The Canadian dollar moved back above parity with its U. S. counterpart on April 20, and appears poised to see further strength, according to a currency analyst.

After hitting parity earlier in the month, retreating, and then bouncing back to parity with the U. S. dollar following comments from the Bank of Canada, the Canadian dollar was “back to Square 1,” according to Andrew Pyle, a wealth adviser and market commentator with Scotia McLeod.

He said the overall view was still the same, in that the Canadian economy “is dealing with this currency better than it did 2-1/2 years ago.” As a result, he said the Canadian dollar could work its way as high as US$1.05 to US$1.10 over the next several months “provided the global fundamental picture stays fairly upbeat.”

Read Also

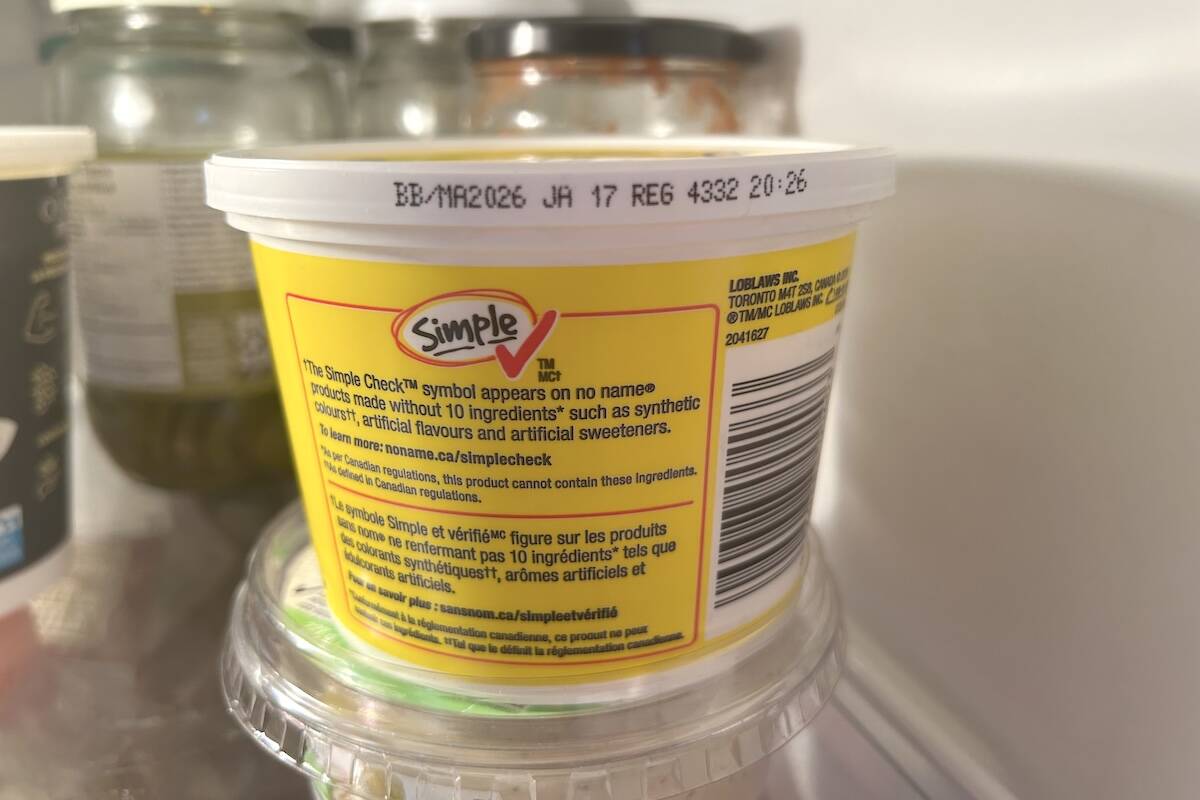

Best before doesn’t mean bad after

Best before dates are not expiry dates, and the confusion often leads to plenty of food waste.

In 2008, the last time the Canadian dollar was worth more than its U. S. counterpart, much of the strength in the domestic currency came as a result of U. S. dollar weakness. Pyle said this time around the U. S. dollar was also looking relatively firm in the international markets.

He said the U. S. currency could still be prone to weakness, which would exaggerate any relative strength in the Canadian dollar. He said such a sudden move that wasn’t based on any Canadian economic fundamentals would likely not be good for the country’s economy.

“The longer we trade around parity, the more comfort the market gets in the belief that the economy is handling the currency at this level,” said Pyle. He said current levels even with the U. S. dollar would likely provide a basing point for the Canadian dollar for its eventual move higher.

From a technical standpoint, Pyle said there wasn’t much resistance between current levels and US$1.10, although there may be fundamental constraints such as crude oil values or the need for more favourable economic data.