The beef sector continues to enjoy strong market prices across Canada, but Trump-promised tariffs loom in the background, causing some uncertainty in the industry.

“We finished 2024 with record prices and, despite all the uncertainty in the political world here right now, the marketing in the first two weeks of January has opened up very strong,” said Rick Wright of the Livestock Markets Association of Canada and a well-known cattle markets expert in Manitoba.

Why it matters: The Canadian beef sector is enjoying optimism over record-high prices, tempered by uncertainty from potential U.S. tariffs, and that’s pushing producers to adapt strategies to sustain profitability amidst market challenges.

Read Also

Don’t let winter deplete your cows vital vitamin A reserves

Boost your calving season success: prevent weak calves and maintain gestating cow health by fortifying winter beef diets with vitamin A.

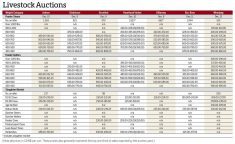

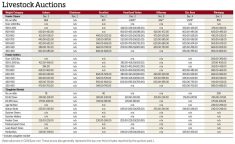

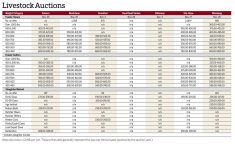

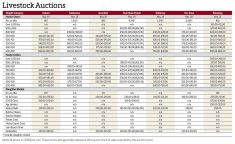

For the week ending Jan. 10, at Winnipeg Livestock Sales Ltd., feeder steers weighing 900-1,000 pounds were priced between $300 and $357 per hundredweight (cwt.), while those from 800 to 900 pounds fetched $310 to $373 per cwt. Steers in the 700- to 800-pound range were valued at $335 to $395 per cwt., with lighter steers weighing 600 to 700 lbs. priced at $350 to $455 per cwt.

Smaller classes, including steers 500-600 lbs. and 400-500 lbs., were priced at $410 to $507 per cwt. and $500 to $565 per cwt., respectively. Steers under 400 lbs. commanded prices ranging from $530 to $588 per cwt.

Feeder heifer prices were slightly lower across most weight categories. Heifers weighing 900-1,000 lbs. were priced at $280 to $305 per cwt., while those between 800-900 lbs. sold for $280 to $332 per cwt. Heifers in the 700-800 lbs. category were valued at $305 to $335 per cwt., while lighter heifers weighing 600-700 lbs. fetched $330 to $392 per cwt.

Prices for smaller heifers increased, with those 500-600 lbs. priced at $350 to $432 per cwt., and heifers between 400 and 500 lbs ranging from $350 to $490 per cwt.

Slaughter cattle prices also showed variability. Dry-fed cows were priced between $176 and $184 per cwt., while good fleshed cows ranged from $165 to $178 per cwt. Lean cows fetched $155 to $167 per cwt., and young age-verified cows were priced higher, at $180 to $225 per cwt. Good bulls were valued at $206 to $220 per cwt.

Behind the market curtain

Key factors driving these prices include a shortage of beef in North America, favourable exchange rates and strong export markets, Wright said, although tariff worries weigh heavily over the industry.

The whole sector was looking to the United States, and President-elect Donald Trump’s inauguration Jan. 20, he noted in mid-January.

Both Canada and Mexico were warned following Trump’s electoral win that as the new president he would impose 25 per cent blanket tariffs on their goods, causing significant alarm throughout various agricultural sectors.

The U.S. is Canada’s largest consumer of beef products, Wright added, saying any policy changes could significantly disrupt market dynamics.

In spite of the uncertain political climate, there are opportunities for resilience and adaptability, Wright believes.

“We encourage the producers to grow as many pounds as they can,” he said.

The luxury of beef

With the high cost of beef at the supermarket, Wright continues to predict that the commodity will move from being a staple in most homes to a luxury item.

“I mentioned that about three years ago…about beef being for the rich and being a luxury food much compared to what lobster was from my generation growing up,” he said.

The price point may drive some consumers away from meat entirely, he worries. At the same time, the economic reality facing producers means that high prices are necessary for those farmers to be financially sustainable into the future.

Although fewer people might be able to afford beef, Wright doesn’t believe that plant-based meat substitutes will become the norm for the average Canadian consumer.

“I’ve tried them, just to say that I’ve tried them, and they don’t offer anything that’s any better,” he said.

“Canada basically produces some of the safest beef in the world. We have more checks and balances in Canada than a lot of countries have. So, consumers know that when they’re buying a native Canada product, they’re getting safe protein.”

Forecasts

Looking ahead, Wright encourages producers and the industry to create adaptive strategies to make the most of any opportunities that present themselves. He suggests producers review their marketing strategies and calving windows to target ideal timing and set themselves up for marketing success.

“We’ve got some very, very good times ahead of us in the cattle business… especially if you’re in the cow-calf business,” he said. “I think you’re in the driver’s seat for the next little while.”

At the end of the day, producers should be maximizing the production of pounds of beef that they have to sell to try and the market when it’s at it’s highest, Wright said.