By Dave Sims, Commodity News Service Canada

WINNIPEG, July 27 – ICE Canada canola contracts were weaker Monday morning, breaking below the psychologically-important C$500 per tonne mark.

The US soy complex, Malaysian palm oil and European rapeseed futures were also lower which contributed to the declines.

Traders on both sides of the border are responding to improving soy crop conditions in the US, according to a report.

Large funds bailed out of long positions after values

triggered technical indicators during their descent.

Read Also

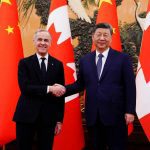

Canadian Financial Close: Loonie higher, Greenland threats weaken markets

Glacier FarmMedia – The Canadian dollar moved higher on Tuesday as its United States counterpart fell back. The loonie…

The general outlook for the canola crop in Canada has improved with recent rain. General estimates for the 2015/16 season range from 12.5 million tonnes to 14.5 million tonnes which is still shy of recent levels.

The Canadian dollar was higher against its US counterpart which helped to undermine the market.

Despite the recent moisture, last week’s CWB crop tour reinforced earlier concerns about excessive dryness in the early part of the summer damaging the crop.

About 7,300 canola contracts had traded as of 8:40 CDT.

Milling wheat, durum, and barley futures were all untraded and unchanged.

Prices in Canadian dollars per metric ton at 8:40 CDT:

Price Change

Canola Nov 496.70 dn 11.90

Jan 497.70 dn 11.30

Mar 496.00 dn 10.80

Milling Wheat Oct 224.00 unch

Dec 224.00 unch

Durum Oct 335.00 unch

Dec 345.00 unch

Barley Oct 212.10 unch

Dec 212.10 unch