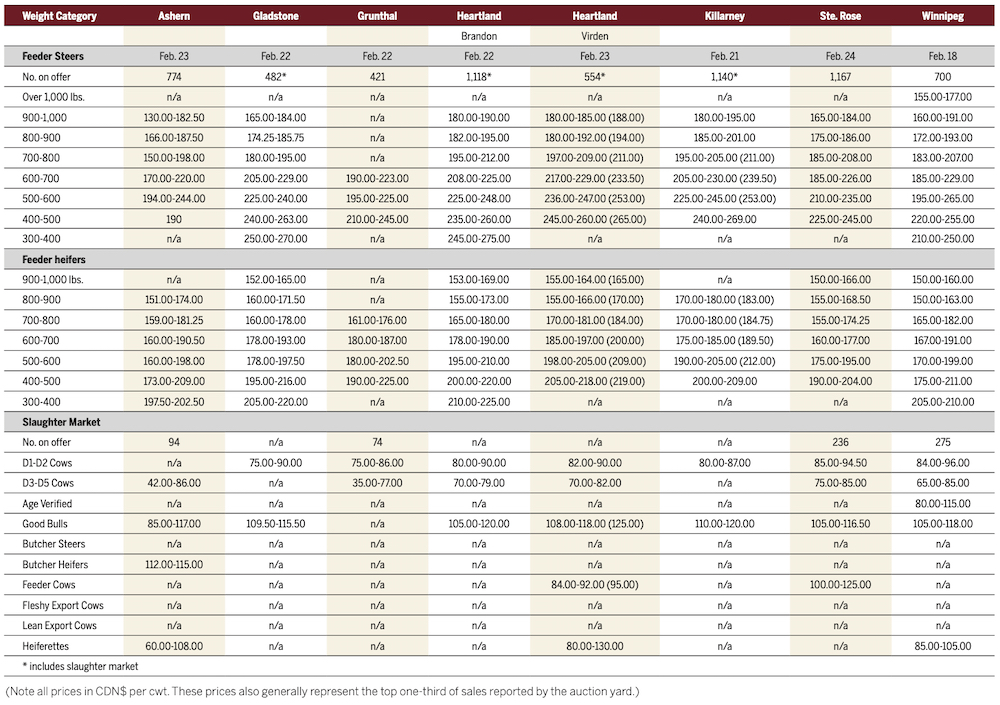

Cold weather seemed to have played its hand once again at Manitoba cattle auction sites for the week ended Feb. 24.

Below-normal temperatures with wind chills around -40 C convinced cattle producers to wait at least one more week to sell their animals. The weather forecast predicted a break from the extreme temperatures in the coming week.

“We were at -40 C over (the mornings of Feb. 21 and 22). So we had people cancel and say they were going to come next week,” said Kirk Kiesman, general manager of Ashern Auction Mart. “We probably would’ve seen 1,500 to 1,800 head instead of (868).”

Read Also

EU’s pesticide reciprocity could disrupt trade

The Canada Grains Council says the EU’s pesticide reciprocity rules could seriously damage trade to one of Canada’s top diversification markets.

Most sales across Manitoba witnessed a decline in the number of head being auctioned off, with only Killarney and Winnipeg seeing an increase in numbers. In total, 7,035 cattle went through the rings during the week, compared to at least 9,081 (excluding numbers from Brandon) from the previous week when snowstorms and high wind chills affected much of the province. During the week of Feb. 4-10, 13,386 cattle were sold in Manitoba.

Unlike the number of cattle for sale, there was no clear trend emerging from this week’s prices. The majority of prices remained mostly steady from the previous week, despite notable declines in steer prices in Grunthal as well as feeder prices (steers and heifers) in Ste. Rose.

“We were steady this week just like the last few weeks. (Cattle going east) were definitely stronger than the ones going west mainly due to feed costs. Cows were fairly steady as well,” Kiesman added. “I’m expecting (prices) to be stronger next week than they were this week.”

The April live cattle contract on the Chicago Mercantile Exchange (CME) closed at US$142.30 per hundredweight on Feb. 24, US$6.40 less than the contract high two weeks earlier. On the same day, the March feeder cattle contract hit its lowest point (US$156.525/cwt) since Nov. 1, 2021, before closing at US$159.10/cwt. One week earlier, it closed US$7.10 higher.

Countering the declines in the futures market is the bearish Canadian dollar. Largely due to the conflict in Ukraine, it fell 0.7 U.S. cent in one day, to 77.93 U.S. cents, on Feb. 24. It was the first time the loonie closed below 78 U.S. cents since Dec. 22, 2021.

Kiesman said there is “more optimism” in Eastern Canada than in the West, as Ontario appears to be a more attractive option for cattle sellers.

“There are guys who are looking for quality animals in the East, whereas the West is just trying to figure out what’s going on with grain movement and availability,” he said.

Kiesman expects at least 1,500 cattle for his next two weekly regular sales.

“I think (March 2) is going to be better for the exotic type of cattle and we’re still going to have a lot of first-cut quality heifers that are going to be moving,” he said. “(Prices are going to be) steady. I don’t think we’re going to see a big jump in the next couple of weeks. The grain prices are going to hold it back.”