CNS Canada –– Canadian farmers are sitting on large stocks of poor-quality durum, which should cut into acres seeded to the crop this spring. Durum stocks in the country, as of Dec. 31, 2016, came in at 6.9 million tonnes, marking a new record for that date, according to Statistics Canada data going back to

Durum acres to decline in 2017

StatsCan canola stocks in line with expectations

CNS Canada –– Canadian canola stocks may be tighter than a year ago and wheat stocks larger — but the updated numbers from Statistics Canada may also need more asterisks than normal. StatsCan, in a report released Friday, pegged Canadian canola supplies as of Dec. 31 at 12.159 million tonnes, down from 13.452 million at

ICE weekly outlook: Canola pointed lower

CNS Canada — ICE Futures Canada canola contracts saw a bit of a corrective bounce on Wednesday but their overall trend remains pointed lower, with the winter highs possibly in for now, according to an analyst. “The technical and the fundamentals are pointing down,” said Errol Anderson of Pro Market Communications in Calgary, pointing to

Wheat, durum exports running behind average

CNS Canada — Canadian wheat and durum exports are running well behind the year-ago pace, despite the country’s larger production. Canadian wheat exports during the crop-year-to-date of 6.56 million tonnes compare with 8.12 million at the same point a year ago and the five-year average for week 25 of the crop year of 7.28 million,

Canola crush margins tumble

CNS Canada — Canola crush margins dropped by more than $30 per tonne over the past two weeks, which may be putting a damper on end-user demand. As of Thursday, the Canola Board Crush Margins calculated by ICE Futures Canada were at about $100 above the March contract, which compares with levels only two weeks

Canada’s oat acres look to rise in 2017

CNS Canada –– Canadian oat acres will likely be up in 2017, as relatively favourable cash prices draw in interest from producers, according to an oats merchandiser. Chicago Board of Trade (CBOT) oat futures have climbed sharply higher over the past month, but are still trading at a discount to the relatively steady cash market.

CBOT weekly outlook: Soy, corn can’t keep their distance from Argentina

CNS Canada — Soybean futures at the Chicago Board of Trade posted sharp gains over the past week, as weather concerns in Argentina and a bullish U.S. Department of Agriculture report sparked a rally. South American weather also underpinned the corn market — and both commodities will be following the forecasts out of the region

ICE weekly outlook: Canola watching South America

CNS Canada — ICE Futures Canada canola contracts moved lower during the week ended Wednesday, breaking below some chart resistance levels in the process. The chart pattern is turning flat, however, and further moves will likely depend on outside factors. Speculators have moved to the short side in the canola market, which accounted for some

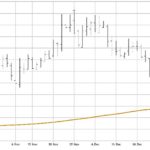

Tipping point seen for March canola

CNS Canada — ICE Futures Canada canola futures find themselves at a bit of a tipping point from a chart standpoint, with the most active March contract settling right at the $500 per tonne mark on Tuesday. In addition to being a psychological benchmark, $500 is also within 30 cents of the 200-day moving average

Canola crushers running at full steam

CNS Canada — Canadian canola crushers showed no signs of slowing down their record pace over the Christmas and New Year’s holidays, with the weekly crush topping 200,000 tonnes for only the second time ever. The canola crush during the week ended Wednesday came in at 200,294 tonnes, according to the most recent Canadian Oilseed