If market analysts have one common thread when they try to untangle the future of Canadian beef, should United States tariffs come into effect, it’s that the longer the tariffs go on, the worse it will be. Past that, the crystal ball gets hard to read.

Why it matters: Canada’s beef sector argues that threatened 25 per cent tariffs from U.S. President Donald Trump could devastate longstanding trade and would be bad news for both sides of the border.

Jerry Klassen of Resilient Capital suggests that, depending on its duration, the resulting trade war could spur a crisis “on the same magnitude” as bovine spongiform encephalopathy (BSE) for Canadian beef.

Read Also

Tie vote derails canola tariff compensation resolution at MCGA

Manitoba Canola Growers Association members were split on whether to push Ottawa for compensation for losses due to Chinese tariffs.

“That would be a punitive tariff that would basically shut down the border for cattle and beef to the U.S,” he said, noting those impacts would be felt across fed cattle, feeder cattle and beef meat trade.

The Canadian economy is already in a recession, he noted, while beef is a comparatively pricey meat. Tariffs would lead to a “burdensome supply” of beef and cattle, weakening cattle prices.

“So I think when you take out that natural trade flow, then you would see a significant discount for the Canadian market.”

Leigh Anderson, a senior economist with Farm Credit Canada (FCC), thinks the impacts would be more moderate.

While he agrees the degree of tariff pain will depend on factors that no one currently knows — such as the enforcement period and exact terms — he also suggests that, based on where industry is sitting right now in the market, it won’t be the kind of pain Canadian beef producers felt under BSE when the border locked down to all calves under 30 months of age.

“This isn’t doing that,” he said.

In an article published by FCC Feb. 5, Anderson said, “We estimate Canadian cattle prices could decline five to 10 per cent with 25 per cent tariffs applied at the U.S. border. For example, our feeder 850-pound price forecast would decline to a $320 – $340 per hundredweight range.”

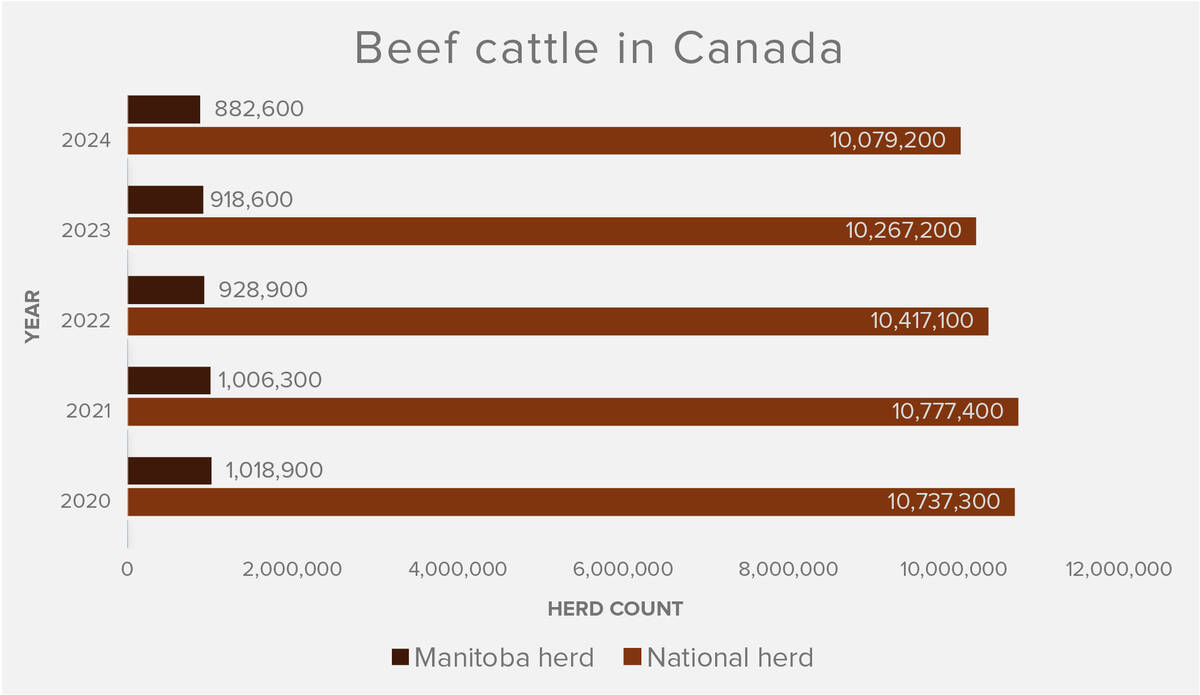

Anderson further pointed to the high consumer demand for beef and ongoing lack of beef cattle in both the U.S. and Canada, both of which are sitting at their lowest cattle herd numbers in decades. Both of those, among other factors, could somewhat stabilize beef and cattle prices, according to the economist.

“The outlook for cattle still is, in my opinion, very strong,” Anderson said in a recent interview.

“Given what we’re seeing, even if these [tariffs] come to light, it’s still a very positive outlook for the cattle industry. After years of all those droughts that the producers went through, [plus] high feed costs, things are pretty optimistic, I think, overall.”

That doesn’t mean there won’t be some chaos, especially at the start of any U.S. tariff enforcement, said Brenna Grant, executive director of CanFax.

“Ultimately, there will be trade-offs that every player is going to have to consider and the expectation is that, if they come into place, that it will be very messy, that there will be lots of volatility and lots of uncertainty as players figure out what they’re going to do and what their strategy is going to be to respond to it.”

Different sectors, different outcomes

Individual links in the supply chain will experience tariffs differently, said Anderson.

At the cow-calf level, the impact would likely be felt in a wider basis as U.S. cattle bids fail to offset the increased risk of exporting to the U.S.

Klassen suggests that U.S. tariffs would have minimal effect on feeder cattle price in Canada, which is currently a net importer of feeder cattle. According to Agriculture and Agri-Food Canada, in 2024 Canada exported just under 150,000 head of feeder cattle to the U.S. by year’s end — less than half the 340,000 feeders it imported from the U.S. as of Nov. 30, 2024.

That would likely change if Canada places a retaliatory tariff on U.S. cattle, he said. At the time of writing, neither beef nor cattle were on Canada’s list of retaliatory tariffs introduced after Canada and Mexico’s near miss with the tariffs at the start of February.

Feedlots, though, “especially those involved in exporting to the U.S., face uncertainty regarding whether potential tariffs will still be in place or escalated by the time feeder calves are finished and ready for slaughter,” Anderson noted. “U.S. packers are likely to adjust their bids and volumes of purchases of Canadian cattle.”

Canadian meat companies, meanwhile, would have to contend with risks facing boxed beef exports “and will likely be discounted as a result to compete in the U.S. market,” he added.

Although domestic consumers would get some relief on beef prices at the meat counter, Klassen urged them not to expect big discounts and certainly not the kind of rock-bottom prices experienced in Canada during BSE.

“There would probably be some prices decreasing but, at the same time, at the retail and restaurant level, the price of [wholesale] beef is such a small portion of the actual cost when you look at the final cost of the product,” he said.

Unless exemptions are sought, there is also risk that Canada’s promised retaliatory tariffs on U.S. goods could cause some products to be subject to tariffs twice, said Anderson, albeit in different forms.

For example, there could be cases where a finished Canadian cow destined for U.S. slaughter could come across the border, have the U.S. tariff applied, and then come back to Canada as boxed beef subject to a retaliatory tariff.

“It could be compounded,” he warned.

Hedging short versus hedging long

Grant also emphasized tariff duration as a key factor in keeping product moving across the border. Supply chain participants would need to hedge their bets on either a long-term tariff scenario or a quick abandonment of those trade barriers.

Canada doesn’t have a lot of recent experience with tariffs from its neighbours to the south, but the first Trump era did see brief tariffs on steel and aluminum at the same time. Also, there were the “Nixon shocks” of 1971 when then-president Richard Nixon placed a 10 per cent tariff on all foreign goods entering the country. Neither example lasted more than four months.

“If you’re expecting it to be a short-term impact … you may say that you want to show your U.S. clients that you are a reliable supplier and that you are going to continue to ship product to them and that you’re going to take the price hit, but that also means that we will continue to see product flowing through the supply chain,” said Grant during a Manitoba Agriculture-hosted webinar Feb. 13.

However, the U.S. also has a history of maintaining tariffs across administrations and party divisions. If that turns out to be the case, it would be a sign it’s time to look elsewhere for trading partners, she said.

“The expectation of a long-term piece would be that, in Trump’s first administration, he put the tariffs on China and when [former president Joe] Biden came in, they actually maintained those tariffs. There was bipartisan support from both Republicans and Democrats for those.

“And so, if you’re expecting this is designed to change trade deficits and have re-shoring of industries back to the U.S. market, that then changes strategy to say maybe there’s advantages to actually shifting product away from the U.S. to other countries like Japan, Korea or Southeast Asia.”

Exchange rate effects

There may be some opportunity for Canadian sellers to offset a portion of the tariffs and, in the process, offer U.S. customers a better deal. That’s largely based on expected exchange rate impacts, said Grant.

The U.S. is expected to have a higher-valued dollar going forward, while reduced economic performance on the Canadian side would weaken the Canadian dollar. That would mean a further drop in Canadian currency, which has already weakened six per cent since Oct. 1, 2024, when it started to become clear to investors that Trump would win the presidency, she noted.

A weaker Canadian dollar tends to make Canadian exports more competitive in the U.S. and, while it won’t numb all the tariff pain for the cattle sector, it should reduce it, she said.

There’s also a question of how much Trump’s tariff expectations have already been built into the exchange rate. When Trump signed his executive order on tariffs Feb. 1, the Canadian dollar lost around two cents. The market rallied and gained the loss back once Trump announced a 30-day moratorium on the tariffs.

“Right now, Rabobank is projecting that the further move in the exchange rate could be anywhere between seven and 12 per cent, and so that is substantial. It still means that there would be a significant price impact, but it is a substantial piece of offsetting it,” said Grant.

On the flip side though, a low Canadian dollar also means higher prices for Canadian producers buying supplies from the U.S.

“We’ve got to remember that for anyone who has been importing U.S. corn or DDGs, a weaker Canadian dollar is going to make that more expensive,” said Grant.

“We may see a shifting away from those U.S. products.”

Faltering market info

There may be a chance tariffs could muddy the waters to the point sellers can’t tell if the markets are reflective of true supply and demand. In the process, the cash and futures market may become outmoded as a price reference for the Canadian industry, said Klassen.

“Once things develop, then you might see the basis widen out accordingly, but initially [the cash and futures market] would probably be obsolete,” he said.