By Glen Hallick, MarketsFarm

WINNIPEG, May 29 (MarketsFarm) – ICE Futures canola contracts were steady to higher at midday Friday as the Canadian dollar retreats.

A Winnipeg-based trader said the United States dollar is regaining lost strength, which is pushing down the loonie. The Canadian dollar was lower at 72.40 U.S. cents compared to Thursday’s close of 72.65.

Otherwise, “it’s a jumble with some things are up and some things are down, so canola is just chopping around in the middle,” he commented.

Chicago soyoil was firm while European rapeseed and Malaysian palm oil were lower.

Read Also

Canadian Financial Close: Loonie higher, Greenland threats weaken markets

Glacier FarmMedia – The Canadian dollar moved higher on Tuesday as its United States counterpart fell back. The loonie…

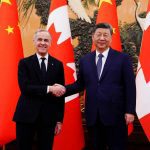

The trader noted that the markets have been closely watching China.

“All of the oilseeds are under the influence of China. There are worries about the tensions building, mostly with the U.S., but also Canada,” he said.

The weather has been a bit of a factor as Canadian farmers have contended with wet and dry conditions, while U.S. farmers have had fairly good weather for planting, he said.

Saskatchewan reported that planting in that province reached 80 per cent complete as of May 25. Alberta is scheduled to release its weekly crop later today, and Manitoba said earlier this week that seeding there was at 65 per cent finished.

Approximately 10,100 canola contracts were traded as of 10:44 CDT.

Prices in Canadian dollars per metric tonne at 10:44 CDT:

Price Change

Canola Jul 461.80 up 1.10

Jan 477.60 up 0.50

Mar 483.10 up 0.80