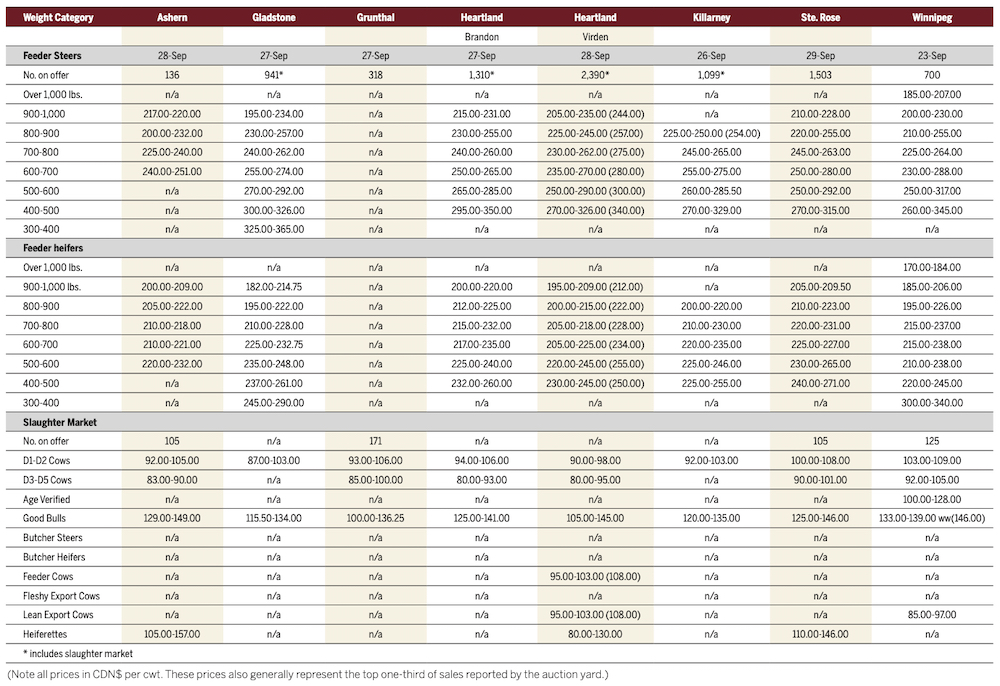

More cattle went through the rings at Manitoba auction sites during the week ended Sept. 29, concluding the first month of the fall run.

In total, 8,903 head were sold at the eight auction sites across the province. By comparison, 6,198 cattle were sold in the previous week, making this week’s total a 43.6 per cent increase.

“The yearling market is definitely strong. It’s bringing the yearlings out of the pasture and they’re starting to see a lot of guys with small groups of calves, either cull cows or cows they intend on getting rid of,” said Tyler Slawinski, auctioneer at the Ashern and Gladstone Auction Marts.

Read Also

VIDEO: Manitoba’s Past Lane – Jan. 31

Manitoba, 1946 — Post-war rations for both people and cows: The latest look back at over a century of the Manitoba Co-operator

“Right now, the main focus is on the yearlings. With the attractive prices two weeks ago, it definitely caught the attention of the cattle producers because we had (more than) double the cattle in Gladstone this week than we did last week.”

Cattle producers may start rounding up animals from community pastures to sell over the next two weeks to take advantage of higher prices, he said.

Similar to the previous week, six of eight cattle auction sites in Manitoba saw feeder steers exceed the $300 per hundredweight mark. Four sites had steers sell for $340 per cwt. or more. In Winnipeg on Sept. 23, heifers under 400 pounds sold for between $300 and $345 per cwt.

Slawinski said he hasn’t seen prices this high in at least five years.

“It’s been a long time coming,” he said. “We did see similar prices, but in some cases, I think we may be touching new record highs. It needs to be there and it needs to stay there because the costs of production and everything else have doubled.”

On the Chicago Mercantile Exchange, the December live cattle contract closed at US$147.775 per cwt. on Sept. 29. It was the first time the price closed higher in seven sessions, falling more than $3 over nine days. As for the November feeder cattle contract, it closed at $177.825 per cwt. on Sept. 29, despite falling to its lowest point since June 1 at $174.225 on the same day.

Pasture conditions are still good, according to Slawinski, with plenty of grass and hay available as the grain harvest is six weeks behind schedule in some places.

Cattle sold are moving to both Western and Eastern Canada, with black Charolais cattle going to the latter.

Slawinski believes there will be fall run pressure over the next few weeks, but he is also worried about a shortage in workers driving trucks and hauling livestock.

“Companies have lost so many employees over the last two years who are not coming back to the business. That’s going to be a huge problem when it comes to buying feeder cattle. They’re worth a lot of money and they’re an investment you don’t want for too long,” he said.

“The cattle will have to stay more local if the trucks aren’t available and they’re just not going to pay the price that the guys in the East are willing to pay to feed those cattle.”