The growing presence of retailer branded products on grocery store shelves threatens the future of many processors, says Derek Nighbor, senior vice-president of public and regulatory affairs at Food and Consumer Products of Canada.

“We have seen a shift from national brands to store brands on retail shelves right across the country,” Nighbor told the Commons agriculture committee. “Right now, the top five grocery retailers make up about 75 per cent of the retail marketplace in Canada.”

His association isn’t opposed to the products themselves, “but rather how their prevalence in the marketplace is allowing the country’s largest retailers to squeeze manufacturers and farmers,” he said.

Read Also

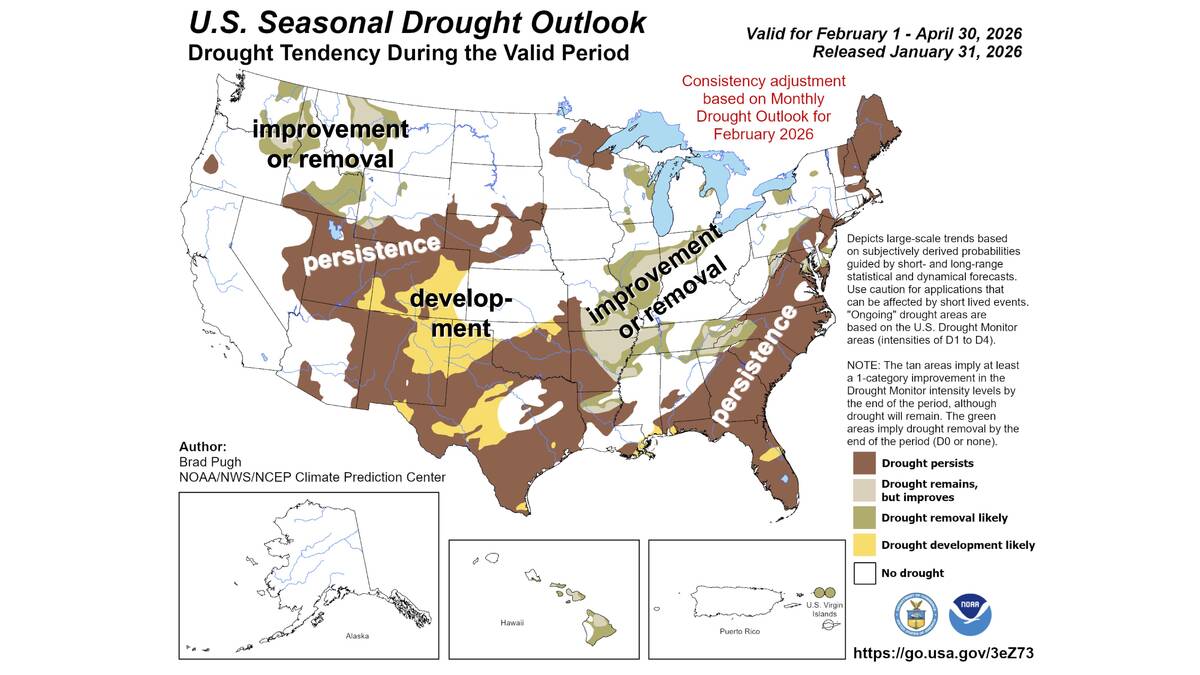

Neutral conditions drive 2026 weather as La Niña subsides

U.S. government meteorologist expects there will be neutral ENSO conditions for the 2026 farm growing season.

“Retailers in Canada today are not merely the buyers of our products who control the shelf space, they are also direct competitors,” said Nighbor, whose association represents large and small manufacturers.

“It’s the conduct and the demands of retailers, in tandem with the rise in store brand products in Canadian stores, that’s causing concern about the future of our industry, as well as the farmers they provide markets for.”

Grocery chains, which sometimes request up to 26 weeks of lead time for the introduction of a new product, are also asking for more information about input costs, product formulations, brand information, marketing plans, insights on investment and innovation plans, he said.

“These practices can create serious challenges for manufacturers who are seeking to get access to the limited shelf space in leading stores,” said Nighbor. “They are concerned about the longer-term impacts of sharing this critical business information with retailers, and how it could be used against them.”

Another threat is parasitic copying of products, he said.

“Manufacturers invest millions of dollars in product development and marketing to establish their brands and to build consumer loyalty with their consumers. We’re seeing real growth in a troubling trend in look-alike products in stores across the country.

“As well, the grocery chains are trying to off-load costs to manufacturers along with increased product listing fees and increased delisting activity.”

All of this results in less shelf space for smaller Canadian processors.

“Exorbitant fees to get on the shelf and stay on the shelf remain serious barriers for many manufacturers,” said Nighbor.

Such costs make Canadian manufacturers less competitive, he said.

“All of these issues, combined with higher commodity prices, (and) a strong Canadian dollar are having a very real and negative impact on investment and innovation in our sector,” he said.

Other countries are dealing with these trends while Canada continues to depend on a decade-old policy administered by the Competition Bureau that “does not address store brand issues, and the issues associated with retailers acting as a double agent or a competitor,” said Nighbor.