By Dave Sims and Jade Markus, Commodity News Service Canada

Winnipeg, August 5 – THE ICE Futures Canada canola market was lower in light-volume trade, as losses in Chicago soyoil and Malaysian palm oil weighed on values.

Improvements in the Canadian canola crop were also bearish for the market, according to a trader.

“They’re getting some rain moving across the prairies (so the) crop seems to be advancing much better,” he said.

Farmer selling is expected to increase going forward.

However, gains in US soybean and European rapeseed futures helped to limit the losses.

Read Also

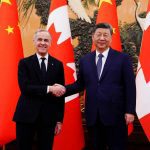

Canadian Financial Close: Loonie higher, Greenland threats weaken markets

Glacier FarmMedia – The Canadian dollar moved higher on Tuesday as its United States counterpart fell back. The loonie…

Prices found support at the technically-important C$500 per tonne mark.

Traders are positioning themselves ahead of the release of next week’s USDA World Agricultural Supply and Demand Estimates Report (WASDE) which is due out on August 12.

There are still deep concerns about the lateness of the crop.

Milling wheat, barley and durum were all untraded.

Settlement prices are in Canadian dollars per metric ton.

SOYBEAN futures at the Chicago Board of Trade closed 16 cents per bushel to one cent per bushel stronger on Wednesday ahead of a USDA crop report.

The US Department of Agriculture’s monthly report will be released on August 12.

Analysts say excessive moisture may have damaged crops, and expect reduced estimates in the report, which is bullish.

Market watchers say dryness in the US is also supporting prices.

SOYOIL prices settled weaker on Wednesday.

SOYMEAL closed stronger Wednesday following soybean futures.

CORN futures closed five to three cents per bushel stronger on Wednesday, supported by the potential for stalled crops.

A dry forecast for the US Midwest could damage crops, which are already vulnerable from too much moisture earlier in the growing season.

WHEAT futures in Chicago closed eight to five cents per bushel higher on Wednesday, likely on a technical bounce, traders say.

Wheat prices have sunk low enough to be appealing to foreign buyers. A lack of demand for US wheat has been a bearish factor for the commodity, but lower prices are bullish.

Analysts say US wheat prices are getting oversold, which also provided support for prices.

– Market watchers say global wheat supplies are still ample as healthy crops emerge from Europe, Canada, and the US.

– Spring wheat harvest is ongoing, though a forecast for rain could temporarily halt farmers.