* CME live cattle mixed in choppy trading

* Fund selling drops feeder cattle futures

By Theopolis Waters

CHICAGO, Sept 6 (Reuters) - Chicago Mercantile Exchange hog

futures rose for a sixth straight session on Friday, led

by fund buying that prompted short-covering, traders and

analysts said.

October futures' discount to CME's hog index, which was at

91.45 cents, encouraged buying and bullish spreads.

CME hogs closed up 3.6 percent for the week.

October ended 1.500 cents higher at 90.900 cents per

lb and hit a new contract high of 91.025 cents. December

ended up 1.075 cents to 87.000 cents.

Read Also

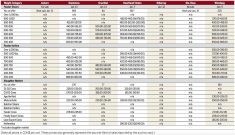

Manitoba cattle prices, Feb. 25

Your weekly table of price ranges for beef cattle from seven Manitoba auction markets during the week ending Feb. 24, 2026.

The possibility that spread of the Porcine Epidemic Diarrhea

virus (PEDv), which is fatal to baby pigs, will reduce hog

supplies later this year generated October and December futures

buying.

"A lot of baby pigs that have died from that (PEDv) would

have gone to slaughter in the fourth quarter, which is helping

boost fourth-quarter futures," University of Missouri livestock

economist Ron Plain said.

Others contend that the virus's impact will be minimal and

may have been factored into the market already.

Futures climbed despite packers lowering cash hog bids as

wholesale pork demand wanes.

Processors may trim production next week to preserve

operating margins. The move could offset a brief reduction in

hog supplies after a recent bout of hot weather slowed animal

weight gains.

The U.S. Department of Agriculture on Friday morning

reported the average hog price in the most watched

Iowa/Minnesota market at $68.33 per hundredweight (cwt), $1.34

lower than on Thursday.

Friday morning's U.S. government data showed the wholesale

pork price, or cutout, at $94.94 per cwt, down 56 from Thursday.

The cutout was largely weighed down by the $5.06 price drop

for loins, which are cut into pork chops and which are popular

at backyard barbecues.

Wholesale pork and beef prices tend to lag after the U.S.

Labor Day holiday, the unofficial end of the summer grilling

season.

Funds that trade CME hogs and live cattle periodically sold

October futures and bought deferred months. They moved October

long positions mainly into December prior to similar moves next

week by followers of the Goldman Sachs Commodity Index

(S&PGSCI).

That shifting will be for five days beginning Sept. 9.

MIXED, CHOPPY LIVE CATTLE TRADE

CME live cattle settled mixed after a volatile session.

For the week, CME live cattle gained 2.4 percent.

October closed up 0.450 cent per lb at 125.675

cents, while December ended down 0.100 cent at 129.025

cents.

Sentiment that cash cattle prices have forged a near-term

bottom stirred CME live cattle October buyers, traders said.

Cash cattle traded lightly in Texas and Kansas at $123 per

cwt, steady with last week, feedlot sources said. Initial

live-basis cattle sales in Nebraska were at $122, down $2 from a

week ago, they said.

Packers held cash prices steady despite ample supplies of

contracted cattle and waning wholesale beef demand.

The USDA on Friday morning showed the wholesale choice beef

price at $195.23 per cwt, down 63 cents from Thursday. Select

cuts dropped 73 cents to $181.18.

The belief that futures are over-valued based on cash cattle

price expectations weighed on deferred live cattle months.

"Everyone is optimistic about the cash, but the board

(futures) is carrying that premium," CattleHedging.com analyst

Elaine Johnson said.

CME feeder cattle fell on fund selling and firm corn prices

that may curb feedlot demand for young cattle.

Feeder cattle futures ended down marginally for the

week, snapping a seven-week win streak.

September closed at 156.375 cents, down 0.375 cent,

while October ended 0.875 cent lower at 157.925 cents.

(Editing by Peter Galloway)

LIVESTOCK-Fund buying extends U.S. hog futures advances

By