MarketsFarm — After hitting the largest speculative short position in canola on record, managed money fund traders were finally covering those bearish bets in late March, according to the latest Commitments of Traders report from the U.S. Commodity Futures Trading Commission (CFTC). As of March 28, the net managed money short position in canola futures

Canola short position finally subsiding

CBOT wheat, corn also net short

Canola fund short position still rising

Managed money net long in soybeans

MarketsFarm — The size of the fund short position in continued to rise in early March, according to the latest Commitments of Traders data out from the U.S. Commodity Futures Trading Commission (CFTC). As of March 7, the net managed money short position in canola came in at 46,222 contracts (61,998 short/15,776 long), an increase

Feed weekly outlook: Domestic grain prices slipping

Prairie wheat, barley on par with U.S. corn

MarketsFarm – Feed wheat and barley prices in Western Canada have slowly trended lower over the past few months, with prices for both grains now on par with imported corn from the U.S. into Alberta’s key Lethbridge feedlot alley. All three grains are trading at around $410 per tonne into Lethbridge, according to Jim Beusekom,

Canola values end their slide

After nine straight days of declines, the ICE Futures canola market finally saw a splash of green the day before St. Patrick’s Day. The most active May contract hit a session high of $829.50 per tonne on March 3, then proceeded to lose roughly $90 over the next two weeks. It hit a low of

AAFC supply/demand estimates mostly unchanged

Wheat exports up, but domestic usage cut

MarketsFarm –– Supply/demand estimates for Canadian crops were largely left unchanged in Agriculture and Agri-Food Canada’s (AAFC) latest projections, with only the wheat numbers seeing small adjustments in the report released Tuesday. Projected Canadian wheat exports for the 2022-23 marketing year were raised to 24.3 million tonnes, up by 200,000 from the February estimate. Domestic

Pulse weekly outlook: Steady world trade expected in 2023

IGC sees firmer demand for dry peas in particular

MarketsFarm — World trade in chickpeas and lentils is expected to remain relatively steady in 2023, with solid demand from South Asia underpinning markets, according to the latest outlook from the International Grains Council. The IGC sees the world trade in chickpeas in 2023 at about 1.9 million tonnes, which would be unchanged from 2022,

ICE weekly outlook: No floor in sight for overdone canola

'A lot of money playing around in canola right now'

MarketsFarm — The ICE Futures canola market was in freefall mode through the first half of March, hitting its weakest levels in over a year. While the losses may be looking overdone, the bottom remains to be seen. “This has been a brutal drop in canola,” said Bruce Burnett, director of markets and weather with

Confirmation of large canola short position slowly appears

CFTC data flow slowly resuming

MarketsFarm — The size of the fund short position in canola rose in February and likely grew even larger in March, as weekly Commitments of Traders data slowly trickles out from the U.S. Commodity Futures Trading Commission (CFTC). CFTC data has stalled since a ‘cyber-related incident’ delayed the release of the data for weeks. As

Spring road bans loom across Prairies

Mid-March weight limits pending for heavy trucks

MarketsFarm — The looming spring melt across Western Canada will likely disrupt some grain and livestock movement over the next few weeks, as seasonal spring road restrictions come into effect across the Prairies. Spring road restrictions set axle weight limits for vehicles moving on certain roads to reduce the damage heavier loads can cause during

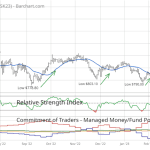

Reading between the lines: Oversold canola due for correction

Technical signs point to possible recovery

MarketsFarm — Canola futures posted sharp losses over the past week, with the May contract touching its weakest level in six months. While damage was done from a chart standpoint, there are technical signs that a recovery is possible. RSI The relative strength index (RSI) is a technical indicator that provides insight into whether a