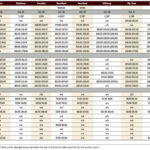

MarketsFarm — Commodity fund traders are maintaining a steady short position in ICE Futures canola, according to the latest commitment of traders (CoT) report from the U.S. Commodity Futures Trading Commission (CFTC). The net managed money short position in ICE Futures canola came in at 53,576 contracts on Tuesday, steady with the previous week. Open

Fund traders hold steady in canola

ICE weekly outlook: Steady canola market stuck in rut

MarketsFarm — ICE Futures canola held within a narrow range during the week ended Wednesday, as the market waits for fresh news to push it one way or the other. “There are certainly some supportive elements underneath the marketplace,” said Mike Jubinville of MarketsFarm Pro, pointing to an upward trend in world vegetable oil prices

Fall cattle run picks up steam

After a slow and muddy start, auction barns have filled up

Cattle auction yards were busy across Manitoba during the last week of October, with the fall run in full swing. “We’re busy, I think every barn is full (across the province),” said Robin Hill, of Heartland Livestock Services in Virden. “The volumes in Western Canada really cranked up over the past week, and now everybody

CWRS bids edge lower with Minneapolis futures, CPSR up

MarketsFarm – Wheat bids in Western Canada were mixed during the week ended Nov. 7, with a steady to lower tone in Canada Western Red Spring Wheat as a downtrend in the Minneapolis future weighed on values. However, the Chicago and Kansas City winter wheat contracts trended higher, which underpinned Canada Prairie Spring Red (CPSR)

Fund traders increase canola short position

MarketsFarm – Commodity fund traders added to their net short positions in canola and corn over the past week, according to the latest Commitment of Traders (CoT) report compiled by the United States Commodity Futures Trading Commission (CFTC). Managed money traders were also on the sell side in soybeans, reducing their net long position in

Feed weekly outlook: Barley, feed wheat at par in southern Alberta

MarketsFarm – Feed barley prices in southern Alberta’s feedlot alley moved higher over the past few weeks, but the price rise will likely slow down as barley trades at par with feed wheat. Feed barley and feed wheat are both currently trading at around C$225 per tonne delivered into Lethbridge, Alta. “That’s a sell signal

Green, yellow pea price spread to widen

MarketsFarm – Quality issues with Canada’s green pea crop are starting to show up in the cash market, with a widening spread between green and yellow peas expected going forward. Top end green pea bids have risen by more than a dollar per bushel over the past month, while yellow peas have only increased by

Bearish fund traders add to shorts in canola and corn

MarketsFarm – Commodity fund traders added to their net short positions in canola and corn, while they maintained a steady position in soybeans, according to the latest Commitment of Traders (CoT) report compiled by the United States Commodity Futures Trading Commission (CFTC) as of Nov. 1. The net managed money short position in ICE Futures

Canadian canola crush pace running well ahead of average

MarketsFarm – Canada’s canola crush pace is running well above average, with demand from domestic processors more than making up for any issues on the export front, according to the latest grain handling data as of Nov. 1. The Canadian Grain Commission reported total domestic usage of canola during the first 12 weeks of the

Canola production on the Prairies takes a weather hit

But that effect on production may have already been digested by the market

Poor harvest weather definitely cut into the size and quality of this year’s Canadian canola crop, with a large percentage still in the fields heading into the end of October. However, that supportive supply-side story may be factored into the futures for the time being, with the market now in need of some fresh demand