Canadian canola supplies for the current crop are looking very tight — but that’s not likely to do much for prices, says a market analyst with Cargill.

That’s because traders have already priced tight supplies into the market and are looking ahead to what’s going to happen next, David Reimann said in a presentation at the recent Wild Oats Grainworld conference.

Moreover, stocks may not be as tight as forecast, because farmers have a history of under-reporting their supplies to Statistics Canada, he said. Canola ending stocks for 2012-13 are expected to be 350,000 tonnes — half of year-earlier levels — according to StatsCan data.

Read Also

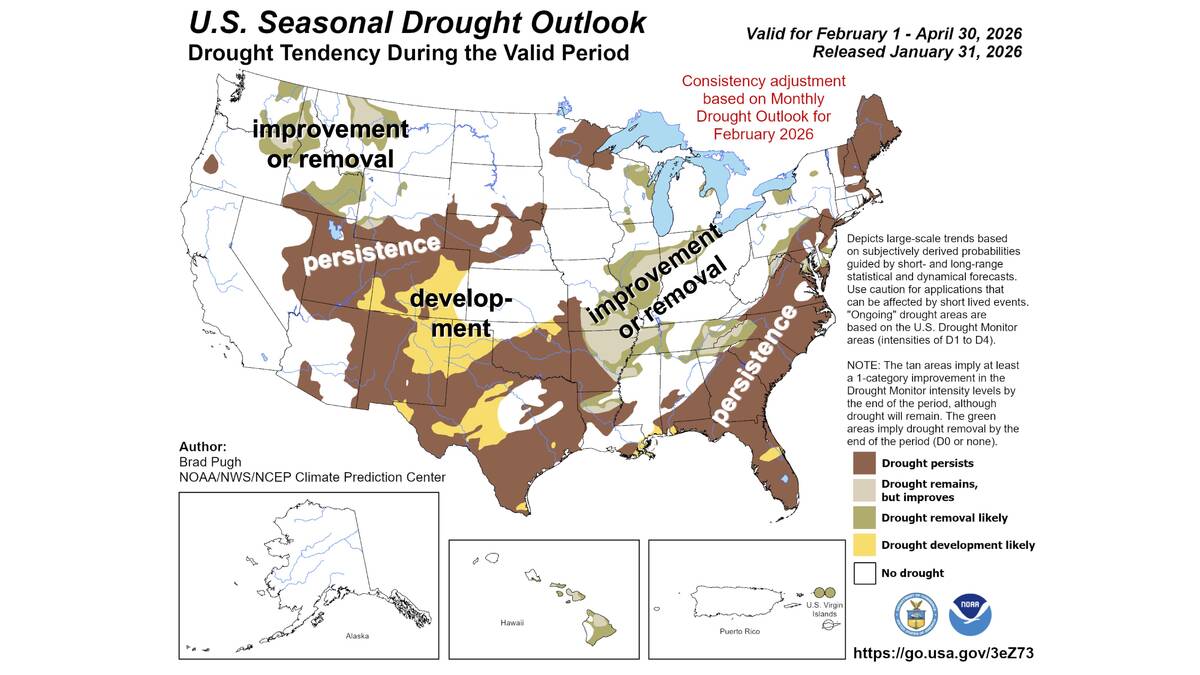

Neutral conditions drive 2026 weather as La Niña subsides

U.S. government meteorologist expects there will be neutral ENSO conditions for the 2026 farm growing season.

Farmers looking for price signals should keep a close watch on the U.S. soy market, which reflects not only conditions in that country but responds to South American production, he said.

So far, the weather picture in South America is looking good, and soybean crops in Brazil and Argentina are receiving beneficial moisture during key pod-filling stages, Reimann said. That’s setting the stage for a record crop that will push oilseed values down, he said.

The U.S. outlook has also improved, thanks to precipitation in many drought-stricken areas. American soybean production is also expected to rise, to 92.7 million tonnes compared to about 80 million tonnes last year.

With current canola prices at fairly high levels, Reimann said it’s a good time for farmers to sell and buyers to be patient.