Reuters – Private exporters canceled sales of 264,000 tonnes of U.S. soft red winter wheat that had been booked for delivery to China, the U.S. Department of Agriculture confirmed March 11.

It was the third cancellation in as many business days and the largest of the three, following two cancellations totaling 240,000 tonnes in the first week of March.

Wheat prices have fallen since China made a series of U.S. wheat purchases in December 2023. The price break reflects strong competition from global suppliers, particularly Russia, the word’s biggest wheat exporter, and improved crop conditions in the U.S. winter wheat belt.

Read Also

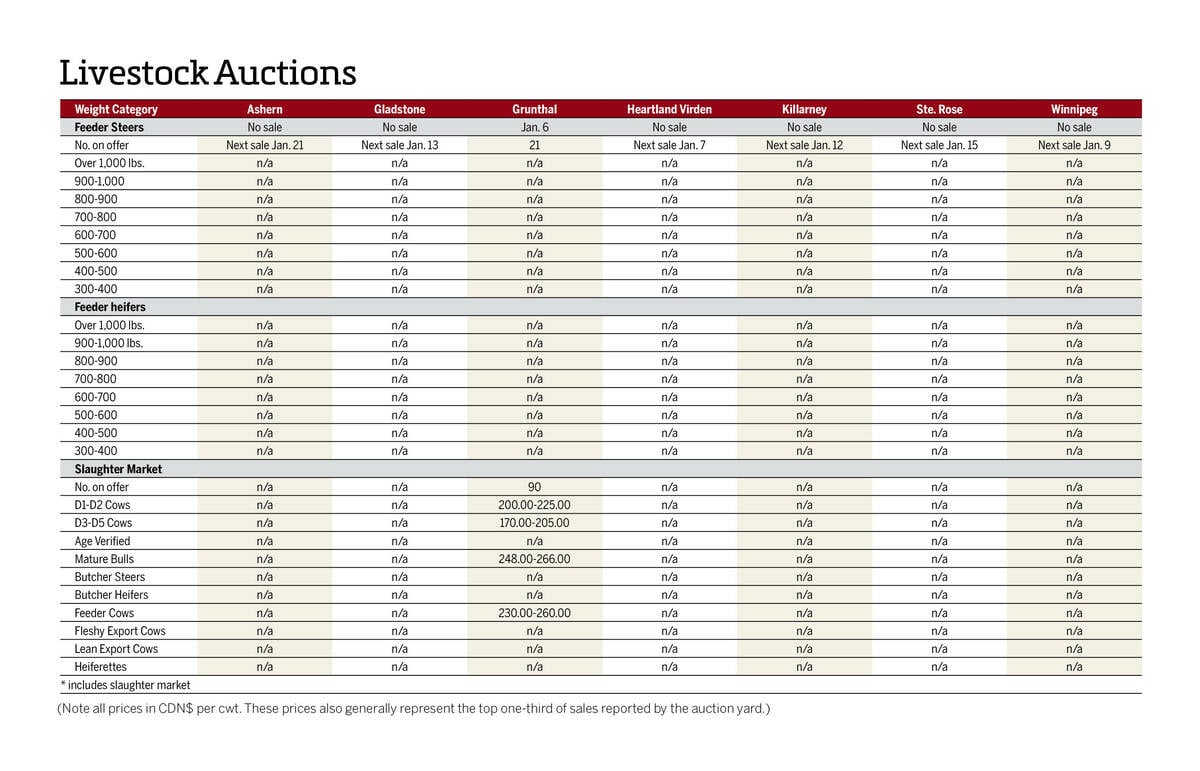

Manitoba cattle prices Jan. 6

Grunthal was the first Manitoba livestock auction mart to kick off 2026 cattle sales in early January.

“China booked a few million tonnes of U.S. wheat at the end of last year when it was trying to secure tonnages,” said Ole Houe, director of advisory services at brokerage IKON Commodities.

“But now, international prices have dropped, especially for those cargoes which are being offered from the Black Sea region. When China booked U.S. wheat, Russian wheat was around (US)$230-$240 per tonne and now the price is around $195 a tonne.”

In early March, China expanded its budget to stockpile grains and edible oils, as it aims to reduce dependence on imports.

Benchmark Chicago Board of Trade soft red winter wheat futures dipped to $5.23-1/2 per bushel after the USDA’s announcement, the lowest on a continuous chart of the most-active contract since August 2020.

The benchmark contract is down about 19 per cent from a four-month peak reached in early December at $6.49-1/2, around the time China’s weekly purchases of U.S. wheat peaked.

Chinese importers also made sizable purchases of French and Australian wheat last autumn due to rain damage in their domestic crop.

In a monthly supply-demand report March 8, the USDA cut its estimate of U.S. wheat exports in the marketing year begun June 1, 2023, to 710 million bushels, the lowest in 52 years.