Adrug billed as the first federally-approved treatment for coccidiosis in hog herds in Canada is “on track” for release later this fall, Bayer Healthcare says in a release.

The company’s animal health division says its toltrazuril product Baycox 5% now has a notice of compliance from Health Canada and will be available to veterinarians, and to hog producers through their veterinarians, sometime next month at the earliest.

The drug “has helped producers in other countries to raise healthier, more uniform piglets and we are excited that Canadian pork producers will soon be able to access this product,” Bruce Kilmer, director of veterinary services and regulatory affairs for Bayer HealthCare, said in a release.

Read Also

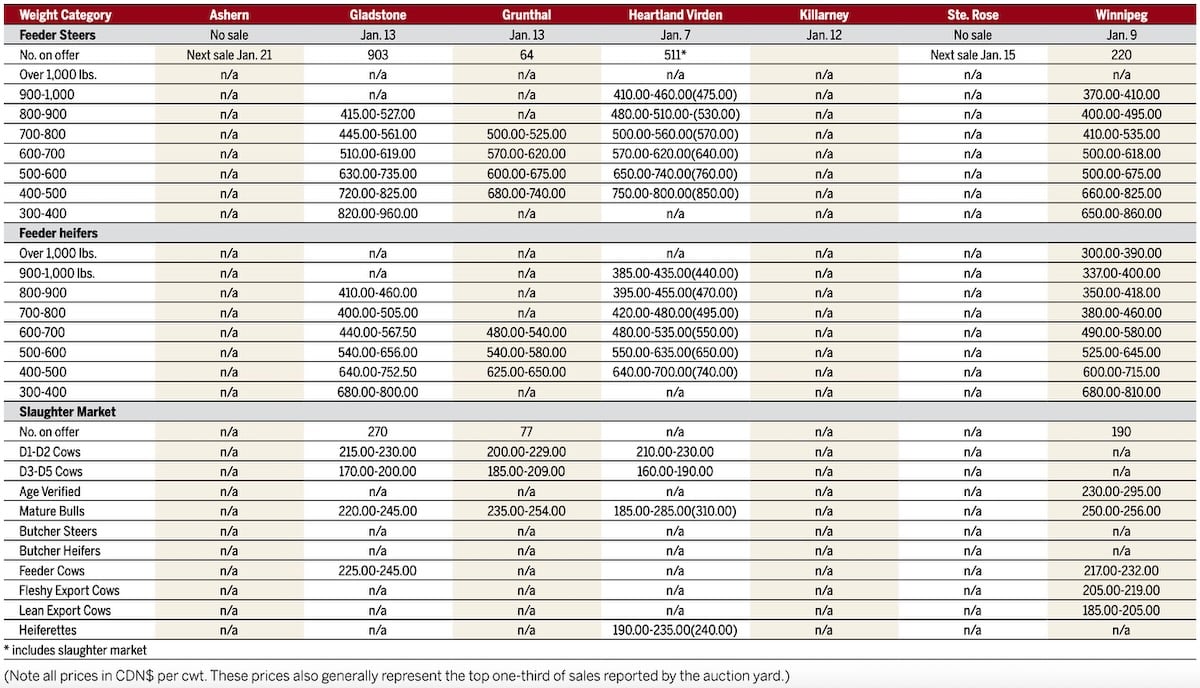

Manitoba cattle prices, Jan. 15

Bayer cited research that found significantly lower (coccidia) oocyst counts in weanling piglets as well as a marked improvement in feed conversion in treated weaner-finisher pigs, with weight gains consistently and significantly better through to day 150.

Rising Corn Prices Hit U. S. Meat Company Shares

Shares of leading U. S. meat companies fell Sept. 17 in an apparent reaction to corn prices shooting past $5 per bushel for the first time in two years, analysts said.

In addition, talk has circulated that corn may go to $6, in part because of problems with foreign crops. Dry weather has been reported in Australia and Russia, while a possible crop-damaging frost was reported in Canada.

Corn is an important feed grain and is a major cost in producing cattle, hogs and chickens.

Shares of Tyson Foods Inc, which is the largest U. S. meat processor and has the largest chicken flock, fell more than six per cent, while hog producer Smithfield Foods Inc’s stock dropped five per cent.

“The psychological pressure of corn above $5 is the primary reason,” Allendale Inc analyst Rich Nelson said.