Reuters – Corteva raised its 2021 sales forecast for a second time this year Nov. 3, and posted a smaller-than-expected quarterly loss, benefiting from higher prices and strong demand for its insecticides and seeds.

A jump in price for corn, soybean and other crops has brightened the financial outlook for farmers who have started pre-buying seeds and chemicals to secure supplies for next spring amid sector-wide supply chain problems.

Corteva, spun off in 2019 after a merger of Dow Chemical and DuPont, said it expected net sales between US$15.5 billion and US$15.7 billion, compared with its previous forecast of US$15.2 billion and US$15.4 billion.

Read Also

Farm Credit Canada forecasts higher farm costs for 2026

Canadian farmers should brace for higher costs in 2026, Farm Credit Canada warns, although there’s some bright financial news for cattle

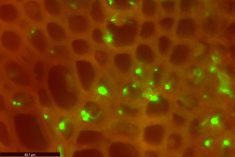

Strong sales of new products in the U.S., such as Isoclast insecticide and Arylex herbicide and a three per cent price increase boosted the company’s crop protection business in the third quarter, while the seed unit benefited from a 19 per cent hike in prices and an 18 per cent jump in volumes.

The Wilmington, Delaware-based company’s sales rose 27.3 per cent to US$2.4 billion, topping market estimates of US$2.03 billion, according to Refinitiv.

Operating loss before interest, tax, depreciation and amortization narrowed to US$51 million, or 14 cents per share, from US$179 million, or 39 cents per share, a year earlier.

That compared with analysts’ average estimate for a loss of 31 cents.

Corteva last week named ex-Nutrien head Chuck Magro as its chief executive officer, after its previous CEO retired under activist investor Starboard Value LP’s push to oust him.