Chicago | Reuters — U.S. soybean futures fell for the third session in a row on Monday, sinking to their lowest in 9-1/2 months on continued pressure from a government report that showed domestic supplies were bigger than expected.

Wheat firmed to its highest since mid-August on technical buying. Corn futures ended slightly lower after trading both sides of unchanged throughout the day.

Concerns about Chinese demand added pressure to the soybean market after U.S. Trade Representative Katherine Tai pledged she will press Beijing over its failure to keep promises made in former U.S. president Donald Trump’s trade deal.

Read Also

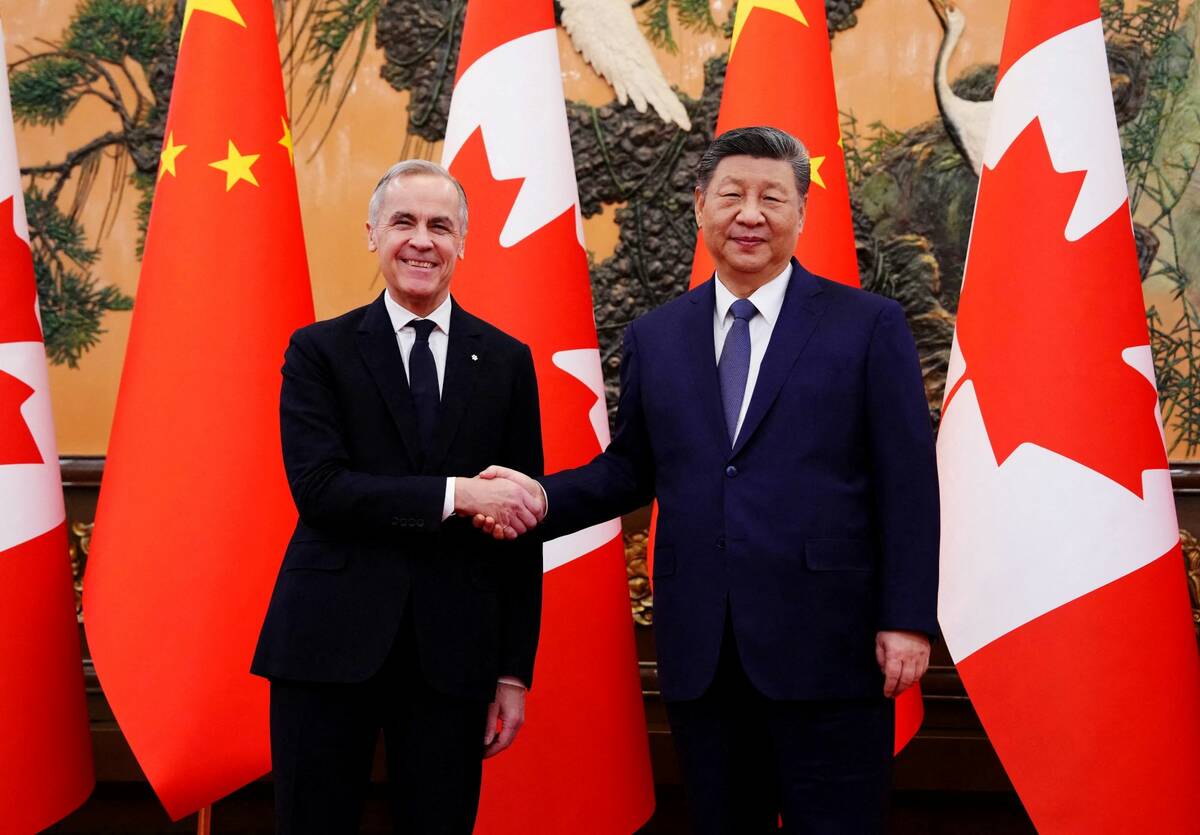

Canada-China roundup: Producer groups applaud tariff relief; pork left out; mix of criticism and praise from Trump administration

Producer groups across Canada expressed a mix of relief and cautious optimism following the news that Canada had struck a deal with China to lower tariffs on canola, peas and other goods, in return for relaxing duties on Chinese electric vehicles.

“There are potential issues with China and the trade representative finding them out of compliance with the Phase 1 deal,” said Jim Gerlach, president of brokerage A/C Trading. “Clearly they have been behind on their purchases.”

Chicago Board of Trade November soybean futures settled down 10-3/4 cents at $12.35-3/4 a bushel (all figures US$). On a continuous basis, the most-active contract bottomed out at $12.35, its lowest since Dec. 21.

“Soybeans continued to be pressured by the U.S. Department of Agriculture’s estimates of larger U.S. soybean inventories last week made after a long period in which the general perception was of tight U.S. supplies,” Matt Ammermann, StoneX commodity risk manager, said.

CBOT soft red winter wheat for December delivery was 1-1/4 cents higher at $7.56-1/2 a bushel, its fourth straight session of gains.

USDA said on Monday morning that weekly export inspections of wheat totaled 611,621 tonnes, topping market expectations.

CBOT December corn futures dropped 3/4 cent to $5.40-3/4 a bushel.

Private exporters reported the sale of 426,800 tonnes of corn to Mexico, USDA said. It was the biggest flash sale of corn since Aug. 23.

USDA also said weekly export inspections of corn totaled 808,814 tonnes, a two-month high.

— Mark Weinraub is a Reuters commodities correspondent in Chicago; additional reporting by Michael Hogan in Hamburg and Naveen Thukral in Singapore.