rates is a strikingly accurate predictor of future economic activity. Every U.S. recession in the past 60 years was preceded by an inverted yield curve, whereby short-term rates were higher than long-term rates.

Given we’ve been flirting with a yield inversion for the past few weeks, a recession would extend the duration of the current stock market correction. Although the odds of a recession have increased in the past few months, the strong employment conditions in both the U.S. and Canada might suggest a milder, shorter-lived slowdown.

So how about stocks going forward? Historically, stock markets tend to do well in the years after rates start to rise. In fact, even when interest rates were rising, the S&P 500 U.S. stock market index had a total annualized average return of just over nine per cent throughout those cycles and was positive in 90 per cent of those periods.

This time around though, we are moving up from a 50-year general downward trend in rates, which culminated in near-zero interest rate policies from many central banks around the world. As rates rise, the boomerang effect of higher interest costs and inflation could be more volatile than history would suggest.

At the same time, stocks typically do well during periods when the U.S. federal funds rate is rising because this usually means a strong economy and increasing corporate profits.

Most of what caused the current inflationary conditions — including years of quantitative easing and money creation going back to the 2008 crash and, more recently, COVID-19, the ensuing pandemic-induced government spending, supply chain disruptions and consumer hoarding — have already reached their end.

As much as financial liquidity was expanding over the past several years, it is now starting to go in the opposite direction. In particular, the U.S. Federal Reserve is now in a quantitative tightening mode, raising interest rates and reducing liquidity.

How much will this slow global markets and the economy? With stocks down 20 to 30 per cent, some economic slowdown is already being factored into the markets.

Will there be continued equity weakness? Are the U.S. Federal Reserve and other central banks still behind the inflation curve, forcing them to continue to raise rates a lot higher? Or maybe we will be surprised to see inflation and rate increases come down by year’s end.

Interestingly, Canadian and U.S. short-term interest rate futures curve charts already show rates peaking by the end of 2022, with expectations they’ll be lower next year.

The path forward

Bottom line, where do we go from here? Often, what goes up comes down, or what goes down comes up, so maybe all the attention inflation and interest rates are getting will have run its course.

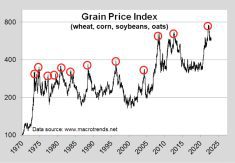

Or perhaps, just as the inflationary dislocations of the 1970s ushered in a new level of higher commodity prices, maybe the impact of recent droughts, the Russian invasion of Ukraine, pandemic-induced hoarding and renewed global inflationary pressures will bring about the next step higher in the long-term staircase of global commodity and consumer prices.

These are a lot of questions without answers, but having a farm marketing plan that includes options and futures hedging strategies can help you navigate the fluctuations and uncertainty. On the investment front, well-priced, moderate risk, big blue-chip companies with long-term histories, as well income investments with steady dividends or interest payments linked to rising interest rates, can be a good way to hedge your investment portfolios in this environment as well.