(CAPI) Canada’s beef sector needs a robust, long-term strategy – and a sustained commitment to execute the strategy – if it wishes to secure its place as a competitive force in domestic and global markets.

For this report, the Canadian Agri-Food Policy Institute (CAPI) undertook a comprehensive study of Canada’s beef sector. The feedback indicates that Canada does not possess such a strategy for the beef sector.

The research also indicates that the sector is foregoing economic opportunities and its competitive position is falling behind. There is a prevailing view among many in the beef sector that a course correction is required.

Read Also

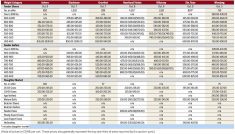

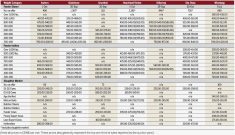

Manitoba cattle prices, Feb. 25

Your weekly table of price ranges for beef cattle from seven Manitoba auction markets during the week ending Feb. 24, 2026.

Stakeholders are keen to have a new dialogue on strategy. But this discussion can only occur if leaders in the sector are willing to act.

CAPI’s mandate is to foster a dialogue on emerging issues and present alternative solutions as a basis to help the country’s agri-food sector to succeed.

The Canadian beef sector has rallied in the past. After reeling from the 2003 BSE crisis, the sector came together and, working with government, found a direction forward. But the marketplace has since moved on, and the sector faces many new challenges, of which our balance of trade with the U.S. is a paramount concern.

CAPI has identified “three pertinent questions” and, based on our research, offers in this report responses and key strategic questions for the beef sector to consider. The prospects of the Canadian beef industry may well depend on how the sector responds to these questions.

Questions

- Recent government initiatives to pursue and open new foreign markets should prompt the relevant question: What is the beef sector’s strategy to follow through on emerging opportunities? CAPI research reveals the sector is not positioned to take advantage of trade doors being opened for it.

- Some 85 per cent of our beef and cattle export trade is with the U.S. This important market generates $1.8 billion in total sales for Canada’s beef sector. Is it not important to diversify our markets by increasing the proportion of exports to those markets beyond the U.S. that are now open to us? The beef sector is foregoing economic opportunities and its competitive position is falling behind.

- The value of beef exports to other countries often exceeds the value received for Canada’s exports to the U.S. Such substantive dependence on the U.S. appears to be costing Canada valuable opportunities. How does the sector decide what is the optimum export market mix and strategic path forward based on existing and potential strengths?

- Increasing exports depends on having beef supply to export. Yet Canada’s cow herd has declined by one million head or 20 per cent since 2005. How do we ensure a critical mass of cattle to meet future market opportunities?

In the domestic market, Canada’s trade balance is worsening. Canada is at risk of becoming a net importer of beef. What are beef stakeholders doing about trying to regain our own domestic beef market share? The data reveal that our significant dependence on the U.S. is generating greater benefits to that country than to our own beef sector.

- In 2011, Canada had a net trade balance in beef of $42 million with the U.S. (excluding beef offal, livers and tongues). In 2002, Canada’s beef trade balance was nearly $1.4 billion. Is the erosion of Canada’s trade balance not a strong signal of a loss of competitiveness?

- The unit value of Canada’s exports to the U.S. is only about 60 per cent of the value of U.S. imports to Canada. We are diverting economic (value-added) activity to the U.S. as American processors, in turn, export higher-value product back to Canada. Are we missing a bigger economic opportunity to better serve our own domestic market (i.e., increased and further processing)?

- With Canada “backfilling” product to the U.S., that country is realizing a greater advantage by significantly expanding exports (beyond) Canada. Since 2005, U.S. beef exports are up 280 per cent on a value basis, and 159 per cent on a tonnage basis. Canada’s exports beyond the U.S. have increased by 45 per cent, in terms of value, and 13 per cent in tonnage of beef.

Compared to 2002, Canada’s exports to international markets other than the U.S. were down 3.5 per cent while the U.S. beef industry increased exports to the international market by 51 per cent (excluding shipments to Canada).

- Are we satisfied with the U.S. growing its exports with, essentially, the use of Canadian slaughter and feeder cattle augmenting domestic supply? The data reveal that our dependence on the U.S. is generating greater benefits to that country than to our own.

Consumer issues

Consumers and other food stakeholders are increasingly raising concerns about how beef, and their food in general, are produced. What does this mean for positioning beef relative to competing proteins and maintaining consumer trust?

- Global poultry consumption has increased 10.3 per cent over the last three years (2008-11) while beef consumption has declined 3.5 per cent. Per capita consumption of beef is falling in Canada, and across the OECD. In Canada, it has declined 10.7 per cent since 2001. Pork consumption over that period has declined by 28 per cent, while poultry (chicken, hen and turkey) consumption has increased 3.4 per cent. Price is a key determinant.

Beef costs more to produce than other proteins. Moreover, despite improvements, more grain is required per kilo of beef production than for other meat proteins. This also feeds the criticism that beef’s environmental footprint is unsustainable and, for some, a reason not to consume beef. There are also concerns about the perceived healthfulness of beef and the ethical treatment of animals. How are consumer perceptions and concerns with beef shaping consumption behaviour?

- Meat consumption is rising in the developing world. The forecasts for continued growth are very positive given the growing affluence of middle classes. Other countries, however, are also positioning themselves to serve these markets.

What are the beef sector’s objectives to target specific market segments? In our interviews, many beef stakeholders told us that the sector is operating without a strategy, that there is minimal collaboration, no vision, no sense of common objectives and fragmented leadership.