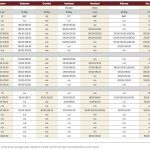

Canola futures slip below psychological support levels

Despite the yield outlook, canola’s supply-demand balance remains tight

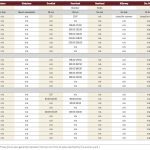

Traders shed long positions in grain, oilseed futures

The canola trade is now net short for the first time in two years

Feeder and butcher cattle see market strength

Best quality animals head east, lower quality go west

U.S. soybean acres come in below expectations

Commodities tumble in tough week

Seasonal effect enhanced by inflation concerns and rising interest rates

Speculators bail out of long positions in canola

Grain traders look past delays to focus on seeded crops

Canola values have dropped below some key chart points

Feeder cattle, butcher cows still in demand

Gathering sufficient cattle to ship east or south is difficult

Grain markets: Risk-averse sentiment reaches canola trade

Spring seeding conditions likely to sway markets

Canola values are recovering up off a hard drop