CNS Canada — Agricultural markets throughout North America continue to weather a storm of tariffs and uncertain political interventions — and from where one trader sits, prices for corn and soybeans may have seen their low points.

“We have gotten back down to recent lows in corn while beans have gotten cheap again,” said Brian Rydlund, a market analyst with CHS Hedging in the Minneapolis-St. Paul area.

Since the beginning of June, the Chicago November soybean contract has dropped from the $10.25 area to the $8.60-$8.70 range (all figures US$). Some minor buying has taken place in recent days, though, on ideas the market was oversold.

Read Also

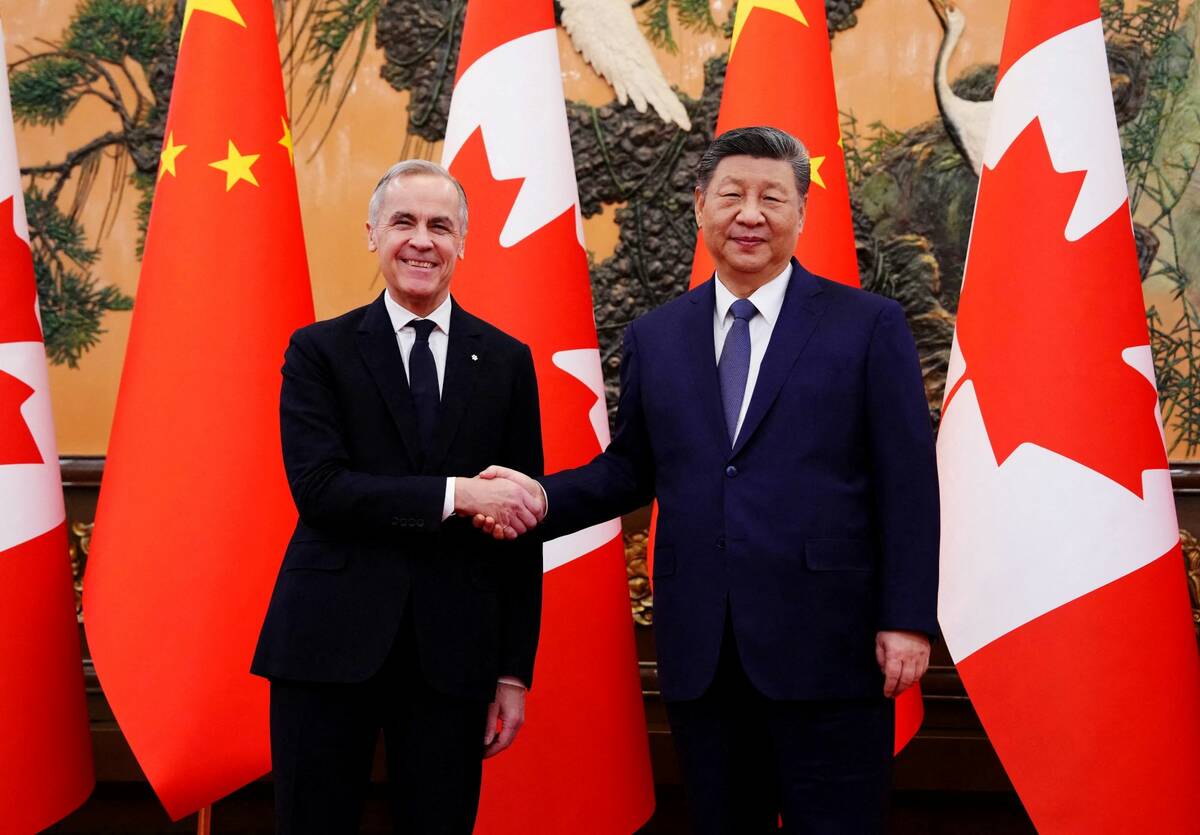

Canada-China roundup: Producer groups applaud tariff relief; pork left out; mix of criticism and praise from Trump administration

Producer groups across Canada expressed a mix of relief and cautious optimism following the news that Canada had struck a deal with China to lower tariffs on canola, peas and other goods, in return for relaxing duties on Chinese electric vehicles.

The damage wasn’t confined to the dominant contract, either, as the nearby August mark was also pressured lower.

“For August beans, the low is right around $8.40 (per bushel),” Rydlund said.

The Chicago corn market has also witnessed a freefall since June 1, falling from the $4 benchmark to the $3.60 range. The most-active December corn contract was testing lows at the $3.60 per bushel mark.

All of the agricultural markets were being pressured by the same forces, he said, namely the tariffs being slapped on China and the U.S. by each other.

“The past two weeks we’ve been going more sideways than up or down,” Rydlund explained. “You just don’t know when politics and government are going to get involved.”

On Thursday, the U.S. Department of Agriculture will release its monthly supply and demand estimates. Most traders don’t expect to see any major surprises but Rydlund said that remains to be seen.

“I don’t know that it will be a market mover but since it’s the government you never know,” he said.

— Dave Sims writes for Commodity News Service Canada, a Glacier FarmMedia company specializing in grain and commodity market reporting.