Chicago | Reuters — U.S. lean hog futures retreated on Wednesday after four straight sessions of gains in a technical and profit-taking setback from two-week highs as investors awaited new developments in U.S.-China trade negotiations.

Cattle futures also fell broadly, although worries about a late-winter snowstorm forecast for the beef cattle-producing U.S. Plains underpinned the nearby live cattle contract.

“Livestock were down with the rest of the ag markets because of the trade issues that we’re facing right now,” said Mike Zuzolo, president of Global Commodity Analytics.

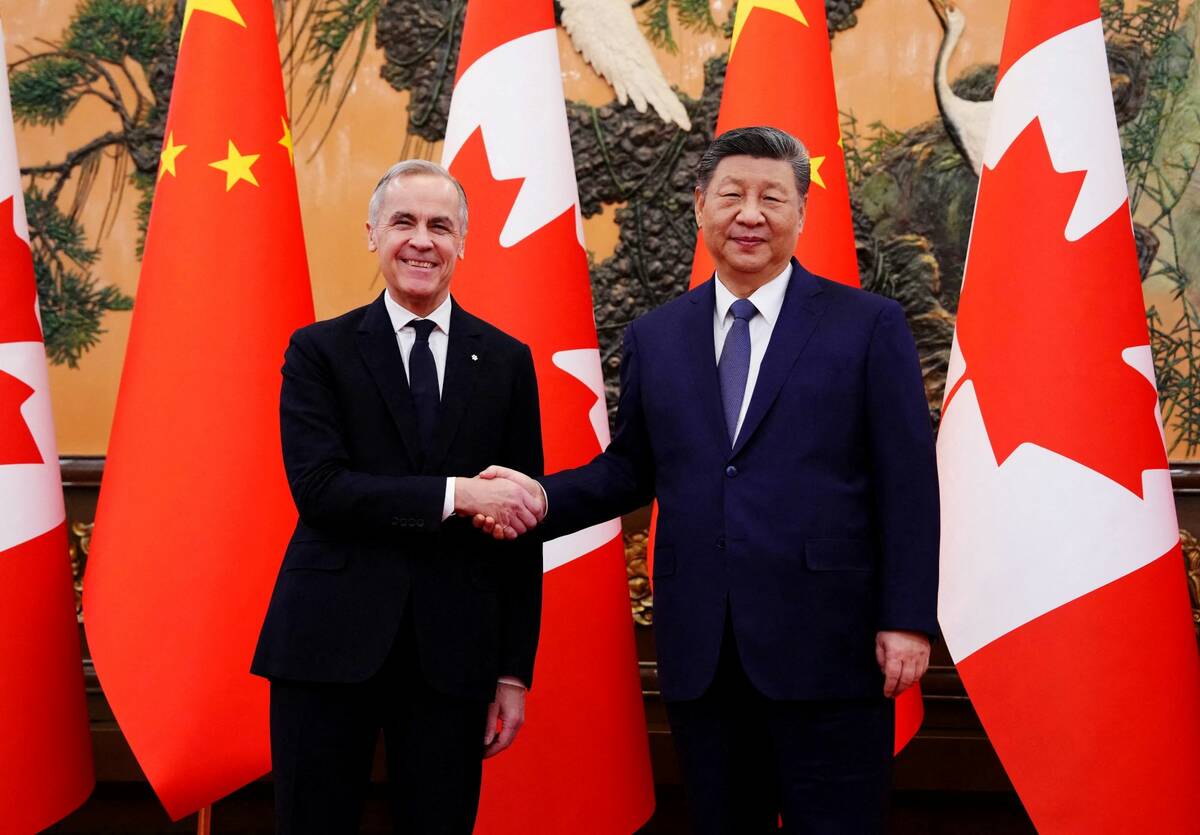

Read Also

Canada-China roundup: Producer groups applaud tariff relief; pork left out; mix of criticism and praise from Trump administration

Producer groups across Canada expressed a mix of relief and cautious optimism following the news that Canada had struck a deal with China to lower tariffs on canola, peas and other goods, in return for relaxing duties on Chinese electric vehicles.

“It’s a trust-and-verify market. They’ve trusted that a trade deal will get done, but now we need verification and the patience is running out,” he said.

U.S. President Donald Trump said on Wednesday that trade talks with China were moving along well and predicted either a “good deal” or no deal between the world’s two largest economies.

Agricultural commodities markets have been sensitive to any news on trade as China is a major importer of grains, soy and pork. Markets have been expecting Beijing to buy large volumes of U.S. agricultural products as part of a trade deal or in anticipation of an agreement.

Chicago Mercantile Exchange April lean hogs fell 0.825 cent, to 57.075 cents/lb., partly erasing four sessions of gains that took prices to their highest since Feb. 19 (all figures US$).

CME April live cattle ended up 0.075 cent at 128.9 cents/lb., firming after three sessions of declines. Deferred contracts were all lower, weighed down by ample cattle supplies.

April feeder cattle were down 0.75 cent at 143.65 cents/lb.

Cattle traders are awaiting the next wave of cash feedlot cattle sales later this week. Packer bids firmed at midweek amid fears of a slowdown in production as snowy weather was seen stressing animals and slowing movement around the Plains cattle belt.

The market is also looking ahead to Friday’s monthly U.S. Department of Agriculture Cattle on Feed report. Analysts, on average, expect on-feed supplies as of Feb. 1 at 100.2 per cent of a year ago, while placements were seen down 6.5 per cent and marketings were expected to be up 2.4 per cent.

— Karl Plume reports on agriculture and ag commodities for Reuters from Chicago.