Little changed from a fundamental standpoint in the canola market during the last week of June, but broader geopolitical factors were enough to take prices off their highs.

News the United States bombed Iranian nuclear facilities initially sent crude oil prices climbing higher. However, any buying quickly turned to selling and crude posted sharp losses on the week as tensions eased, and a tentative ceasefire between Iran and Israel appeared to be holding. World vegetable oil markets tracked the activity in the energy sector, with strength in the Canadian dollar adding to the relative weakness in canola.

November canola hit a high of $751.70 per tonne on June 20 but was $45 off that high only two trading sessions later before eventually seeing some stability.

Read Also

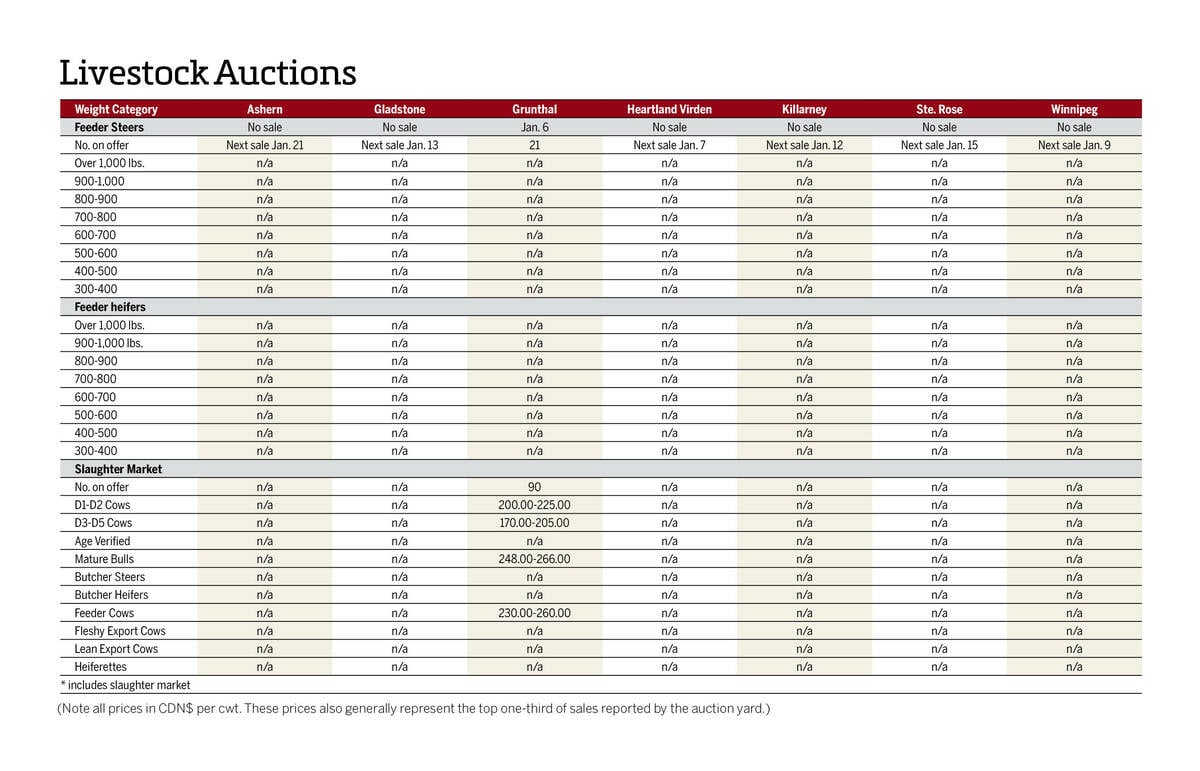

Manitoba cattle prices Jan. 6

Grunthal was the first Manitoba livestock auction mart to kick off 2026 cattle sales in early January.

Charts

From a technical standpoint the November contract had been looking overbought and due for a correction at the highs, with the downturn taking values back in line with the 20-day moving average. The fact the market managed to hold above that key chart level despite the correction was supportive, with the general uptrend still intact heading into the heat of summer.

Weather

Trading typically slows down over Canada Day and Independence Day in the United States, with weather conditions after the holidays a key market driver. While there are areas of concern in both countries, conditions were generally favourable in late-June as warm temperatures and sufficient rains were near ideal for crop growth.

Canada’s canola area

Rising canola prices over the past few months have raised expectations for increased seeded area from at least some analysts. However, uncertainty over trade and tariffs apparently countered any optimism from the rising prices and Statistics Canada lowered their call on canola acres in a report out June 27.

StatCan pegged canola area in 2025 at 21.46 million acres, which was down from the March estimate of 21.65 million and the year ago level of 22.01 million acres.

U.S. markets

Soybean, corn and wheat futures in Chicago were all down sharply during the first official week of summer, with favourable Midwestern crop weather adding to the spillover weakness from crude oil.

Corn set fresh contract lows during the week, with US$4.00 per bushel a major downside target in the September contract. November soybeans traded just above support at US$10.15/bu.

The U.S. winter wheat harvest was moving forward, with seasonal harvest pressure expected to weigh on values over the next few weeks.