There has been a notable difference at times between the canola production numbers from Statistics Canada and the United States Department of Agriculture (USDA). Over the last few years, the USDA pegged its call on Canadian canola higher than what StatCan estimated.

That’s not the case right now. The two agencies are very close in what they see coming off Canadian canola fields in 2025/26.

StatCan and the USDA rely on satellite imagery to gather information in order for their models to spit out their respective numbers. However, StatCan’s December production report will include data gathered from farm surveys.

Read Also

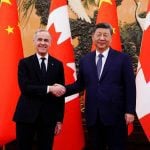

No easy fix for canola as Carney meets Xi in Beijing

China’s tariffs push pain on farmers into 2026. Growers are hopeful for political resolution as PM’s trade mission begins.

On Sept. 17, StatCan upped its projection on the 2025/26 canola harvest to 20.03 million tonnes from 19.94 million in its August production report. On Sept. 12, the USDA world oilseed report slotted Canadian canola smack dab on 20 million tonnes.

It takes pretty much a year for things to shake out in the end.

Case in point, StatCan eventually upped its 2024/25 December canola production number. At 17.86 million tonnes, it had been so low that Agriculture and Agri-Food Canada dropped canola’s feed, waste and dockage figure well into the negatives just to get their monthly calculations to balance.

In the end, StatCan’s original production estimate for 2024/25, 19.50 million tonnes, was closer than the 19.24 million eventually settled on.

In the meantime, the USDA saw last year’s canola harvest at 18.80 million tonnes and later raised it above 19 million.

As for canola futures, the doom and gloom of the November contract falling below C$600 per tonne never came to fruition. Essentially, the November contract has steadily remained above that mark.

Even with the doldrums imposed by China’s tariffs, canola lost less than C$8 a tonne for the week ended Sept. 18. That’s pretty good given Chicago soyoil fell by nearly a half cent per pound during the same period.

A bigger harvest will weigh on canola. However, right now, it’s the slow speed of combining that’s underpinning prices. In the end though, there will be lots of canola to be had.

In looking at the StatCan forecast of 20.03 million tonnes, that would make for Canada’s third-largest canola harvest. Still at the top would be the 21.46 million tonnes in 2017, with 2018 in second at 20.72 million.

One analyst said to keep an eye on the yields, as there are reports of them being better than expected. When StatCan issues its December production report, the canola harvest could be as high as 21 million tonnes.