Glacier Farm Media — There are grim prospects for canola prices as the New Year approaches said Winnipeg-based trader and farmer Bill Craddock.

“These are some tough markets to trade,” Craddock said. “It’s hard to predict what they’re going to do from one day to the next.”

He explained that when the January canola contract increases to around C$625 per tonne, the market moves to push the price lower.

That held true over the week ended Dec 10, with the January canola contract dropping almost C$14 at C$615.40 per tonne and the March contract down nearly C$16 at C$626.80/tonne.

Read Also

‘Significant’ Canadian GDP slide expected in 2026, FCC says

Farm Credit Canada expects continued trade woes and mortgage renewals to weigh on Canada’s economic growth in 2026

Exports & domestic use

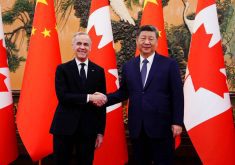

One big issue Craddock said has been the lack of canola export sales to China. However, he pointed out that “the domestic crushers are running flat out” with farmers quite willing to sell their canola to them. That has meant those buyers don’t need to push up their prices to attract more canola from the farmers.

Despite that strong domestic use of canola, Craddock is rather pessimistic about where the Canadian oilseed’s prices are heading.

Bleak outlook

Craddock said his gut feeling says the nearby contracts could lose another C$15 to C$20/tonne before New Year’s. Then in the first part of 2026, he expects those contracts to slide back an additional C$20 to C$40.

“I think we are going to be disappointed (and) scratching our heads on how we can lock in something decent for the coming year,” he said.

When canola was at C$14 per bushel, Craddock estimated a farmer would make between C$50 to C$60/acre over variable costs on a crop that yielded 40 bushels per acre.

“It’s not great,” he said.

Now Prairie cash prices have fallen below C$13/bu. in most cases, making the situation more dire for farmers.