The only things hotter than Prairie temperatures this summer were the prices for cattle during the spring run.

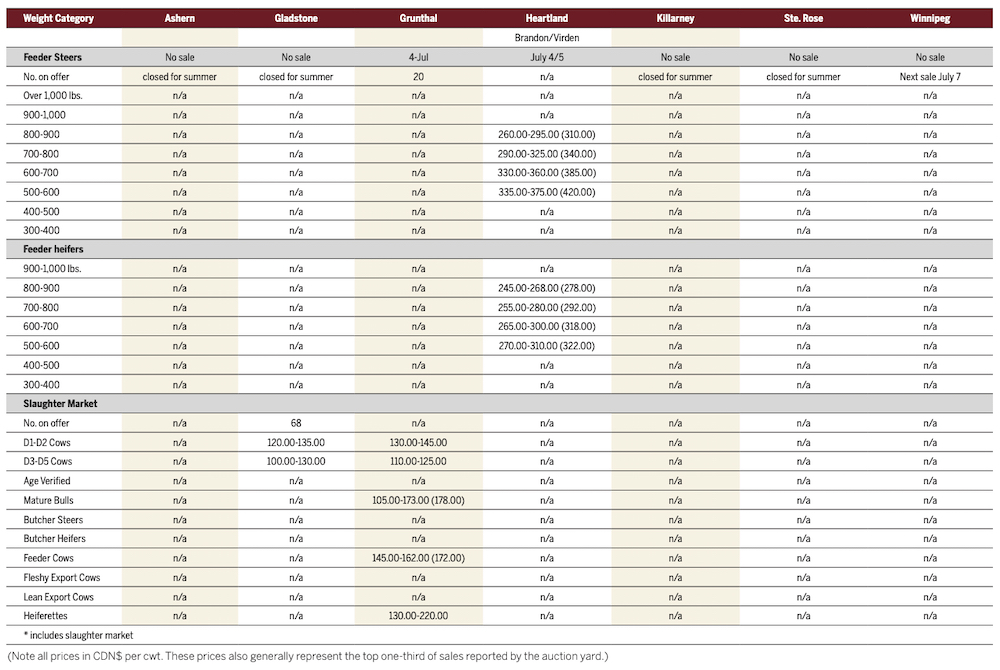

While only a handful of cattle auction sites remain open in Manitoba, feeder and slaughter cattle continue to be sold at rapidly rising prices unseen in at least a decade.

For example, on Jan. 10, the highest-priced feeder at Gladstone Auction Mart was $313 per hundredweight. At Gladstone’s last sale June 27, the highest-priced feeder was $425/cwt., a 36 per cent increase.

Read Also

Winterkill threat minimal for Northern Hemisphere crops

The recent cold snap in North America has raised the possibility of winterkill damage in the U.S. Hard Red Winter and Soft Red Winter growing regions.

“Western Canadian cattle prices have been steadily moving higher since the start of the year,” said Anne Wasko, an Eastend, Sask.-based cattle market analyst for Gateway Livestock Exchange Inc.

“That has continued right here through the second quarter (of 2023)… All classes of cattle are sitting at record levels. It’s been a pretty exciting first half for 2023 in terms of cattle markets and cattle prices.”

The main driver for these rising prices, according to Wasko, has been a shrinking North American cattle herd. The U.S. Department of Agriculture reported last month that 11.6 million calves and cattle were on feed as of June 1, down three per cent from the year before. In Canada, the Jan. 1 total of 11.27 million head was the lowest at the start of a calendar year since 1990.

“These smaller supplies are certainly causing smaller beef production levels for this year in Canada. (Canadian) beef production is down six per cent this year and U.S. beef production is down five per cent,” Wasko added.

Input costs remain a “headwind” and margins are still small relative to the high prices.

“Whether we’re talking about energy prices, interest rates, and of course the biggest cost for cattle producers is feed,” Wasko said. “We are still looking towards the 2023 crop in terms of both feed grain and forage production.

“At this time, we’re seeing a lot of variability across Western Canada. (But) looking south of the border, in terms of the U.S. corn price, we are looking at lower corn prices.”

Dry conditions in Alberta and Saskatchewan so far this summer are a major concern to cattle producers, due to their effects on feed grain crops and the fact both provinces comprise approximately 70 per cent of Canada’s cattle herd.

“Will we see more selloff of cattle in those areas? I expect so,” Wasko said. “In terms of grass, moisture, water, hay supply. All those items in those drought areas are of pretty big concern.”

Strong demand for both live cattle at feedlots and beef from consumers, which was present in 2022, has carried into the first half of 2023, she added.

“Beef supplies are getting smaller and that means there will be continued high prices at retail to ration that demand,” she said. “So far, consumers have been very resilient, looking for that top-quality beef product to consume and that demand has remained strong.”

Final feed costs and supplies will dictate prices for the second half of 2023, according to Wasko, but the typical downside seen late in the year may not be as evident as in previous years, she said.

“We’ve already seen some forward pricing for fall of 2023 and those prices look very strong at present or even higher levels than we’re seeing.”