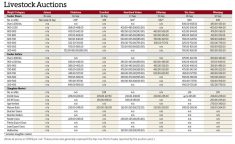

Russia’s invasion of Ukraine sent grain prices climbing sharply higher during the first week of March, which in turn sent Chicago live and feeder cattle futures down sharply. Activity held relatively steady at Manitoba’s cattle auctions during the week, although heavier feeder animals did see some pressure.

In the weekly report from Killarney, the week’s auction was described as a “strong market, despite the volatility created in Ukraine.”

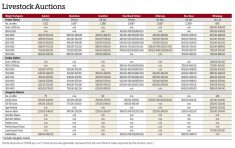

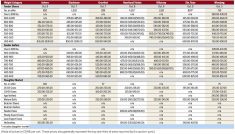

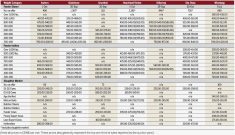

Lighter feeder steers under 500 lbs. were trading in the $200- to $250-per-hundredweight area across the province, with similar-weight heifers generally about $30 lower. D1 and D2 cows were generally in the $80-$90/cwt area.

Read Also

Wheat prices likely headed for sideways trade

U.S. brush with a severe winter storm put only brief upward pressure on wheat futures markets into last week of January.

Corn futures at the Chicago Board of Trade rallied to contract highs, moving well above US$7.50 per bushel in the nearby May contract. Meanwhile, live and feeder cattle futures fell to three-month lows.

“The Black Sea region of Russia/Ukraine/Kazakhstan is a major exporter of grain, if there are supply disruptions over there, there is an expectation of impacts on global feed grain prices,” said Brenna Grant, executive director of CanFax, noting the U.S. futures were pricing in the risk and volatility brought on by the conflict.

However, while the Ukraine situation may be causing grain prices to rise, Grant said there was still some uncertainty about demand from China. As China has rebuilt its hog sector in the wake of African swine fever, it has also overproduced its own grain, leading to questions over how much grain it would be looking to purchase from the Black Sea region this year.

“We expect volatility and we really don’t know how the movement of grain will be affected,” Grant said.

“As feed grain prices have increased the feeder (cattle) futures have dropped… which will likely impact our feeder market.”

Beyond the overarching geopolitical situation, “everything in Canada right now is focused on weather, and what will happen with the rain,” Grant said.

After the drought in the summer of 2021, many ranchers are short on feed and will also need more moisture to grow grass.

Transportation issues are also being followed closely, with high fuel costs, the ongoing pandemic and recent trucker blockades causing some disruptions getting feed into southern Alberta’s Feedlot Alley.

“We tend to work on a just-in-time arrival system in North America, and the supply disruptions the market has experienced over the past two years has made that a challenge… forcing people to question how much they need of any product on hand,” Grant said.