Oct 31 (Reuters) - CME live cattle futures turned higher on

Thursday, with investors adjusting positions ahead of the U.S.

Department of Agriculture monthly cattle-on-feed report at 2

p.m. CDT (1900 GMT), traders said.

* Analysts polled by Reuters said U.S. feedlot cattle

placements likely increased 1.2 percent in September from a year

earlier as lower-cost corn encouraged feedlots to buy young

cattle to fatten.

* Also on Thursday, the USDA will simultaneously release its

monthly cold storage report, including September total beef and

pork inventories.

* Both reports will be released while CME livestock markets

Read Also

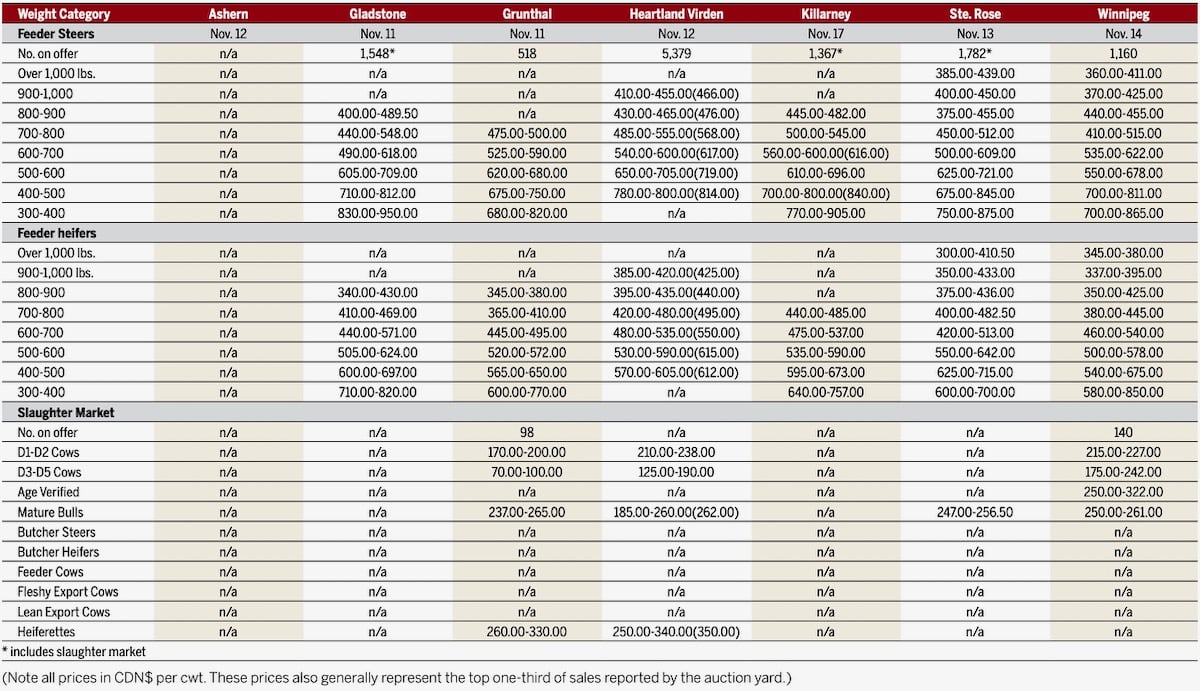

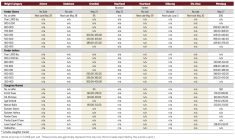

Manitoba cattle prices, Nov. 17

trade electronically after the pit sessions close.

* CME live cattle also gained in anticipation of at least

steady cash prices this week as wholesale beef prices worked

higher.

* There were no deliveries posted by CME late Wednesday

against the October live cattle contract, expiring Thursday at

noon CDT (1700 GMT).

* The USDA weekly export report Thursday morning showed U.S.

beef sales last week at 55,500 tonnes, mostly to Mexico,

compared with 10,400 tonnes the previous week.

* "The government is playing catch-up from the shutdown by

essentially lumping three weeks of export data into one, which

distorts the results," a trader said.

* South Korea plans to end its ban on animal feed additive

zilpaterol early next year, a senior food ministry official

said, opening the door to beef imports containing the growth

enhancer and its domestic sale.

LIVE CATTLE - At 8:51 a.m. CDT (1351 GMT), October

was up 0.300 cent at 133.650 cents per lb. December was

at 133.500 cents, up 0.375 cent.

* Cash cattle bids surfaced in Texas and Kansas at $130 per

cwt (hundredweight), with no response from sellers, feedlot

sources said.

* Bullish traders anticipated cash cattle trading steady to

higher with last week's record-high price of $132 per cwt.

* They said overall tight cattle numbers and the recent

surge in wholesale beef values can lend cash support.

* Market bears contend packers will cut back slaughter to

avoid spending more for supplies and recoup lost margins.

* FEEDER CATTLE - October was up 0.075 cent to

165.300 cents per lb, while November was at 165.400

cents, 0.450 cent higher.

* October feeders cattle are guided by CME's feeder cattle

index at 165.24 cents. CME October feeder cattle will also

expire today at noon CDT (1700 GMT).

* Short-covering and live cattle market gains lifted

remaining feeder cattle futures.

LEAN HOGS - December was at 90.275 cents per lb, down

0.125 cent, while February slipped 0.150 cent to 92.950

cents.

* Lower cash hog and wholesale pork prices pressured CME

hogs, traders said.

* Packers have all the hogs they need going into the

weekend, a trader said. And grocers are hesitant to book large

pork orders as their attention turns to turkey demand for the

U.S. Thanksgiving Day holiday, he said.

* On Thursday, the USDA reported U.S. pork export sales last

week at 23,500 tonnes, mainly to Mexico, compared with 8,600

tonnes the previous week.

(Reporting by Theopolis Waters in Chicago; Editing by Jeffrey

Benkoe)

CME live cattle futures firm on positioning before USDA report

By