What will biofuel policies in the United States mean for Canadian canola?

That was the key question causing large swings in canola futures during the week ended May 16, as traders tried to get a handle on conflicting rumours on biofuel coming out of Washington. The nearby July contract swung within a C$45 per tonne range in the span of two days, while new crop November moved in a C$30 range.

The supportive news came first, as the U.S. House Ways and Means Committee proposed extending the Clean Fuel Production Credit, also known as the 45Z biofuel tax credit, through 2031. The proposed amendments would limit feedstocks to those sourced from the U.S., Canada and Mexico. Canola-based fuels — currently deemed as too carbon-intensive for the credit — could also qualify for credits once again.

Read Also

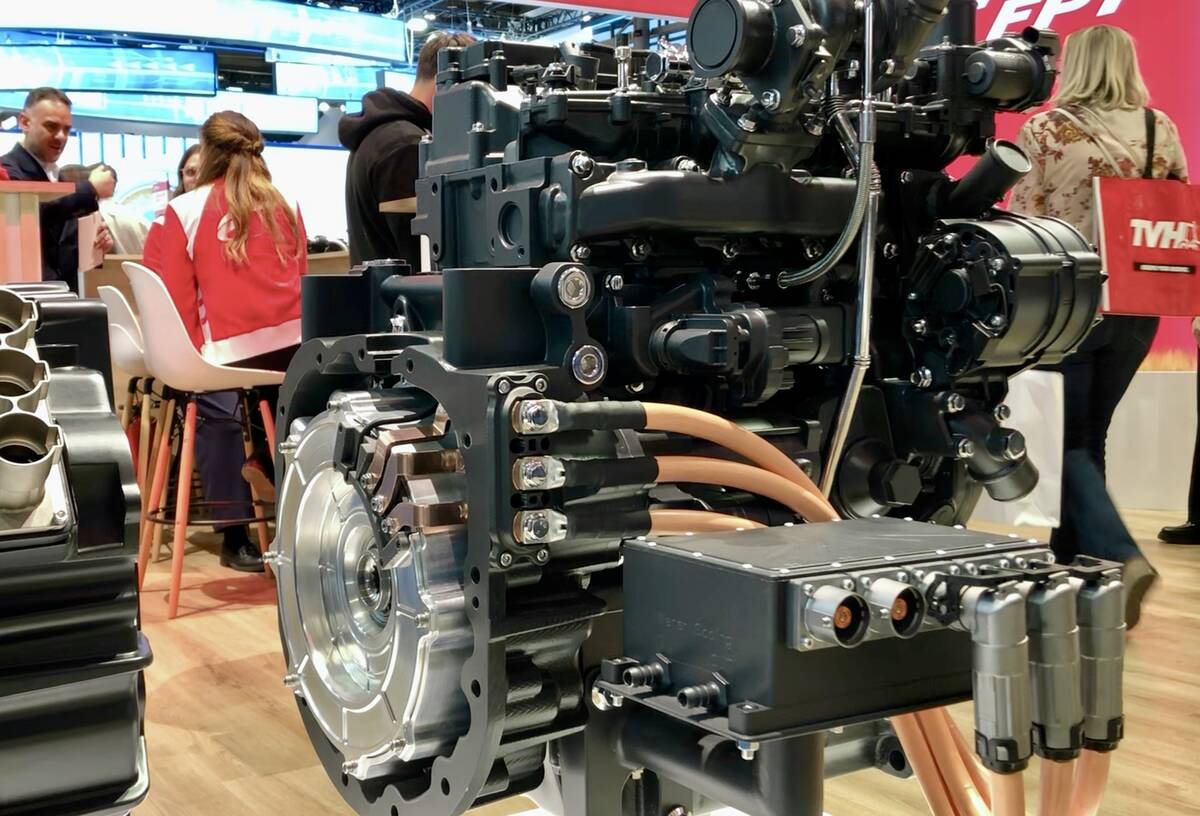

FPT showcases hybrid engines, modular battery concept at Agritechnica

Diesel engines have been the workhorse in agriculture for decades. FPT Industrial is one engine manufacturer that’s looking ahead to a post-diesel future.

Even if canola oil isn’t used for biofuel production in the U.S., the proposals would effectively keep three million tonnes of used Chinese cooking oil out of the U.S. market. If that’s replaced with soyoil, the edible vegetable oil market would still need to be filled by something.

July canola climbed to the highest level for a nearby contract in 18 months on the news, settling above C$720 per tonne on May 13.

However, the optimism faded amid talk that proposed biodiesel blending targets from the U.S. Environmental Protection Agency came in well below what the industry had lobbied for.

An alliance of oil and biofuel producers had called for a biodiesel blending target in the U.S. of 5.25 billion gallons, but the proposed level submitted by the EPA was rumoured to be much smaller than that at 4.65 billion gallons.

The loss of 600 million gallons of prospective demand sent soyoil and canola crashing lower. However, to put it in perspective the 2025 target was only 3.35 billion gallons.

The likelihood of more twists and turns on the biofuel front will lead to more swings in the futures, especially as the price movement so far has all been tied to proposals and rumours.

The underlying tariff and trade issues have also not gone away, with market participants also watching for any developments on that front.

From a fundamental standpoint, weather conditions through the growing season will be another factor to keep an eye on.