Coronavirus leaves grain markets uncertain

A lot remains to be worked out as spring marches ever nearer

Broader cattle market volatility resonates at local level

Meat supply lines are filling up again in the wake of pandemic panic buying

Limits on border traffic not affecting cattle movement

Manitoba’s cattle sales continue, albeit with social distancing in mind

Currency weakness supportive for Canadian-grown commodities

Wheat futures drew some strength from demand for shelf-stable goods

Feed barley bids to stay under pressure through spring

Commodities not immune to risk-off mentality

Coronavirus fears drag grains, oilseeds, equities and energy markets lower

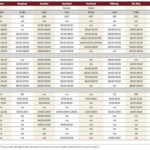

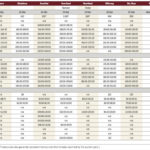

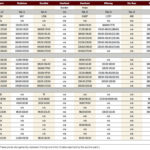

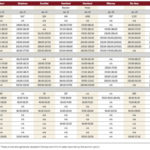

Good movement, steady prices at livestock auctions

Futures are recovering from coronavirus reaction

Risk-off trade sentiment outweighing market fundamentals

Crops still out on the fields cast clouds over StatsCan’s latest data

Chicago cattle futures pull some bids lower

Manitoba buyers are very sensitive on cattle weights at the moment