Canada’s food processing sector is becoming increasingly vulnerable as a direct consequence of the federal government’s policy decisions.

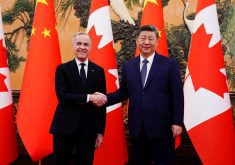

In choosing to retaliate against United States protectionism with formal counter-tariffs, Canada now finds itself aligned with China as one of only two countries to pursue such measures. While these actions may serve domestic political optics, they are inflicting measurable and lasting harm on Canada’s food manufacturing ecosystem.

Tariffs on U.S. food ingredients and critical inputs such as food-grade aluminum and steel are rippling through the supply chain. Large multinational processors often have the ability to absorb or deflect these added costs, passing them on to dominant grocery retailers like Loblaws, Sobeys, and Metro. Those grocers, in turn, push the increases to consumers. The result is a persistent layer of food price inflation that is now entrenched across many product categories.

Read Also

A short recap of the never-ending glyphosate saga

Prairie farmers are concerned about the chances of losing a herbicide that’s played a pivotal role in conservation agriculture — and the chill this saga puts on new product investment.

But the deepest strain is being felt by Canada’s smaller, regionally based food manufacturers — the vast network of family-owned processors and local businesses that make up the core of this sector. These firms operate with tighter margins, limited purchasing power, and few options for substituting inputs. Many are now facing cost increases of 15 to 25 per cent on specific goods — levels that can jeopardize their viability.

Although Ottawa claims that mechanisms exist to offset these tariff impacts, the design of the system largely excludes the very firms it is meant to protect. Most smaller processors don’t import directly; they purchase ingredients through distributors and brokers, who are registered as the importers of record. Consequently, any rebates or tariff refunds are routed to intermediaries, not the manufacturers actually absorbing the higher costs. Federal guidelines often classify end-users in ways that further disqualify small manufacturers from receiving support. This is what we are hearing from food manufacturers.

If a food manufacturer isn’t both the importer of record and the end-user, it’s out of luck — effectively excluding hundreds of food processors across the country.

The policy design here reveals a fundamental misunderstanding of how Canada’s food supply chain actually works. Expecting small processors to negotiate retroactive relief from intermediaries — some of whom are foreign-owned — is both impractical and naive. Encouraging them to “source elsewhere” ignores ingredient-specific dependencies that cannot be easily replicated outside the U.S.

The downstream effects are already emerging: reduced innovation, diminished product variety, and fewer new entrants in the market. With less competition and more reliance on imports, Canada’s food sovereignty erodes — and the system becomes more fragile.

This isn’t about whether Canada should take a stand in trade disputes. It’s about choosing tools that don’t quietly undermine our own economic foundation. Trade tensions with the U.S. — a country that accounts for roughly one-quarter of global gross domestic product — require more than performative gestures. They demand smart, targeted policy informed by rigorous economic analysis.

Canada’s independent processors are the backbone of our food manufacturing base. If they are forced out of the market by blunt instruments like counter-tariffs, the cost will be borne not just by business owners, but by consumers — through higher prices, fewer choices, and a diminished capacity to feed ourselves.

Sylvain Charlebois is a senior director of the agri-food analytics lab and a professor in food distribution and policy at Dalhousie University.