Soybeans, wheat and corn have been trading generally lower of late on the Chicago Board of Trade (CBOT).

In particular soybeans are in “a little bit of a free fall,” said Terry Reilly, senior agriculture futures analyst with Futures International in Chicago.

“It’s purely technical. We closed below the 100-day moving average (Tuesday) based on the May contract. We saw additional selling coming to the market today without any fresh bullish news.”

The same traders have been looking at the May soybean contract in the area of $9 per bushel, he said (all figures US$). May soybeans dropped to $9.07 per bushel Wednesday morning, but managed to settle well above that at $9.16.

Read Also

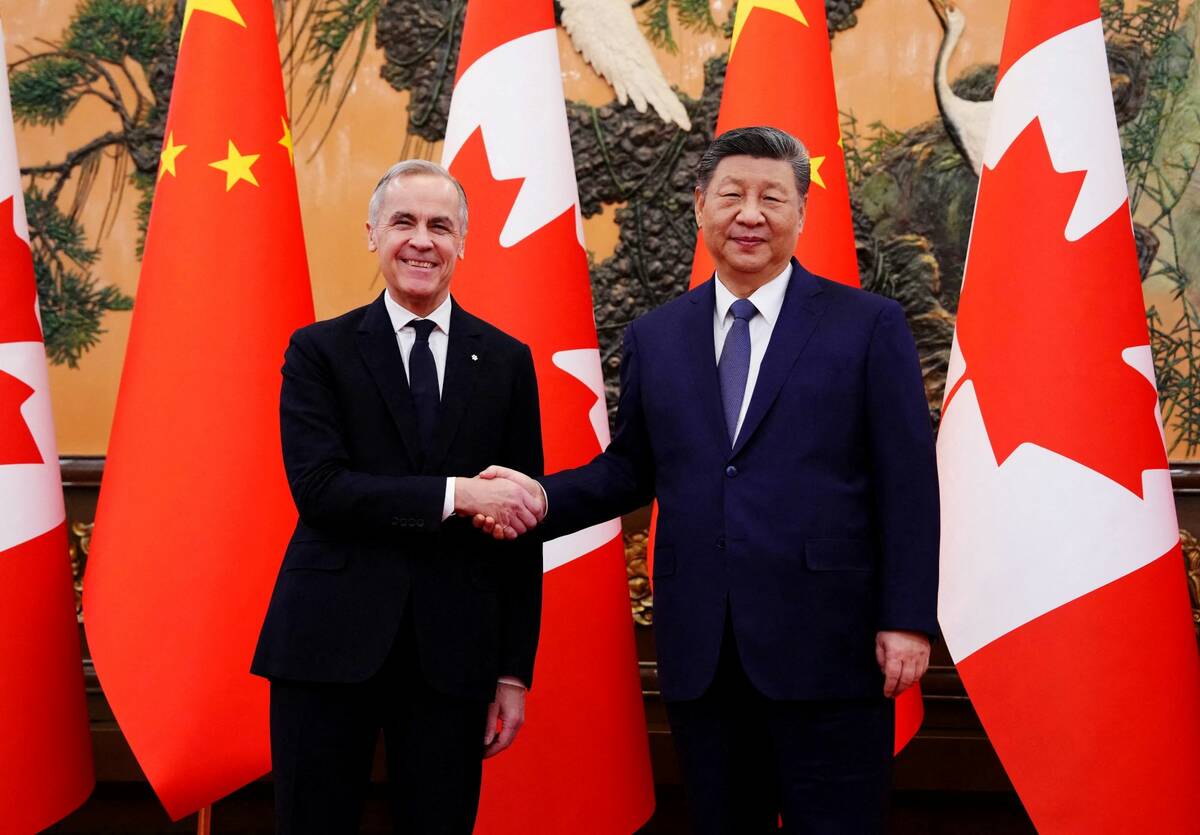

Canada-China roundup: Producer groups applaud tariff relief; pork left out; mix of criticism and praise from Trump administration

Producer groups across Canada expressed a mix of relief and cautious optimism following the news that Canada had struck a deal with China to lower tariffs on canola, peas and other goods, in return for relaxing duties on Chinese electric vehicles.

Wheat was feeling the pressure as well, according to Reilly, and pointed to the Paris wheat market as one reason, as it’s been hitting lows since July 2018.

“Also, U.S. wheat wasn’t part of the Egyptian import tender for offers this morning. So traders are seeing that as U.S. not competitive against major exporting countries.”

Corn has been following soybeans and wheat on the downward trend, without a fundamental reason as to why, Reilly noted.

He pointed out that U.S. President Donald Trump wants corn to be included in any upcoming trade deal with China.

“Corn is seen as underpinned, seeing limited losses because of that remark,” Reilly said.

Trade talks between the two economic superpowers continued in Washington, D.C. this week, picking up from where they left off the previous week in Beijing. Talks began with lower-level discussions and are to move to high-level negotiations Thursday.

So far, little news has come out of the talks, but Reilly said it has been positive. With several tough issues to deal with, including agriculture, intellectual property and corporate regulation, a final deal may not be reached any time soon, he added.

“It may take just a little bit longer than what people are looking for to get the deal done.”

— Glen Hallick writes for MarketsFarm, a Glacier FarmMedia division specializing in grain and commodity market analysis and reporting.