Increasing demand from cattle producers selling their herds convinced Tyler Slawinski of Gladstone Auction Mart to hold a sale Aug. 3, even if it wasn’t entirely the best idea.

“We had 160 head. It wasn’t cost feasible to run a sale that small, but we like to provide a service for producers in need. That’s the bottom line. When you have a business, you’ve got to be open for business,” he said, adding that prices looked steady.

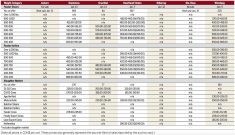

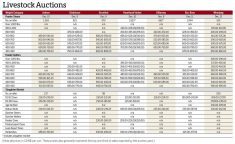

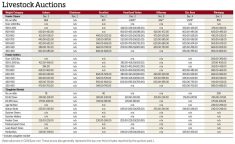

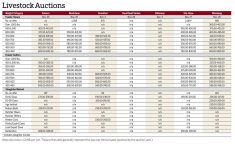

There was an increase in the number of cattle going through the rings at Manitoba auction sites during the week ending Aug. 5, totalling 3,011 at five sites: Ashern, Gladstone, Heartland-Brandon, Heartland-Virden and Ste. Rose. There were 2,508 cattle sold the previous week.

Read Also

Farm Credit Canada forecasts higher farm costs for 2026

Canadian farmers should brace for higher costs in 2026, Farm Credit Canada warns, although there’s some bright financial news for cattle

With Ste. Rose’s sale on Aug. 5, it has reopened for the season and will have weekly sales from now on. At Ashern, located in the northwest of the parched Interlake region and where Slawinski also works, 1,363 butchers and feeders, as well as 800 cow-calf pairs, were put up for sale on Aug. 4.

“In Ashern, it’s very dry. It’s very desolate. They’re going through a very tough time. They’re probably going to end up losing quite a few of the breeding stock numbers there,” Slawinski said.

On the Chicago Mercantile Exchange (CME), the August live cattle contract closed at US$122.575 per hundredweight (cwt) on Aug. 5, staying within a $2 range since June. Meanwhile, the most traded October contract has also traded mostly sideways since June, closing at US$127.575/cwt. The August feeder contract closed at US$157.650/cwt on Aug. 5, a decline of US$4.55 since July 26.

The Canadian dollar had wavered along the 80-cent U.S. mark over the past week.

Slawinski said there has recently been increased demand for cattle from feedlots in Eastern Canada.

“Manitoba is lacking feed right now, but lots are going to Ontario and Quebec. Quite a few of the slaughter cattle are going south across the (Canada-U.S. border) and lots of the cheaper cows from the U.S. are coming north, which doesn’t make a lot of sense,” he added. “That’s just how the economics are working out and that’s why it’s happening.”

While cattle prices are staying healthy for the time being, according to Slawinski, he worries that an influx of cattle entering the market will cause prices to slip.

“We’re at least a good month, a month and a half, if not two months earlier than normal. Our fall run is going to be a lot earlier than normal,” he said. “I think we’re going to see a boom in cattle numbers move through the market earlier than expected and probably run consistently for a while, and then probably taper off because there just aren’t the cattle numbers there needs to be.”