* Feeder cattle track CME live cattle advances

* USDA cattle report release unlikely on Friday

* Hog prices up on fund buying, short-covering

* CME posts final October 2013 hog futures settlement

By Theopolis Waters

CHICAGO, Oct 16 (Reuters) - Chicago Mercantile Exchange live

cattle futures closed higher on Wednesday, supported by the

steep climb in equities in response to the U.S. Senate's budget

deal that puts the government one step closer to reopening soon.

"I hope that's the case so we can get USDA price data

flowing again," a trader said.

U.S. stocks closed more than 1 percent higher on Wednesday

Read Also

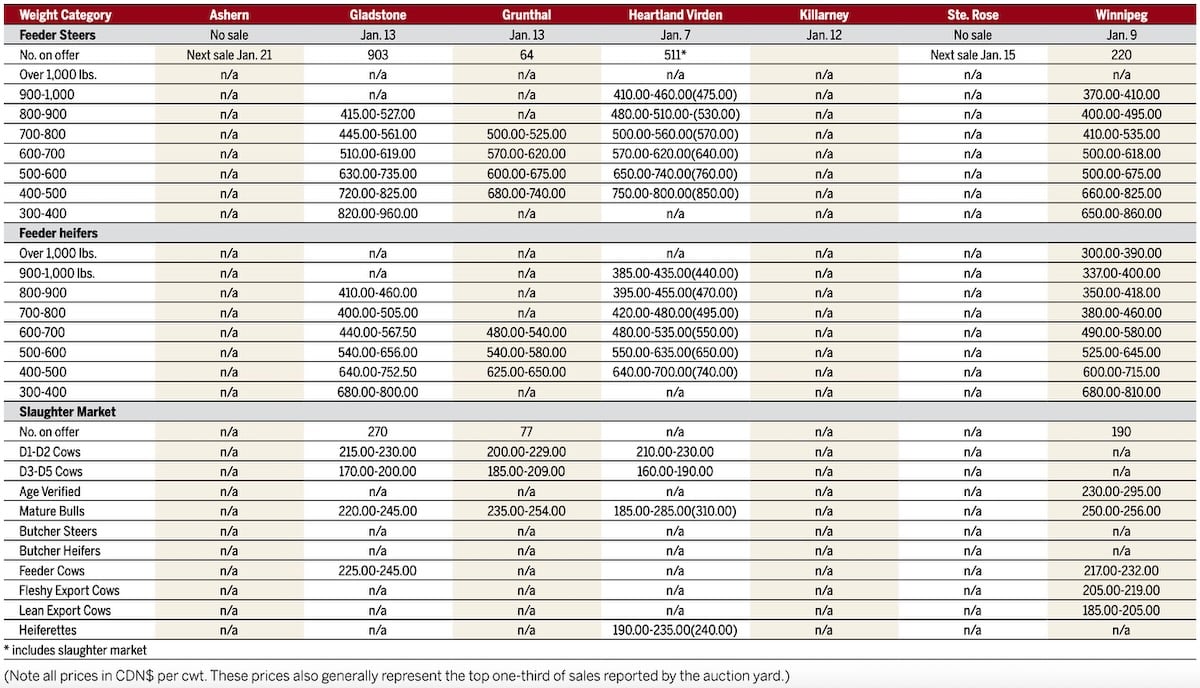

Manitoba cattle prices, Jan. 15

after Senate leaders said they had a deal to reopen the federal

government and raise the debt ceiling, avoiding the threat of a

debt default.

The U.S. Department of Agriculture's cattle-on-feed report,

which is scheduled for release on Friday, likely will not be

issued in time because of the U.S. government shutdown, analysts

and traders said.

Most analysts polled by Reuters for the report said feedlot

placements last month likely rose 1.6 percent from a year ago as

corn costs declined.

Traders bought CME live cattle in anticipation of at least

steady cash prices this week based on tight supplies and

improved wholesale beef demand.

Cattle sellers in Texas have not responded to spotty cash

bids of $126 per hundredweight (cwt), feedlot sources said. Last

week, cash cattle in Texas and Kansas moved at mostly $128 per

cwt, with sales of $127.50 to $129 in Nebraska.

Wednesday morning's wholesale choice beef price, or cutout,

was at $194.66 per cwt, up 10 cents from Tuesday. Select cuts

gained 11 cents to $180.73, according to analytical

market-research firm Urner Barry.

Processors will resist spending more for supplies while

grappling with their eroding operating margins.

Estimated margins for U.S. beef packers on Wednesday were a

negative $43.55 per head, compared with a negative $42.75 on

Tuesday and a negative $37.40 last week, according to

HedgersEdge.com.

The higher live cattle market and short-covering helped CME

feeder cattle recover a portion of Tuesday's big losses.

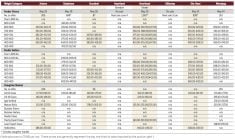

October feeder cattle ended 0.300 cent per lb higher

at 166.000 cents. November settled at 167.725 cents, up

0.225 cent.

FUND BUYING BOOSTS HOGS

CME hogs spiked to new contract highs, driven by fund buying

that prompted short-covering, analysts and traders said.

"The outside markets didn't hurt," a trader said referring

to Wednesday's U.S. stock market surge.

Investors bought December futures that were at a discount to

the CME's restructured settlement price for the October lean hog

contract that expired on Monday at 90.750 cents per lb.

CME Group Inc said on Wednesday that the final

settlement price for October 2013 lean hog futures and options

contracts is 90.62 cents based on a volume-weighted average.

The exchange was forced to alter its 2013 October hogs

settlement price calculation due to the lapse of USDA price

information during the partial government closure.

December hogs closed 1.000 cents per lb higher at

88.800 cents after posting a new contract high of 89.050 cents

in electronic trading.

February finished at 90.650 cents, 0.850 cents

higher. It eased from a new contract high of 90.825 cents.

Traders sold into Wednesday's gains, guided by sentiment

that cooler weather and new-crop corn would allow hogs to

quickly gain weight. More hogs at heavier weight can pressure

cash prices while increasing the tonnage of pork at the retail

level.

LIVESTOCK-Senate budget deal lend US cattle, hog futures support

By