Chicago | Reuters — Chicago Mercantile Exchange lean hog futures fell for a third straight session on Monday as technical selling and profit-taking dragged prices to a 4-1/2-week low.

Another steep sell-off in equities markets also stoked concerns that meat demand may not meet earlier expectations over the coming months.

“Today we sucked more futures premium out of the hog market,” said Don Roose, president of U.S. Commodities. “The hog market didn’t respond positively to supportive news.”

Top hog and pork market China reported more cases of African swine fever, suggesting the disease that has struck nearly 100 farms is far from contained.

Read Also

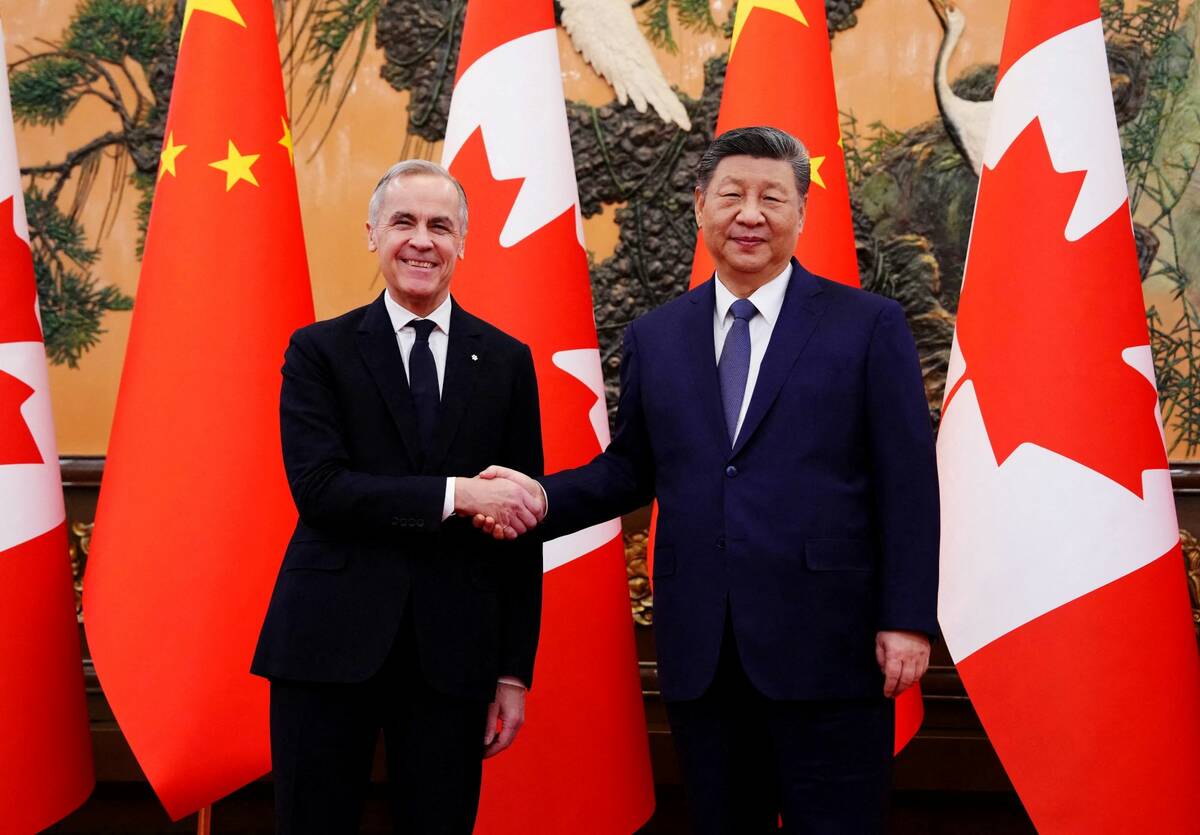

Canada-China roundup: Producer groups applaud tariff relief; pork left out; mix of criticism and praise from Trump administration

Producer groups across Canada expressed a mix of relief and cautious optimism following the news that Canada had struck a deal with China to lower tariffs on canola, peas and other goods, in return for relaxing duties on Chinese electric vehicles.

U.S. cash pork prices, meanwhile, jumped by more than $3/cwt at midday on Monday (all figures US$).

“Both of those things gave us bounces, but none of it was sustained,” Roose said.

The most-active February hog futures contract fell 0.675 cent to 63.825 cents/lb. The contact failed to break through chart resistance at its 50-day moving average, but held support at its 100- and 200-day averages.

Live cattle futures also slumped in a profit-taking setback after hitting a 1-1/2-month high last week and as cash feedlot cattle prices late last week were below some traders’ expectations.

Cash cattle at Plains feedlot markets traded at roughly steady prices following earlier optimism for higher prices.

CME February live cattle fell 0.85 cent to settle at 121.55 cents/lb. January feeder cattle were down 2.2 cents at 145.375 cents.

— Karl Plume reports on agriculture and commodity markets for Reuters from Chicago.