UPDATED — U.S. President Donald Trump said Friday afternoon he would impose a 10 per cent global tariff under Section 122 of the 1974 Trade Act. after the U.S. Supreme Court struck sweeping tariffs that he pursued under a law meant for use in national emergencies.

The tariff will be “over and above our normal tariffs already being charged,” Trump said in a media briefing.

“The Supreme Court did not overrule tariffs. They merely overruled a particular use of IEEPA for tariffs.”

Read Also

USDA defends $12 billion subsidy amid farm economy challenges

As the U.S. Department of Agriculture prepares to dole out $12 billion (C$16.4 billion) in government subsidies next week, officials and economists at the agency’s annual forum near Washington defended the assistance as a necessary measure to prevent more farmers from financial ruin.

Trump said his administration would also launch several investigations “to protect our country from unfair trading practices of other countries and companies.”

WHY IT MATTERS: While Canadian agricultural goods largely escaped tariffs under the CUSMA trade agreement, U.S. President Donald Trump’s on-again, off-again tariffs created significant uncertainty.

Trump signed an executive order later Friday imposing a 10 per cent ad valorem tariff to take effect on articles imported into the U.S. starting Tuesday (Feb. 24).

Section 122 allows the president to impose duties up to 15 per cent or quotas for up to 150 days, the Retail Industry Leaders Association explained in a post.

“Specifically, Section 122 allows the President to impose duties of up to 15 per cent or quotas for up to 150 days on imports from all countries, or selectively against countries that maintain unjustifiable or unreasonable restrictions on U.S. commerce.”

The new 10 per cent tariff will not be imposed on any CUSMA-compliant “goods of Canada and Mexico,” the White House said in a fact sheet later Friday.

Nor will it be imposed on “certain agricultural products, including beef, tomatoes, and oranges.”

Other imports exempt from the new tariff will include “natural resources and fertilizers that cannot be grown, mined, or otherwise produced in the United States or grown, mined, or otherwise produced in sufficient quantities to meet domestic demand” as well as “certain critical minerals, metals used in currency and bullion, energy and energy products.”

Among other specific goods, pharmaceuticals and electronics, it will also not apply to “passenger vehicles, certain light trucks, certain medium and heavy-duty vehicles, buses, and certain parts of passenger vehicles, light trucks, heavy-duty vehicles and buses.”

Trump on Friday separately announced the continued suspension, first imposed on Feb. 1 last year, of duty-free de minimis treatment for low-value shipments, including goods shipped through the international postal system. Those goods will also be subject to the new 10 per cent tariff.

Canadian groups react

Canadian Federation of Agriculture president Keith Currie told Glacier FarmMedia in a text that he hoped the Supreme Court’s decision would bring back some stability to cross-border trade. However, he noted that we’d have to wait and see what other tools the Trump administration utilizes.

“Obviously this court decision supports what we’ve been saying about the tariffs not being justified,” Currie said.

“Today’s Supreme Court ruling that the IEEPA tariffs are unlawful is welcome news for equipment manufacturers, which have spent the last year navigating higher input costs and mounting trade uncertainty,” said Kip Eideberg, senior vice-president of industry and government relations for the Association of Equipment Manufacturers, in a statement.

“What equipment manufacturers need most is certainty so they can make long-term decisions that benefit their workers, their customers, and the broader economy.”

Following Trump’s vow to impose other tariffs, the Association of Equipment Manufacturers reiterated equipment manufacturers’ need for certainty while making longterm decisions.

The justices, in a 6-3 ruling authored by conservative Chief Justice John Roberts, upheld a lower court’s decision that the Republican president’s use of this 1977 law exceeded his authority.

Trump says he’s “ashamed” of SCOTUS members

Trump, in comments at the White House, condemned the ruling as “terrible” and lashed out at the six justices who ruled against him.

“I’m ashamed of certain members of the court – absolutely ashamed – for not having the courage to do what’s right for our country,” Trump said.

Trump has leveraged tariffs – taxes on imported goods – as a key economic and foreign policy tool.

“Our task today is to decide only whether the power to “regulate … importation,” as granted to the president in IEEPA, embraces the power to impose tariffs. It does not,” Roberts wrote in the ruling, quoting the statute’s text that Trump claimed had justified his sweeping tariffs.

The U.S. Constitution grants Congress, not the president, the authority to issue taxes and tariffs.

Tariffs have been central to a global trade war that Trump initiated after he began his second term as president, one that has alienated trading partners, affected financial markets and caused global economic uncertainty.

Trump has called his tariffs vital for U.S. economic security, predicting that the country would be defenseless and ruined without them.

“Foreign countries that have been ripping us off for years are ecstatic,” Trump said on Friday. “They’re so happy, and they’re dancing in the streets, but they won’t be dancing for long that, I can assure you.”

The Supreme Court, which has a 6-3 conservative majority, had allowed Trump’s expansive exertion of presidential powers in other areas in a series of rulings issued on an emergency basis, and Friday’s ruling represented the biggest setback it has dealt him since he returned to office in January 2025.

“It’s my opinion that the court has been swayed by foreign interests and a political movement that is far smaller than people would ever think,” Trump said.

“He cannot”

Roberts, citing a prior Supreme Court ruling, wrote that “the president must ‘point to clear congressional authorization’ to justify his extraordinary assertion of the power to impose tariffs,” adding: “He cannot.”

Trump has leveraged tariffs – taxes on imported goods – as a key economic and foreign policy tool. They have been central to a global trade war that Trump initiated after he began his second term as president, one that has alienated trading partners, affected financial markets and caused global economic uncertainty.

The Supreme Court reached its conclusion in a legal challenge by businesses affected by the tariffs and 12 U.S. states, most of them Democratic-governed, against Trump’s unprecedented use of this law to unilaterally impose the import taxes.

Trump’s tariffs were forecast to generate over the next decade trillions of dollars in revenue for the United States, which possesses the world’s largest economy.

Tariffs will likely need to be refunded

Trump’s administration has not provided tariffs collection data since December 14. But Penn-Wharton Budget Model economists estimated on Friday that the amount collected in Trump’s tariffs based on the International Emergency Economic Powers Act stood at more than $175 billion (C$239.4 billion). And that amount likely would need to be refunded with a Supreme Court ruling against the IEEPA-based tariffs.

The U.S. Constitution grants Congress, not the president, the authority to issue taxes and tariffs. But Trump instead turned to a statutory authority by invoking IEEPA to impose the tariffs on nearly every U.S. trading partner without the approval of Congress. Trump has imposed some additional tariffs under other laws that are not at issue in this case. Based on government data from October to mid-December, those represent about third of the revenue from Trump-imposed tariffs.

IEEPA lets a president regulate commerce in a national emergency. Trump became the first president to use IEEPA to impose tariffs, one of the many ways he has aggressively pushed the boundaries of executive authority since he returned to office in areas as varied as his crackdown on immigration, the firing of federal agency officials, domestic military deployments and military operations overseas.

Trump described the tariffs as vital for U.S. economic security, predicting that the country would be defenseless and ruined without them. Trump in November told reporters that without his tariffs “the rest of the world would laugh at us because they’ve used tariffs against us for years and took advantage of us.” Trump said the United States was abused by other countries including China, the second-largest economy.

U.S. could invoke other legal justifications: Bessent

After the Supreme Court heard arguments in the case in November, Trump said he would consider alternatives if it ruled against him on tariffs, telling reporters that “we’ll have to develop a ‘game two’ plan.”

Treasury Secretary Scott Bessent and other administration officials said the United States would invoke other legal justifications to retain as many of Trump’s tariffs as possible. Among others, these include a statutory provision that permits tariffs on imported goods that threaten U.S. national security and another that allows retaliatory actions including tariffs against trading partners that the Office of the U.S. Trade Representative determines have used unfair trade practices against American exporters.

None of these alternatives offered the flexibility and blunt-force dynamics that IEEPA provided Trump, and may not be able to replicate the full scope of his tariffs in a timely fashion.

Trump’s ability to impose tariffs instantaneously on any trading partner’s goods under the aegis of some form of declared national emergency raised his leverage over other countries. It brought world leaders scrambling to Washington to secure trade deals that often included pledges of billions of dollars in investments or other offers of enhanced market access for U.S. companies.

But Trump’s use of tariffs as a cudgel in U.S. foreign policy has succeeded in antagonizing numerous countries, including those long considered among the closest U.S. allies.

IEEPA historically had been used for imposing sanctions on enemies or freezing their assets, not to impose tariffs. The law does not specifically mention the word tariffs. Trump’s Justice Department had argued that IEEPA allows tariffs by authorizing the president to “regulate” imports to address emergencies.

Tariffs generated $195 billion

The Congressional Budget Office has estimated that if all current tariffs stay in place, including the IEEPA-based duties, they would generate about $300 billion annually over the next decade.

Total U.S. net customs duty receipts reached a record $195 billion (C$266.8 billion) in fiscal 2025, which ended on September 30, according to U.S. Treasury Department data.

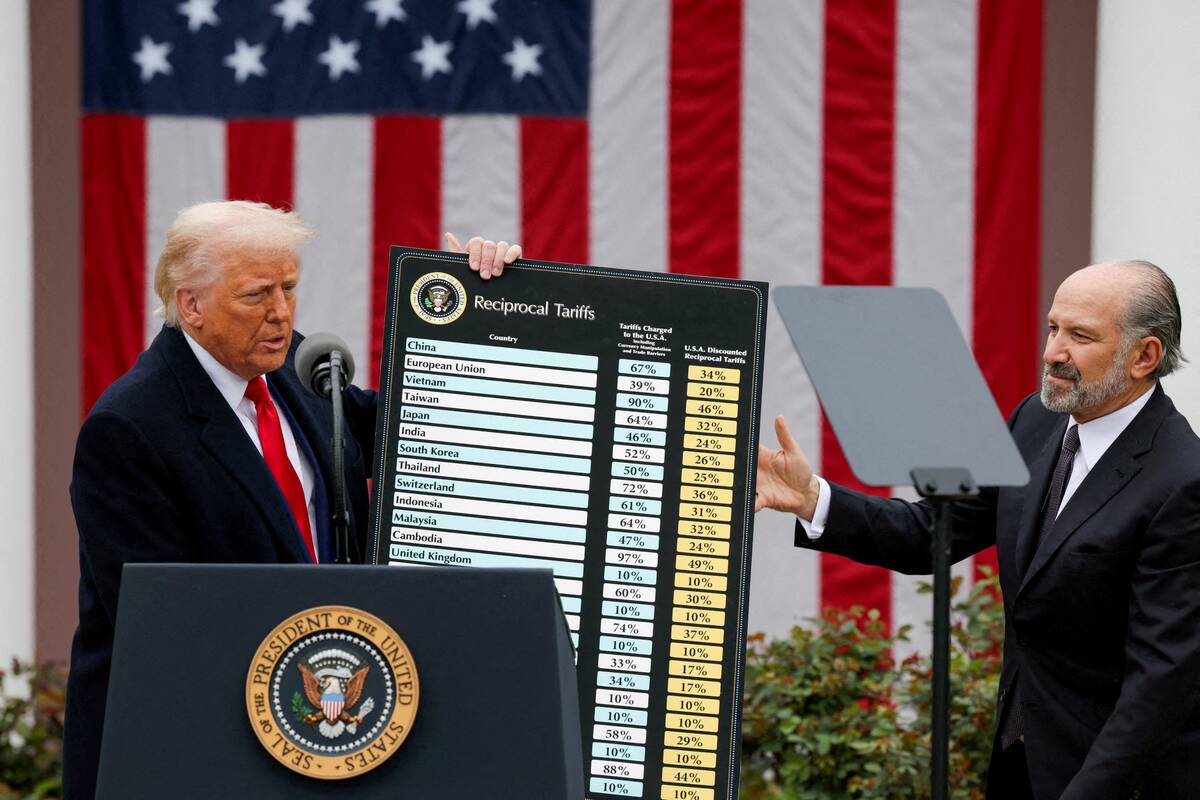

On April 2 on a date Trump labeled “Liberation Day,” the president announced what he called “reciprocal” tariffs on goods imported from most U.S. trading partners, invoking IEEPA to address what he called a national emergency related to U.S. trade deficits, though the United States already had run trade deficits for decades.

In February and March of 2025, Trump invoked IEEPA to impose tariffs on China, Canada and Mexico, citing the trafficking of the often-abused painkiller fentanyl and illicit drugs into the United States as a national emergency.

Trump has wielded his tariffs to extract concessions and renegotiate trade deals, and as a weapon to punish countries that draw his ire on non-trade political matters. These have ranged from Brazil’s prosecution of former president Jair Bolsonaro, India’s purchases of Russian oil that help fund Russia’s war in Ukraine, and an anti-tariffs ad by Canada’s Ontario province.

IEEPA was passed by Congress and signed by Democratic President Jimmy Carter. In passing the measure, Congress placed additional limits on the president’s authority compared to a predecessor law.

The cases on tariffs before the justices involved three lawsuits.

The Washington-based U.S. Court of Appeals for the Federal Circuit sided with five small businesses that import goods in one challenge, and the states of Arizona, Colorado, Connecticut, Delaware, Illinois, Maine, Minnesota, Nevada, New Mexico, New York, Oregon and Vermont in another.

Separately, a Washington-based federal judge sided with a family-owned toy company called Learning Resources.

— Additional reporting by David Lawder and John Kruzel. With files from Jonah Grignon and Geralyn Wichers.