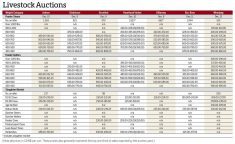

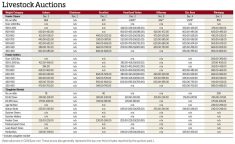

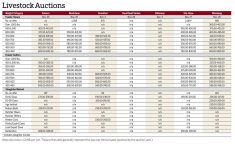

For the week ending Feb. 1, western Canadian feeder cattle markets traded $3-$6 per hundredweight on either side of unchanged compared to seven days earlier.

Higher quality genetics and lower flesh replacements were slightly firmer, but feedlot operators incorporated the appropriate discounts on fleshier types and lower efficiency, smaller frame animals.

Once again, stronger demand surfaced from Ontario in the eastern Prairie regions, resulting in a small premium over Alberta markets.

Read Also

MANITOBA AG DAYS: Unmoved China tariffs worrying for Manitoba pork

Manitoba pork producers and Agriculture Minister Ron Kostyshyn have both noted lack of progress on Chinese tariffs on pork.

Corn in Ontario was trading at $240-$255 per tonne, while barley in Lethbridge was valued at $310 per tonne last week.

The Alberta barley market is expected to strengthen by $30-$40 per tonne over the next couple of months, which may have tempered the upside for 700 pound and heavier replacements. The market for lighter calves was relatively flat across the Prairies.

In central Alberta, larger-frame, lower-flesh mixed steers on light grain and silage diet with full processing records averaging 920 lb. sold for $361.

In the same region, larger-frame Charolais-based heifers weighing 915 lb. traded for $346.

At the Lloydminster sale, larger frame Simmental cross steers with thinner flesh evaluated at 860 lb. were last bid at $389.

South of Edmonton, larger-frame tan heifers with medium to lower flesh levels weighing 850 lb. were quoted at $344.

Northwest of Winnipeg, red medium-frame steers weighing 807 lb. notched the board at $409.

South of Edmonton, Simmental blended steers on light grain and silage diet with full processing records measured at 803 lb. were let out of the ring at $387.

In southwestern Manitoba, larger-frame Angus based steers weighing 711 lb. silenced the crowd at $440, and black heifers on the card at 715 lb. were quoted at $380.

In central Saskatchewan, a smaller package of Charolais based steers averaging slightly more than 600 lb. were reported to have traded for $498.

In the Calgary region, black Limousin based heifers with a mean weight of 615 lb. reportedly sold for $426.

In southern Manitoba, black steers weighing 520 lb. were valued at $532. South of Edmonton, Simmental Angus cross steers weighing 505 lb. reportedly sold for $539.

East of Edmonton, a smaller group of mixed heifers weighing 475 pounds reportedly moved at $491.

On Jan. 29, Alberta packers were buying fed cattle on a dressed basis at an average price of $460 per cwt., up $10-$15 per cwt. from seven days earlier. Using a 60 per cent grading, this equates to a live price of $276 per cwt. delivered.

Cattle on feed 120 days or longer in Alberta and Saskatchewan as of Jan. 1, 2025, totalled 110,617 head, down 42 per cent, or 77,428 head, from Jan. 1, 2024.

Market components

Western Canadian carcass weights are below year-ago levels.

For the week ending Jan. 21, the managed money length on the feeder cattle futures was 27,983 contracts. This is a record.

We’re expecting the United States to resume imports of Mexican feeder cattle in late February or early March. It may take a couple weeks to work out procedures and protocols, but imports may reach up to 150,000 to 200,000 head per month during the spring period. This will cause the managed money funds to liquidate their long position and weigh on the cash market.

We continue to have a bullish outlook for Canadian barley and U.S. corn prices.

Canadian barley ending stocks for the 2024-25 crop year are expected to drop to historical low levels. The market needs to strengthen so that more feedlot operators switch over to U.S. corn.

As well, the barley market needs to encourage Canadian acreage for the 2025 growing season. The corn market has potential to rally $40 per tonne, or $1 per bushel, because of lower ending stocks among all major exporters.

Feeding margins remain in positive territory with higher fed cattle prices.

The feeder market will be well supported at the current levels.

Fund liquidation on the feeder futures market and rising barley prices are factors that could temper the upward momentum for the western Canadian feeder market during February and March.