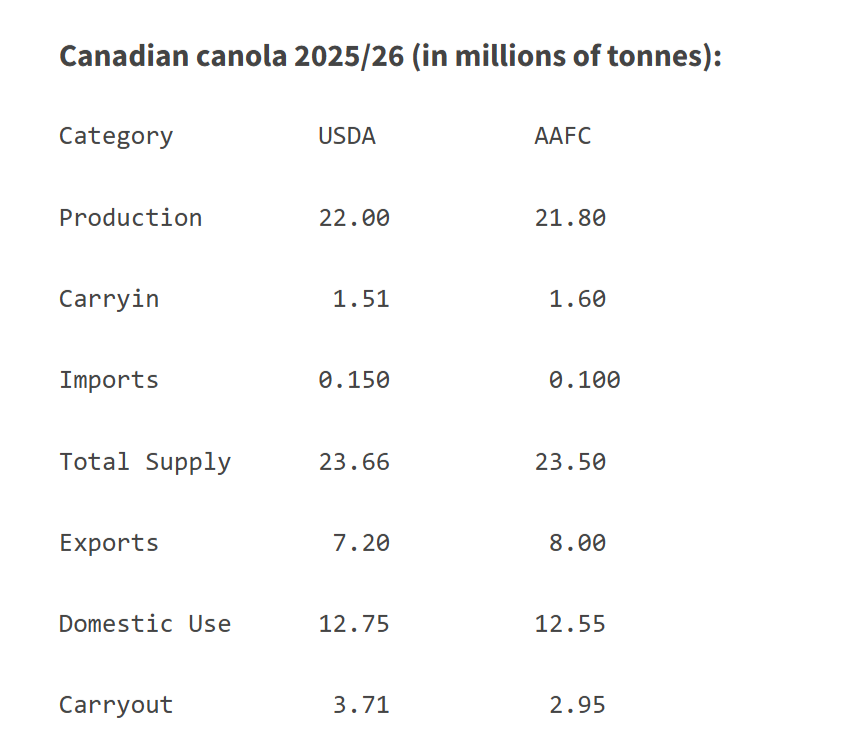

Glacier FarmMedia — There’s a 760,000-tonne difference in the ending stocks for Canada’s 2025/26 canola crop, respectively estimated by Agriculture and Agri-Food Canada and the United States Department of Agriculture. Aside from that, the canola data from AAFC and the USDA remain quite similar.

USDA vs. AAFC

In the USDA’s monthly world oilseed report issued on Jan. 12, the department maintained its December projection of a Canadian canola ending stocks of 3.71 million tonnes. Should that hold, it would make for a jump of nearly 146 per cent from 2024/25.

Read Also

More canola, spring wheat likely to be seeded this spring

As spring planting approaches, farmers are busy planning which crops to seed this year and how much. With that, market thoughts have turned toward planted area projections, as Statistics Canada is set to issue its report on Thursday.

In December, AAFC forecasted those canola ending stocks at 2.95 million tonnes, up from 1.60 million in 2024/25.

“The USDA is currently estimating lower crush and exports than AAFC in 2025/26 which would explain the difference in ending stocks,” USDA spokesperson Luke Cummings said in an email to Glacier FarmMedia. Cummings noted USDA policy is to assume any trade policies are assumed to remain in effect for a given marketing year.

‘Both wrong’

To MarketsFarm analyst Mike Jubinville, AAFC and the USDA are “both wrong” when it comes to their carryover estimates.

“We are currently running a weekly export shipment pace to total 6.6 million tonnes of canola exports this year. That’s well short of the eight million tonnes AAFC is using,” Jubinville continued.

The Canadian Grain Commission reported for the week ended Jan. 4, that cumulative canola exports for 2025/26 reached 2.81 million tonnes, compared to 4.72 million a year ago. China’s steep tariffs on Canadian canola being main reason for the 40.5 per cent decline.

Jubinville said unless China were to lower or eliminate its levies on its imports of Canadian canola seed, oil and meal, the carryout for the oilseed is likely to reach 4.10 million tonnes.

“I’d say USDA is closer to reality and AAFC is slow to catch up,” Jubinville said, adding that such high ending stocks would be “burdensome.”